GitLab (NASDAQ:GTLB - Get Free Report) had its price objective raised by Wells Fargo & Company from $80.00 to $85.00 in a research note issued on Thursday,Benzinga reports. The brokerage presently has an "overweight" rating on the stock. Wells Fargo & Company's price target suggests a potential upside of 32.56% from the stock's previous close.

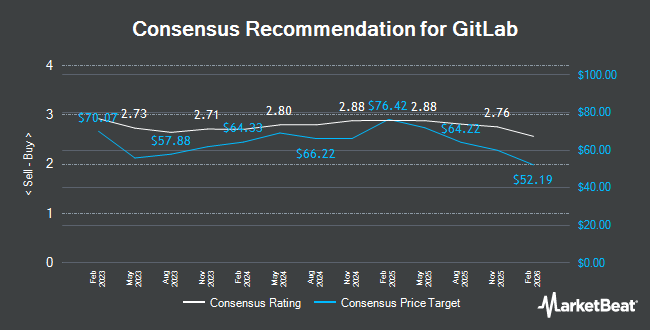

GTLB has been the topic of several other reports. Mizuho raised their price objective on shares of GitLab from $67.00 to $80.00 and gave the company an "outperform" rating in a research report on Monday, December 9th. Macquarie reiterated an "outperform" rating and issued a $90.00 price target on shares of GitLab in a report on Wednesday, January 15th. Royal Bank of Canada lifted their price target on shares of GitLab from $73.00 to $80.00 and gave the company an "outperform" rating in a report on Friday, December 6th. Needham & Company LLC reiterated a "buy" rating and issued a $85.00 price target on shares of GitLab in a report on Tuesday, January 7th. Finally, Canaccord Genuity Group boosted their target price on shares of GitLab from $65.00 to $78.00 and gave the stock a "buy" rating in a report on Friday, December 6th. Three equities research analysts have rated the stock with a hold rating, twenty-three have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, GitLab currently has an average rating of "Moderate Buy" and an average target price of $76.62.

Read Our Latest Stock Analysis on GTLB

GitLab Stock Performance

Shares of GitLab stock traded down $3.33 on Thursday, hitting $64.12. 2,096,551 shares of the company's stock were exchanged, compared to its average volume of 2,759,466. The company has a 50-day simple moving average of $64.00 and a 200-day simple moving average of $57.61. The stock has a market capitalization of $10.41 billion, a PE ratio of -200.38 and a beta of 0.63. GitLab has a 1 year low of $40.72 and a 1 year high of $76.41.

Insider Activity

In other GitLab news, Director Matthew Jacobson sold 547,679 shares of GitLab stock in a transaction on Thursday, December 26th. The shares were sold at an average price of $59.72, for a total value of $32,707,389.88. Following the completion of the transaction, the director now owns 58,471 shares of the company's stock, valued at $3,491,888.12. The trade was a 90.35 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this link. Also, insider Sytse Sijbrandij sold 84,000 shares of GitLab stock in a transaction on Wednesday, January 15th. The stock was sold at an average price of $62.99, for a total transaction of $5,291,160.00. The disclosure for this sale can be found here. Insiders have sold 740,257 shares of company stock worth $44,710,867 over the last 90 days. Company insiders own 21.36% of the company's stock.

Institutional Investors Weigh In On GitLab

Hedge funds and other institutional investors have recently modified their holdings of the stock. SG Americas Securities LLC bought a new stake in GitLab in the third quarter worth about $119,000. Creative Planning bought a new stake in GitLab in the third quarter worth about $208,000. Blue Trust Inc. raised its position in GitLab by 18.2% in the third quarter. Blue Trust Inc. now owns 3,166 shares of the company's stock worth $157,000 after acquiring an additional 488 shares in the last quarter. Cullinan Associates Inc. bought a new stake in GitLab in the third quarter worth about $2,606,000. Finally, Mirae Asset Global Investments Co. Ltd. raised its position in GitLab by 22.2% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 11,000 shares of the company's stock worth $568,000 after acquiring an additional 2,000 shares in the last quarter. 95.04% of the stock is currently owned by institutional investors.

About GitLab

(

Get Free Report)

GitLab Inc, through its subsidiaries, develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific. It offers GitLab, a DevOps platform, which is a single application that leads to faster cycle time and allows visibility throughout and control over various stages of the DevOps lifecycle.

Featured Articles

Before you consider GitLab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GitLab wasn't on the list.

While GitLab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.