Northern Trust (NASDAQ:NTRS - Free Report) had its price target raised by Wells Fargo & Company from $108.00 to $110.00 in a research note released on Friday,Benzinga reports. They currently have an equal weight rating on the asset manager's stock.

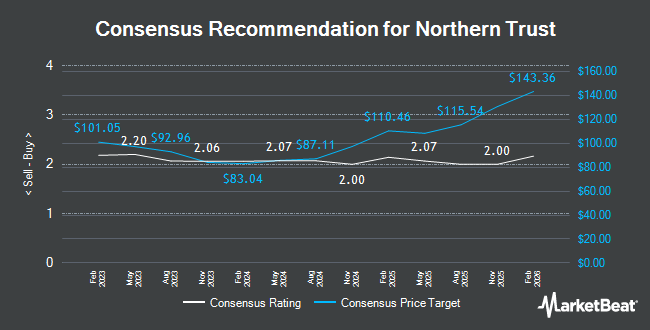

Several other brokerages have also recently weighed in on NTRS. Evercore ISI lifted their price target on Northern Trust from $86.00 to $103.00 and gave the company an "in-line" rating in a research report on Thursday, October 24th. Bank of America increased their price target on shares of Northern Trust from $103.00 to $115.00 and gave the stock a "buy" rating in a report on Thursday, October 24th. Morgan Stanley boosted their price objective on shares of Northern Trust from $97.00 to $103.00 and gave the company an "underweight" rating in a research note on Thursday, October 24th. UBS Group increased their target price on shares of Northern Trust from $86.00 to $92.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 8th. Finally, The Goldman Sachs Group lowered shares of Northern Trust from a "neutral" rating to a "sell" rating and reduced their price target for the company from $84.00 to $82.00 in a research report on Thursday, September 26th. Three research analysts have rated the stock with a sell rating, six have assigned a hold rating and four have assigned a buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $100.67.

Get Our Latest Report on NTRS

Northern Trust Stock Performance

Northern Trust stock traded up $1.01 during midday trading on Friday, reaching $106.97. The stock had a trading volume of 1,012,120 shares, compared to its average volume of 1,298,574. The company has a quick ratio of 0.71, a current ratio of 0.71 and a debt-to-equity ratio of 0.58. The firm has a market capitalization of $21.20 billion, a PE ratio of 13.27, a P/E/G ratio of 1.20 and a beta of 1.06. Northern Trust has a 12 month low of $73.98 and a 12 month high of $108.53. The firm's 50-day moving average price is $95.26 and its 200 day moving average price is $88.69.

Northern Trust Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 1st. Investors of record on Friday, December 6th will be issued a dividend of $0.75 per share. The ex-dividend date of this dividend is Friday, December 6th. This represents a $3.00 dividend on an annualized basis and a yield of 2.80%. Northern Trust's dividend payout ratio is currently 37.31%.

Insiders Place Their Bets

In other Northern Trust news, COO Peter Cherecwich sold 16,153 shares of the company's stock in a transaction that occurred on Thursday, November 7th. The stock was sold at an average price of $105.18, for a total transaction of $1,698,972.54. Following the transaction, the chief operating officer now owns 4,397 shares in the company, valued at approximately $462,476.46. This represents a 78.60 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Charles A. Tribbett sold 1,855 shares of the stock in a transaction on Friday, September 13th. The stock was sold at an average price of $88.12, for a total value of $163,462.60. Following the completion of the transaction, the director now owns 1,000 shares of the company's stock, valued at approximately $88,120. This trade represents a 64.97 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 80,906 shares of company stock valued at $8,176,652 in the last quarter. Insiders own 0.64% of the company's stock.

Institutional Inflows and Outflows

A number of large investors have recently bought and sold shares of the business. Olistico Wealth LLC purchased a new position in shares of Northern Trust during the second quarter valued at approximately $25,000. Innealta Capital LLC bought a new stake in Northern Trust in the second quarter worth $26,000. Ridgewood Investments LLC purchased a new stake in shares of Northern Trust in the second quarter worth $30,000. Versant Capital Management Inc increased its holdings in shares of Northern Trust by 343.9% during the second quarter. Versant Capital Management Inc now owns 435 shares of the asset manager's stock valued at $37,000 after acquiring an additional 337 shares in the last quarter. Finally, Northwest Investment Counselors LLC bought a new position in Northern Trust in the 3rd quarter worth about $39,000. 83.19% of the stock is owned by hedge funds and other institutional investors.

About Northern Trust

(

Get Free Report)

Northern Trust Corporation, a financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide. It operates in two segments, Asset Servicing and Wealth Management. The Asset Servicing segment offers asset servicing and related services, including custody, fund administration, investment operations outsourcing, investment management, investment risk and analytical services, employee benefit services, securities lending, foreign exchange, treasury management, brokerage services, transition management services, banking, and cash management services.

Recommended Stories

Before you consider Northern Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northern Trust wasn't on the list.

While Northern Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.