Apollo Global Management (NYSE:APO - Get Free Report) had its price objective lifted by Wells Fargo & Company from $164.00 to $197.00 in a research report issued on Thursday,Benzinga reports. The firm currently has an "overweight" rating on the financial services provider's stock. Wells Fargo & Company's price target points to a potential upside of 11.68% from the company's previous close.

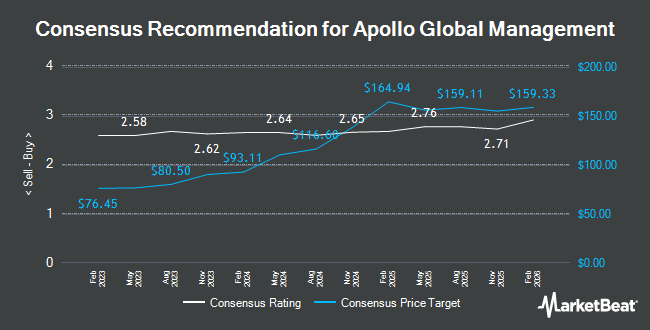

A number of other analysts have also recently weighed in on the company. Redburn Atlantic assumed coverage on Apollo Global Management in a research report on Tuesday, August 27th. They set a "buy" rating and a $153.00 price target on the stock. Piper Sandler started coverage on shares of Apollo Global Management in a research note on Tuesday, November 19th. They set an "overweight" rating and a $188.00 target price on the stock. StockNews.com lowered Apollo Global Management from a "hold" rating to a "sell" rating in a report on Tuesday. Redburn Partners assumed coverage on Apollo Global Management in a research note on Tuesday, August 27th. They set a "buy" rating and a $153.00 price target for the company. Finally, Deutsche Bank Aktiengesellschaft raised their target price on Apollo Global Management from $141.00 to $155.00 and gave the company a "buy" rating in a report on Wednesday, November 6th. One research analyst has rated the stock with a sell rating, four have assigned a hold rating and sixteen have given a buy rating to the company. Based on data from MarketBeat, Apollo Global Management has a consensus rating of "Moderate Buy" and an average target price of $160.89.

View Our Latest Stock Analysis on APO

Apollo Global Management Trading Down 1.2 %

APO stock traded down $2.21 during midday trading on Thursday, reaching $176.40. 3,547,458 shares of the company's stock traded hands, compared to its average volume of 2,837,445. The company has a market capitalization of $99.81 billion, a P/E ratio of 18.65, a PEG ratio of 1.84 and a beta of 1.63. The company has a debt-to-equity ratio of 0.33, a current ratio of 1.44 and a quick ratio of 1.44. Apollo Global Management has a fifty-two week low of $89.76 and a fifty-two week high of $189.49. The business has a 50-day moving average price of $156.19 and a two-hundred day moving average price of $130.15.

Insider Buying and Selling at Apollo Global Management

In related news, insider Leon D. Black sold 133,400 shares of the business's stock in a transaction on Monday, December 2nd. The shares were sold at an average price of $174.16, for a total transaction of $23,232,944.00. Following the completion of the transaction, the insider now directly owns 35,471,373 shares in the company, valued at $6,177,694,321.68. The trade was a 0.37 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO Martin Kelly sold 5,000 shares of the firm's stock in a transaction dated Tuesday, December 3rd. The stock was sold at an average price of $172.61, for a total value of $863,050.00. Following the sale, the chief financial officer now directly owns 320,564 shares in the company, valued at approximately $55,332,552.04. This trade represents a 1.54 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 196,600 shares of company stock worth $34,186,128. 8.50% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On Apollo Global Management

A number of hedge funds have recently bought and sold shares of APO. Geode Capital Management LLC raised its position in shares of Apollo Global Management by 4.7% during the 3rd quarter. Geode Capital Management LLC now owns 5,717,266 shares of the financial services provider's stock worth $713,230,000 after purchasing an additional 254,268 shares during the last quarter. Legal & General Group Plc boosted its holdings in Apollo Global Management by 3.0% in the 2nd quarter. Legal & General Group Plc now owns 4,383,217 shares of the financial services provider's stock valued at $517,527,000 after purchasing an additional 126,859 shares during the last quarter. TD Asset Management Inc lifted its holdings in Apollo Global Management by 3.8% in the second quarter. TD Asset Management Inc now owns 2,697,739 shares of the financial services provider's stock valued at $318,522,000 after acquiring an additional 97,797 shares during the last quarter. Charles Schwab Investment Management Inc. grew its holdings in shares of Apollo Global Management by 27.0% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,806,098 shares of the financial services provider's stock worth $225,600,000 after purchasing an additional 383,557 shares during the period. Finally, Janus Henderson Group PLC boosted its stake in Apollo Global Management by 0.4% during the third quarter. Janus Henderson Group PLC now owns 1,339,355 shares of the financial services provider's stock worth $167,298,000 after buying an additional 4,892 shares during the period. Hedge funds and other institutional investors own 77.06% of the company's stock.

Apollo Global Management Company Profile

(

Get Free Report)

Apollo Global Management, Inc is a private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets. The firm prefers to invest in private and public markets. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth, venture capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions.

Read More

Before you consider Apollo Global Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apollo Global Management wasn't on the list.

While Apollo Global Management currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.