CACI International (NYSE:CACI - Free Report) had its price objective cut by Wells Fargo & Company from $637.00 to $564.00 in a research report report published on Tuesday,Benzinga reports. They currently have an overweight rating on the information technology services provider's stock.

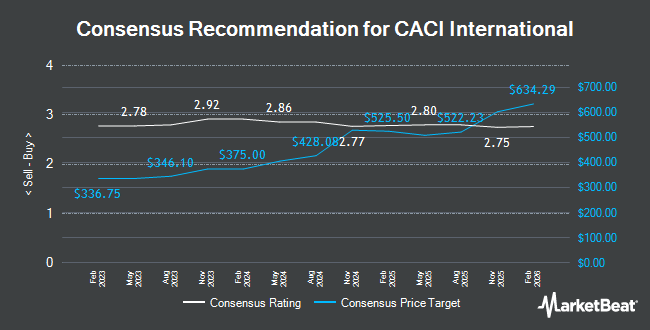

Other equities analysts have also issued research reports about the stock. Barclays upped their price objective on shares of CACI International from $610.00 to $625.00 and gave the company an "overweight" rating in a report on Tuesday, November 12th. JPMorgan Chase & Co. upped their price objective on shares of CACI International from $520.00 to $555.00 and gave the company an "overweight" rating in a report on Wednesday, October 2nd. TD Cowen upped their price objective on shares of CACI International from $545.00 to $570.00 and gave the company a "buy" rating in a report on Friday, October 25th. Bank of America upped their price objective on shares of CACI International from $535.00 to $555.00 and gave the company a "buy" rating in a report on Tuesday, September 17th. Finally, Truist Financial dropped their price objective on shares of CACI International from $650.00 to $550.00 and set a "buy" rating on the stock in a report on Friday. Three research analysts have rated the stock with a hold rating and nine have issued a buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $535.90.

View Our Latest Report on CACI

CACI International Trading Up 1.5 %

CACI stock traded up $6.84 during midday trading on Tuesday, hitting $471.19. The stock had a trading volume of 100,884 shares, compared to its average volume of 127,691. The firm has a market cap of $10.56 billion, a P/E ratio of 23.02, a price-to-earnings-growth ratio of 1.45 and a beta of 0.91. The company has a current ratio of 1.75, a quick ratio of 1.75 and a debt-to-equity ratio of 0.48. CACI International has a 1-year low of $314.06 and a 1-year high of $588.26. The business has a fifty day moving average price of $516.95 and a two-hundred day moving average price of $470.67.

CACI International (NYSE:CACI - Get Free Report) last released its earnings results on Wednesday, October 23rd. The information technology services provider reported $5.93 earnings per share (EPS) for the quarter, beating the consensus estimate of $5.08 by $0.85. The business had revenue of $2.06 billion for the quarter, compared to analyst estimates of $1.92 billion. CACI International had a net margin of 5.77% and a return on equity of 14.78%. CACI International's revenue for the quarter was up 11.2% on a year-over-year basis. During the same quarter in the previous year, the business earned $4.36 earnings per share. On average, sell-side analysts predict that CACI International will post 23.47 earnings per share for the current fiscal year.

Insider Buying and Selling

In other CACI International news, EVP J William Koegel, Jr. sold 970 shares of the company's stock in a transaction dated Thursday, August 29th. The shares were sold at an average price of $483.27, for a total value of $468,771.90. Following the completion of the sale, the executive vice president now directly owns 22,651 shares of the company's stock, valued at approximately $10,946,548.77. This represents a 4.11 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, insider Gregory R. Bradford sold 10,000 shares of the company's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $492.41, for a total transaction of $4,924,100.00. Following the completion of the sale, the insider now directly owns 35,538 shares of the company's stock, valued at $17,499,266.58. The trade was a 21.96 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.35% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On CACI International

A number of institutional investors have recently added to or reduced their stakes in the company. First Horizon Advisors Inc. grew its position in shares of CACI International by 40.0% during the 3rd quarter. First Horizon Advisors Inc. now owns 63 shares of the information technology services provider's stock valued at $32,000 after acquiring an additional 18 shares during the period. Rosenberg Matthew Hamilton grew its position in shares of CACI International by 9.8% during the 3rd quarter. Rosenberg Matthew Hamilton now owns 212 shares of the information technology services provider's stock valued at $107,000 after acquiring an additional 19 shares during the period. UMB Bank n.a. grew its position in shares of CACI International by 81.4% during the 3rd quarter. UMB Bank n.a. now owns 78 shares of the information technology services provider's stock valued at $39,000 after acquiring an additional 35 shares during the period. Captrust Financial Advisors grew its position in shares of CACI International by 10.2% during the 3rd quarter. Captrust Financial Advisors now owns 823 shares of the information technology services provider's stock valued at $415,000 after acquiring an additional 76 shares during the period. Finally, TD Private Client Wealth LLC boosted its holdings in CACI International by 49.1% in the 3rd quarter. TD Private Client Wealth LLC now owns 252 shares of the information technology services provider's stock worth $127,000 after buying an additional 83 shares during the period. 86.43% of the stock is owned by institutional investors.

About CACI International

(

Get Free Report)

CACI International Inc, through its subsidiaries, engages in the provision of expertise and technology to enterprise and mission customers in support of national security in the intelligence, defense, and federal civilian sectors. The company operates through two segments, Domestic Operations and International Operations.

Recommended Stories

Before you consider CACI International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CACI International wasn't on the list.

While CACI International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.