Samsara (NYSE:IOT - Free Report) had its target price upped by Wells Fargo & Company from $46.00 to $55.00 in a research note published on Friday,Benzinga reports. They currently have an overweight rating on the stock.

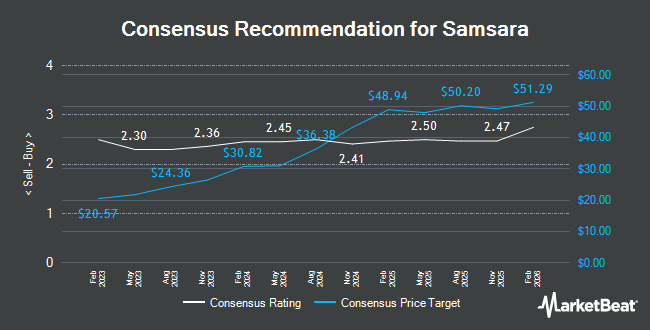

Several other equities analysts also recently issued reports on IOT. Evercore ISI upped their target price on Samsara from $40.00 to $42.00 and gave the company an "in-line" rating in a research report on Friday, September 6th. Morgan Stanley increased their price objective on Samsara from $40.00 to $52.00 and gave the company an "equal weight" rating in a report on Wednesday, November 20th. StockNews.com raised Samsara from a "sell" rating to a "hold" rating in a report on Friday, November 8th. Royal Bank of Canada raised their price target on shares of Samsara from $49.00 to $64.00 and gave the stock an "overweight" rating in a research report on Thursday. Finally, BMO Capital Markets upped their price objective on shares of Samsara from $44.00 to $57.00 and gave the company a "market perform" rating in a report on Friday. Nine research analysts have rated the stock with a hold rating and six have given a buy rating to the company. Based on data from MarketBeat.com, Samsara currently has a consensus rating of "Hold" and an average target price of $51.29.

Check Out Our Latest Stock Report on Samsara

Samsara Trading Down 5.2 %

Shares of IOT traded down $2.86 during midday trading on Friday, hitting $52.27. 10,742,267 shares of the company's stock traded hands, compared to its average volume of 2,404,721. Samsara has a 1 year low of $27.14 and a 1 year high of $57.51. The firm's fifty day moving average is $50.44 and its 200-day moving average is $42.40. The stock has a market capitalization of $29.08 billion, a price-to-earnings ratio of -111.21 and a beta of 1.53.

Samsara (NYSE:IOT - Get Free Report) last announced its quarterly earnings data on Thursday, September 5th. The company reported $0.05 EPS for the quarter, beating the consensus estimate of $0.01 by $0.04. The firm had revenue of $300.20 million during the quarter, compared to analyst estimates of $289.53 million. Samsara had a negative net margin of 24.19% and a negative return on equity of 20.39%. Samsara's revenue was up 36.9% on a year-over-year basis. During the same period last year, the firm posted ($0.11) EPS. On average, equities research analysts anticipate that Samsara will post -0.34 EPS for the current year.

Insider Buying and Selling at Samsara

In other Samsara news, CEO Sanjit Biswas sold 96,000 shares of the business's stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $46.88, for a total value of $4,500,480.00. Following the transaction, the chief executive officer now directly owns 698,299 shares in the company, valued at $32,736,257.12. The trade was a 12.09 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, insider Adam Eltoukhy sold 5,008 shares of the firm's stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $47.30, for a total transaction of $236,878.40. Following the sale, the insider now owns 455,797 shares of the company's stock, valued at $21,559,198.10. This represents a 1.09 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 1,873,300 shares of company stock worth $91,752,243 in the last three months. 60.04% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On Samsara

A number of hedge funds have recently modified their holdings of the business. Baillie Gifford & Co. increased its holdings in Samsara by 23.4% in the 3rd quarter. Baillie Gifford & Co. now owns 33,844,390 shares of the company's stock valued at $1,628,592,000 after purchasing an additional 6,411,178 shares during the last quarter. FMR LLC grew its stake in shares of Samsara by 15.6% in the third quarter. FMR LLC now owns 11,890,600 shares of the company's stock valued at $572,176,000 after buying an additional 1,604,822 shares in the last quarter. 1832 Asset Management L.P. grew its stake in shares of Samsara by 6.6% in the second quarter. 1832 Asset Management L.P. now owns 8,128,500 shares of the company's stock valued at $273,930,000 after buying an additional 500,400 shares in the last quarter. Westfield Capital Management Co. LP raised its holdings in shares of Samsara by 4.1% in the 3rd quarter. Westfield Capital Management Co. LP now owns 3,506,681 shares of the company's stock valued at $168,741,000 after buying an additional 138,702 shares during the period. Finally, Geode Capital Management LLC lifted its stake in Samsara by 9.5% during the 3rd quarter. Geode Capital Management LLC now owns 2,279,383 shares of the company's stock worth $109,307,000 after acquiring an additional 196,867 shares in the last quarter. 89.39% of the stock is currently owned by hedge funds and other institutional investors.

About Samsara

(

Get Free Report)

Samsara Inc provides solutions that connects physical operations data to its connected operations cloud in the United States and internationally. The company's Connected Operations Cloud includes Data Platform, which ingests, aggregates, and enriches data from its IoT devices and has embedded capabilities for AI, workflows and analytics, alerts, API connections, and data security and privacy.

Further Reading

Before you consider Samsara, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Samsara wasn't on the list.

While Samsara currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.