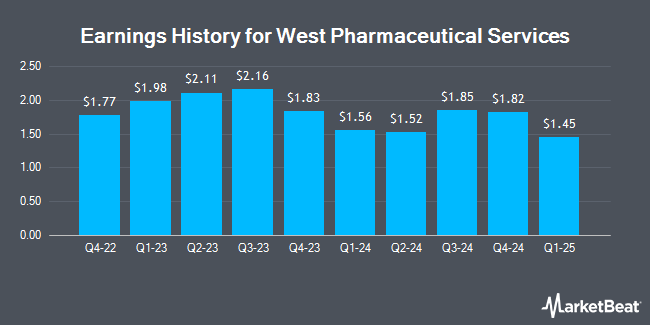

West Pharmaceutical Services (NYSE:WST - Get Free Report) announced its earnings results on Thursday. The medical instruments supplier reported $1.82 earnings per share for the quarter, beating analysts' consensus estimates of $1.75 by $0.07, Zacks reports. West Pharmaceutical Services had a net margin of 17.37% and a return on equity of 18.41%. The business had revenue of $748.80 million during the quarter, compared to analyst estimates of $739.59 million. West Pharmaceutical Services updated its FY 2025 guidance to 6.000-6.200 EPS.

West Pharmaceutical Services Trading Up 7.9 %

Shares of NYSE:WST traded up $15.73 during trading on Monday, reaching $214.84. The company's stock had a trading volume of 5,020,477 shares, compared to its average volume of 424,824. The company has a current ratio of 3.00, a quick ratio of 2.23 and a debt-to-equity ratio of 0.07. West Pharmaceutical Services has a 12 month low of $197.01 and a 12 month high of $400.88. The firm's 50 day simple moving average is $327.86 and its two-hundred day simple moving average is $313.97. The stock has a market capitalization of $15.56 billion, a PE ratio of 31.87, a price-to-earnings-growth ratio of 19.31 and a beta of 1.01.

West Pharmaceutical Services Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Tuesday, February 11th. Investors of record on Friday, February 7th were issued a $0.21 dividend. This represents a $0.84 dividend on an annualized basis and a dividend yield of 0.39%. The ex-dividend date of this dividend was Friday, February 7th. West Pharmaceutical Services's payout ratio is 12.46%.

Wall Street Analysts Forecast Growth

A number of brokerages have issued reports on WST. Deutsche Bank Aktiengesellschaft upgraded West Pharmaceutical Services from a "hold" rating to a "buy" rating and set a $250.00 price target for the company in a research note on Friday. Bank of America raised their price objective on West Pharmaceutical Services from $350.00 to $355.00 and gave the company a "buy" rating in a research report on Friday, December 13th. StockNews.com upgraded West Pharmaceutical Services from a "hold" rating to a "buy" rating in a research report on Tuesday, February 11th. Citigroup assumed coverage on West Pharmaceutical Services in a research report on Wednesday, January 8th. They set a "buy" rating and a $400.00 price objective for the company. Finally, KeyCorp cut their price objective on West Pharmaceutical Services from $470.00 to $325.00 and set an "overweight" rating for the company in a research report on Friday. One research analyst has rated the stock with a hold rating and six have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $344.00.

Get Our Latest Stock Report on WST

About West Pharmaceutical Services

(

Get Free Report)

West Pharmaceutical Services, Inc designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It operates in two segments, Proprietary Products and Contract-Manufactured Products.

Featured Stories

Before you consider West Pharmaceutical Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and West Pharmaceutical Services wasn't on the list.

While West Pharmaceutical Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.