AGNC Investment (NASDAQ:AGNC - Get Free Report) had its price objective lowered by analysts at Wells Fargo & Company from $12.00 to $11.00 in a research report issued on Thursday,Benzinga reports. The firm presently has an "overweight" rating on the real estate investment trust's stock. Wells Fargo & Company's price objective would indicate a potential upside of 9.13% from the stock's current price.

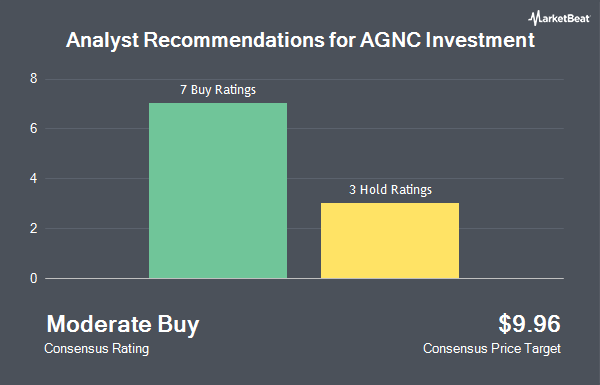

Several other research firms also recently commented on AGNC. JMP Securities reaffirmed a "market perform" rating on shares of AGNC Investment in a research report on Thursday, January 23rd. JPMorgan Chase & Co. lowered their price objective on shares of AGNC Investment from $10.00 to $9.50 and set an "overweight" rating for the company in a research note on Monday, December 9th. StockNews.com downgraded shares of AGNC Investment from a "hold" rating to a "sell" rating in a report on Saturday, October 19th. Keefe, Bruyette & Woods cut their price target on AGNC Investment from $10.75 to $10.25 and set an "outperform" rating for the company in a research note on Wednesday. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and issued a $11.00 price target on shares of AGNC Investment in a report on Thursday. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and seven have assigned a buy rating to the company. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $10.50.

View Our Latest Report on AGNC Investment

AGNC Investment Stock Up 2.5 %

Shares of NASDAQ:AGNC traded up $0.25 during trading on Thursday, reaching $10.08. 32,122,507 shares of the company traded hands, compared to its average volume of 19,409,074. The firm has a fifty day simple moving average of $9.52 and a 200 day simple moving average of $9.89. AGNC Investment has a 1-year low of $8.92 and a 1-year high of $10.85. The company has a quick ratio of 0.23, a current ratio of 0.23 and a debt-to-equity ratio of 0.01. The firm has a market cap of $8.93 billion, a P/E ratio of 7.00 and a beta of 1.47.

AGNC Investment (NASDAQ:AGNC - Get Free Report) last announced its earnings results on Monday, January 27th. The real estate investment trust reported $0.37 earnings per share for the quarter, missing analysts' consensus estimates of $0.42 by ($0.05). AGNC Investment had a net margin of 42.19% and a return on equity of 23.41%. Analysts anticipate that AGNC Investment will post 1.95 earnings per share for the current fiscal year.

Institutional Trading of AGNC Investment

Several hedge funds have recently bought and sold shares of AGNC. Vaughan Nelson Investment Management L.P. increased its position in AGNC Investment by 200.5% during the third quarter. Vaughan Nelson Investment Management L.P. now owns 14,446,725 shares of the real estate investment trust's stock worth $151,113,000 after acquiring an additional 9,639,675 shares during the period. Natixis Advisors LLC lifted its stake in AGNC Investment by 314.8% in the third quarter. Natixis Advisors LLC now owns 3,842,814 shares of the real estate investment trust's stock valued at $40,196,000 after buying an additional 2,916,345 shares in the last quarter. ORG Wealth Partners LLC bought a new position in shares of AGNC Investment during the 3rd quarter worth approximately $17,463,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in shares of AGNC Investment by 115.0% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,912,694 shares of the real estate investment trust's stock valued at $20,007,000 after acquiring an additional 1,023,275 shares during the last quarter. Finally, International Assets Investment Management LLC lifted its stake in AGNC Investment by 945.2% in the third quarter. International Assets Investment Management LLC now owns 1,072,039 shares of the real estate investment trust's stock valued at $102,489,000 after acquiring an additional 969,475 shares during the last quarter. 38.28% of the stock is currently owned by institutional investors.

About AGNC Investment

(

Get Free Report)

AGNC Investment Corp., formerly American Capital Agency Corp., is a real estate investment trust. The Company invests in agency residential mortgage-backed securities on a leveraged basis. Its investments consist of residential mortgage pass-through securities and collateralized mortgage obligations (CMOs) for which the principal and interest payments are guaranteed by a government-sponsored enterprise, such as the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), or by the United States Government agency, such as the Government National Mortgage Association (Ginnie Mae) (collectively, GSEs).

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AGNC Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AGNC Investment wasn't on the list.

While AGNC Investment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.