International Flavors & Fragrances (NYSE:IFF - Free Report) had its price target decreased by Wells Fargo & Company from $115.00 to $105.00 in a research report report published on Thursday,Benzinga reports. Wells Fargo & Company currently has an overweight rating on the specialty chemicals company's stock.

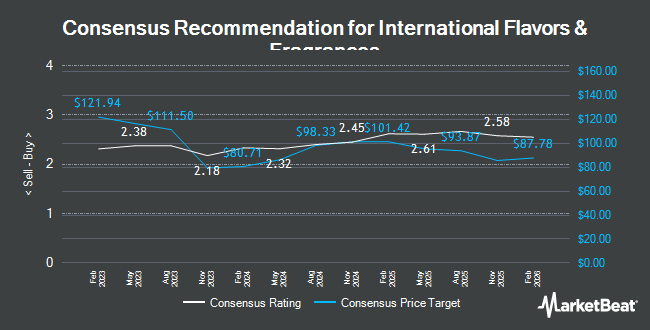

Several other research analysts also recently issued reports on the company. Argus raised International Flavors & Fragrances from a "hold" rating to a "buy" rating in a research note on Tuesday, January 7th. Stifel Nicolaus cut their target price on shares of International Flavors & Fragrances from $113.00 to $105.00 and set a "buy" rating for the company in a research note on Monday, February 3rd. Bank of America raised shares of International Flavors & Fragrances from a "neutral" rating to a "buy" rating and set a $107.00 target price for the company in a research note on Friday, November 8th. JPMorgan Chase & Co. cut their target price on shares of International Flavors & Fragrances from $110.00 to $107.00 and set an "overweight" rating for the company in a research note on Thursday, November 7th. Finally, Cfra downgraded shares of International Flavors & Fragrances from a "buy" rating to a "sell" rating and set a $77.00 target price for the company. in a research note on Thursday. Two investment analysts have rated the stock with a sell rating, three have issued a hold rating and twelve have assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $103.50.

Read Our Latest Research Report on International Flavors & Fragrances

International Flavors & Fragrances Price Performance

Shares of NYSE:IFF traded down $0.22 during midday trading on Thursday, hitting $79.92. 1,571,210 shares of the stock were exchanged, compared to its average volume of 1,501,512. The stock has a market cap of $20.43 billion, a P/E ratio of 85.02, a PEG ratio of 1.48 and a beta of 1.19. The company has a current ratio of 1.84, a quick ratio of 1.93 and a debt-to-equity ratio of 0.54. International Flavors & Fragrances has a twelve month low of $72.94 and a twelve month high of $106.77. The company has a 50 day moving average price of $84.71 and a 200-day moving average price of $93.45.

International Flavors & Fragrances (NYSE:IFF - Get Free Report) last released its quarterly earnings results on Tuesday, February 18th. The specialty chemicals company reported $0.97 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.83 by $0.14. The business had revenue of $2.77 billion during the quarter, compared to the consensus estimate of $2.67 billion. International Flavors & Fragrances had a return on equity of 7.72% and a net margin of 2.12%. On average, research analysts forecast that International Flavors & Fragrances will post 4.35 earnings per share for the current year.

Institutional Trading of International Flavors & Fragrances

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. SBI Securities Co. Ltd. purchased a new stake in shares of International Flavors & Fragrances during the 4th quarter worth about $32,000. Fairway Wealth LLC purchased a new stake in shares of International Flavors & Fragrances during the 4th quarter worth about $34,000. Point72 Hong Kong Ltd purchased a new stake in shares of International Flavors & Fragrances during the 3rd quarter worth about $42,000. Rialto Wealth Management LLC purchased a new stake in shares of International Flavors & Fragrances during the 4th quarter worth about $42,000. Finally, Eastern Bank purchased a new stake in shares of International Flavors & Fragrances during the 3rd quarter worth about $46,000. Hedge funds and other institutional investors own 96.02% of the company's stock.

International Flavors & Fragrances Company Profile

(

Get Free Report)

International Flavors & Fragrances, Inc engages in the manufacture and supply of flavors and fragrances used in the food, beverage, personal care, and household products industries. It operates through the following segments: Nourish, Health & Biosciences, Scent and Pharma Solutions. The Nourish segment consists of legacy Taste segment combined with N&B's Food & Beverage division and the food protection business of N&B's Health & Biosciences division.

See Also

Before you consider International Flavors & Fragrances, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Flavors & Fragrances wasn't on the list.

While International Flavors & Fragrances currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.