Western Alliance Bancorporation (NYSE:WAL - Get Free Report) was upgraded by equities research analysts at StockNews.com from a "sell" rating to a "hold" rating in a report issued on Wednesday.

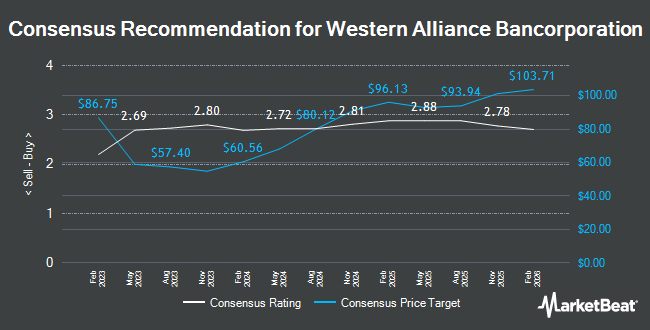

A number of other equities analysts have also weighed in on the company. DA Davidson lowered their target price on Western Alliance Bancorporation from $110.00 to $106.00 and set a "buy" rating on the stock in a research note on Wednesday. Truist Financial decreased their price objective on shares of Western Alliance Bancorporation from $100.00 to $95.00 and set a "buy" rating on the stock in a research note on Monday, October 21st. Royal Bank of Canada set a $99.00 price target on shares of Western Alliance Bancorporation and gave the company an "outperform" rating in a research note on Friday, October 18th. Piper Sandler lowered their target price on Western Alliance Bancorporation from $102.00 to $101.00 and set an "overweight" rating for the company in a report on Monday, October 21st. Finally, Barclays raised their target price on Western Alliance Bancorporation from $105.00 to $107.00 and gave the stock an "overweight" rating in a research report on Friday, November 8th. Two equities research analysts have rated the stock with a hold rating and fifteen have assigned a buy rating to the stock. According to MarketBeat, Western Alliance Bancorporation currently has an average rating of "Moderate Buy" and a consensus target price of $96.13.

Read Our Latest Research Report on Western Alliance Bancorporation

Western Alliance Bancorporation Stock Performance

WAL traded down $0.92 on Wednesday, hitting $88.25. The company had a trading volume of 1,493,696 shares, compared to its average volume of 1,368,778. Western Alliance Bancorporation has a 1-year low of $53.75 and a 1-year high of $98.10. The stock has a market cap of $9.71 billion, a price-to-earnings ratio of 13.62, a price-to-earnings-growth ratio of 0.88 and a beta of 1.46. The company has a debt-to-equity ratio of 0.61, a current ratio of 0.85 and a quick ratio of 0.82. The company's fifty day moving average price is $88.13 and its 200 day moving average price is $84.26.

Western Alliance Bancorporation (NYSE:WAL - Get Free Report) last posted its quarterly earnings data on Monday, January 27th. The financial services provider reported $1.95 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.92 by $0.03. Western Alliance Bancorporation had a return on equity of 13.16% and a net margin of 14.66%. Equities analysts predict that Western Alliance Bancorporation will post 7.11 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in WAL. Retirement Systems of Alabama bought a new stake in shares of Western Alliance Bancorporation during the 3rd quarter worth about $11,461,000. Franklin Resources Inc. increased its stake in shares of Western Alliance Bancorporation by 17.0% during the third quarter. Franklin Resources Inc. now owns 314,972 shares of the financial services provider's stock valued at $27,970,000 after acquiring an additional 45,764 shares during the period. Mutual of America Capital Management LLC bought a new stake in Western Alliance Bancorporation during the third quarter worth approximately $5,099,000. BNP Paribas Financial Markets lifted its position in Western Alliance Bancorporation by 1,091.8% in the third quarter. BNP Paribas Financial Markets now owns 34,073 shares of the financial services provider's stock worth $2,947,000 after purchasing an additional 31,214 shares during the period. Finally, nVerses Capital LLC bought a new position in Western Alliance Bancorporation during the 3rd quarter valued at $623,000. Institutional investors and hedge funds own 79.15% of the company's stock.

About Western Alliance Bancorporation

(

Get Free Report)

Western Alliance Bancorporation operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada. It operates through Commercial and Consumer Related segments. The company offers deposit products, including checking, savings, and money market accounts, as well as fixed-rate and fixed maturity certificates of deposit accounts; demand deposits; and treasury management and residential mortgage products and services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Western Alliance Bancorporation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Alliance Bancorporation wasn't on the list.

While Western Alliance Bancorporation currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.