Park Hotels & Resorts (NYSE:PK - Get Free Report) had its price objective boosted by stock analysts at Wells Fargo & Company from $14.50 to $16.00 in a research report issued to clients and investors on Tuesday,Benzinga reports. The firm presently has an "equal weight" rating on the financial services provider's stock. Wells Fargo & Company's price target indicates a potential upside of 4.10% from the company's previous close.

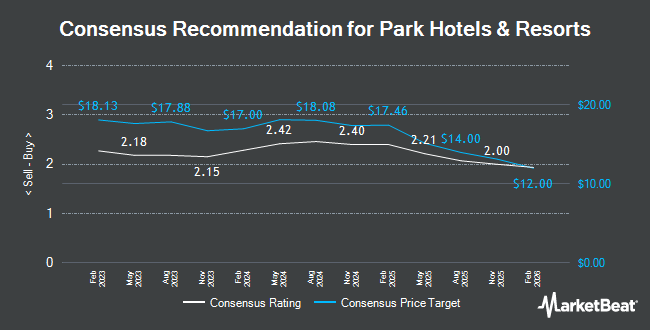

PK has been the subject of several other research reports. UBS Group lifted their price objective on Park Hotels & Resorts from $14.00 to $15.00 and gave the company a "neutral" rating in a research note on Monday, November 18th. StockNews.com cut Park Hotels & Resorts from a "hold" rating to a "sell" rating in a research note on Thursday, November 7th. Wolfe Research cut Park Hotels & Resorts from an "outperform" rating to a "peer perform" rating in a research note on Thursday, September 26th. Bank of America decreased their target price on Park Hotels & Resorts from $17.00 to $16.50 and set a "neutral" rating for the company in a research note on Monday, October 21st. Finally, Evercore ISI decreased their target price on Park Hotels & Resorts from $20.00 to $19.00 and set an "outperform" rating for the company in a research note on Tuesday, August 13th. One analyst has rated the stock with a sell rating, six have given a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average target price of $18.23.

Get Our Latest Stock Report on PK

Park Hotels & Resorts Trading Down 0.8 %

Park Hotels & Resorts stock traded down $0.13 during midday trading on Tuesday, reaching $15.37. 743,285 shares of the stock traded hands, compared to its average volume of 2,763,132. The company has a 50-day simple moving average of $14.45 and a two-hundred day simple moving average of $14.73. Park Hotels & Resorts has a 12-month low of $13.23 and a 12-month high of $18.05. The firm has a market cap of $3.17 billion, a PE ratio of 9.87, a price-to-earnings-growth ratio of 0.83 and a beta of 2.02. The company has a current ratio of 1.51, a quick ratio of 1.51 and a debt-to-equity ratio of 1.24.

Park Hotels & Resorts (NYSE:PK - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The financial services provider reported $0.26 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.47 by ($0.21). The company had revenue of $649.00 million during the quarter, compared to analysts' expectations of $646.15 million. Park Hotels & Resorts had a net margin of 12.66% and a return on equity of 9.63%. The business's quarterly revenue was down 4.4% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.51 EPS. Research analysts expect that Park Hotels & Resorts will post 2.09 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

A number of institutional investors have recently modified their holdings of the stock. Tidal Investments LLC increased its holdings in shares of Park Hotels & Resorts by 5.5% in the third quarter. Tidal Investments LLC now owns 19,522 shares of the financial services provider's stock valued at $275,000 after purchasing an additional 1,020 shares during the period. Wilmington Savings Fund Society FSB acquired a new position in Park Hotels & Resorts during the third quarter worth $477,000. Barclays PLC grew its holdings in Park Hotels & Resorts by 22.4% during the third quarter. Barclays PLC now owns 319,593 shares of the financial services provider's stock worth $4,507,000 after acquiring an additional 58,432 shares during the period. Y Intercept Hong Kong Ltd grew its holdings in Park Hotels & Resorts by 81.6% during the third quarter. Y Intercept Hong Kong Ltd now owns 42,051 shares of the financial services provider's stock worth $593,000 after acquiring an additional 18,892 shares during the period. Finally, MML Investors Services LLC grew its holdings in Park Hotels & Resorts by 55.1% during the third quarter. MML Investors Services LLC now owns 24,634 shares of the financial services provider's stock worth $347,000 after acquiring an additional 8,749 shares during the period. Institutional investors and hedge funds own 92.69% of the company's stock.

About Park Hotels & Resorts

(

Get Free Report)

Park is one of the largest publicly traded lodging REITs with a diverse portfolio of market-leading hotels and resorts with significant underlying real estate value. Park's portfolio currently consists of 43 premium-branded hotels and resorts with over 26,000 rooms primarily located in prime city center and resort locations.

Recommended Stories

Before you consider Park Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Park Hotels & Resorts wasn't on the list.

While Park Hotels & Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.