West Family Investments Inc. bought a new stake in shares of Abbott Laboratories (NYSE:ABT - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund bought 4,772 shares of the healthcare product maker's stock, valued at approximately $544,000.

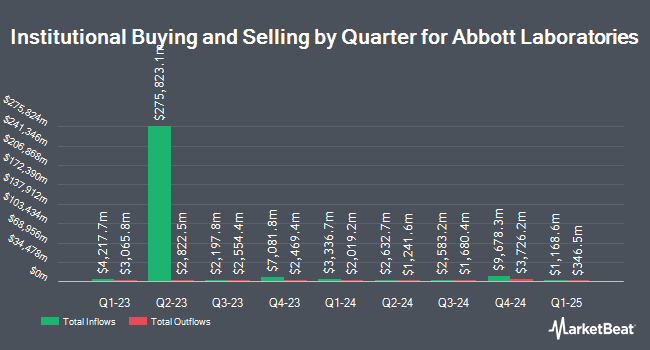

A number of other large investors have also recently bought and sold shares of ABT. Capital International Investors increased its position in Abbott Laboratories by 9.1% in the first quarter. Capital International Investors now owns 70,177,564 shares of the healthcare product maker's stock worth $7,976,382,000 after purchasing an additional 5,882,780 shares during the period. Ameriprise Financial Inc. increased its holdings in Abbott Laboratories by 5.0% in the 2nd quarter. Ameriprise Financial Inc. now owns 10,675,827 shares of the healthcare product maker's stock valued at $1,103,997,000 after buying an additional 508,524 shares during the period. Dimensional Fund Advisors LP lifted its holdings in shares of Abbott Laboratories by 27.4% in the second quarter. Dimensional Fund Advisors LP now owns 7,428,752 shares of the healthcare product maker's stock worth $771,940,000 after acquiring an additional 1,596,835 shares during the last quarter. Diamond Hill Capital Management Inc. grew its holdings in Abbott Laboratories by 8.5% during the 3rd quarter. Diamond Hill Capital Management Inc. now owns 6,683,586 shares of the healthcare product maker's stock worth $761,996,000 after acquiring an additional 524,683 shares during the last quarter. Finally, Swiss National Bank increased its position in Abbott Laboratories by 0.5% during the 3rd quarter. Swiss National Bank now owns 5,163,580 shares of the healthcare product maker's stock valued at $588,700,000 after purchasing an additional 26,000 shares during the period. 75.18% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of research analysts have weighed in on ABT shares. Royal Bank of Canada raised their price objective on shares of Abbott Laboratories from $125.00 to $130.00 and gave the company an "outperform" rating in a research note on Tuesday, October 8th. Raymond James reaffirmed a "buy" rating and issued a $129.00 target price (up from $122.00) on shares of Abbott Laboratories in a research note on Monday, October 14th. Piper Sandler Companies began coverage on shares of Abbott Laboratories in a report on Thursday, September 19th. They issued an "overweight" rating and a $131.00 price target on the stock. Oppenheimer started coverage on shares of Abbott Laboratories in a research note on Tuesday, October 8th. They set an "outperform" rating and a $130.00 target price for the company. Finally, Piper Sandler upped their price objective on Abbott Laboratories from $131.00 to $133.00 and gave the company an "overweight" rating in a research report on Thursday, October 17th. Four investment analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $130.07.

Read Our Latest Stock Report on ABT

Abbott Laboratories Stock Performance

Shares of ABT traded down $0.26 on Tuesday, reaching $117.10. 4,542,800 shares of the stock traded hands, compared to its average volume of 5,698,179. Abbott Laboratories has a 12 month low of $98.95 and a 12 month high of $121.64. The firm has a market cap of $203.10 billion, a price-to-earnings ratio of 35.49, a P/E/G ratio of 2.73 and a beta of 0.72. The stock's 50-day moving average price is $115.55 and its 200-day moving average price is $109.62. The company has a debt-to-equity ratio of 0.32, a current ratio of 1.60 and a quick ratio of 1.14.

Abbott Laboratories (NYSE:ABT - Get Free Report) last released its earnings results on Wednesday, October 16th. The healthcare product maker reported $1.21 EPS for the quarter, topping analysts' consensus estimates of $1.20 by $0.01. Abbott Laboratories had a net margin of 13.99% and a return on equity of 20.18%. The firm had revenue of $10.64 billion during the quarter, compared to analyst estimates of $10.55 billion. During the same quarter in the previous year, the business earned $1.14 EPS. The business's quarterly revenue was up 4.9% compared to the same quarter last year. Equities analysts forecast that Abbott Laboratories will post 4.67 EPS for the current fiscal year.

Abbott Laboratories Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Tuesday, October 15th were given a dividend of $0.55 per share. The ex-dividend date was Tuesday, October 15th. This represents a $2.20 dividend on an annualized basis and a dividend yield of 1.88%. Abbott Laboratories's payout ratio is 66.87%.

Insider Transactions at Abbott Laboratories

In other Abbott Laboratories news, CEO Robert B. Ford sold 141,679 shares of Abbott Laboratories stock in a transaction that occurred on Thursday, September 12th. The stock was sold at an average price of $116.41, for a total value of $16,492,852.39. Following the completion of the sale, the chief executive officer now directly owns 220,059 shares in the company, valued at approximately $25,617,068.19. The trade was a 39.17 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 0.47% of the stock is owned by insiders.

Abbott Laboratories Company Profile

(

Free Report)

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide. It operates in four segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. The company provides generic pharmaceuticals for the treatment of pancreatic exocrine insufficiency, irritable bowel syndrome or biliary spasm, intrahepatic cholestasis or depressive symptoms, gynecological disorder, hormone replacement therapy, dyslipidemia, hypertension, hypothyroidism, Ménière's disease and vestibular vertigo, pain, fever, inflammation, and migraine, as well as provides anti-infective clarithromycin, influenza vaccine, and products to regulate physiological rhythm of the colon.

Featured Articles

Before you consider Abbott Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abbott Laboratories wasn't on the list.

While Abbott Laboratories currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report