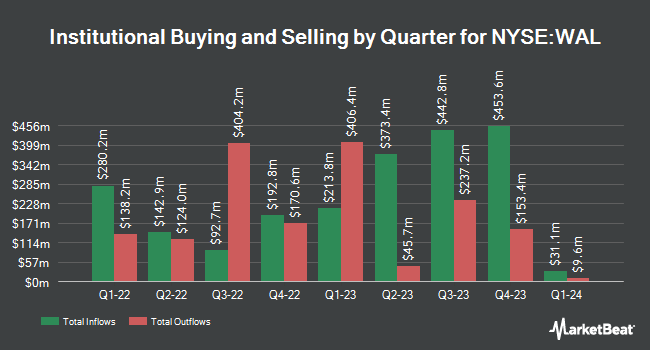

Wellington Management Group LLP reduced its position in shares of Western Alliance Bancorporation (NYSE:WAL - Free Report) by 8.1% in the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 2,332,905 shares of the financial services provider's stock after selling 205,313 shares during the quarter. Wellington Management Group LLP owned about 2.12% of Western Alliance Bancorporation worth $201,773,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in WAL. State Street Corp boosted its stake in Western Alliance Bancorporation by 46.2% during the 3rd quarter. State Street Corp now owns 4,488,345 shares of the financial services provider's stock valued at $388,197,000 after purchasing an additional 1,418,472 shares in the last quarter. FMR LLC boosted its stake in Western Alliance Bancorporation by 93.3% during the 3rd quarter. FMR LLC now owns 2,793,014 shares of the financial services provider's stock valued at $241,568,000 after purchasing an additional 1,347,921 shares in the last quarter. LHM Inc. boosted its stake in Western Alliance Bancorporation by 2,141.1% during the 2nd quarter. LHM Inc. now owns 757,809 shares of the financial services provider's stock valued at $47,606,000 after purchasing an additional 723,995 shares in the last quarter. Dimensional Fund Advisors LP boosted its stake in Western Alliance Bancorporation by 20.6% during the 2nd quarter. Dimensional Fund Advisors LP now owns 3,722,389 shares of the financial services provider's stock valued at $233,832,000 after purchasing an additional 636,577 shares in the last quarter. Finally, Principal Financial Group Inc. boosted its stake in Western Alliance Bancorporation by 6,342.7% during the 3rd quarter. Principal Financial Group Inc. now owns 514,768 shares of the financial services provider's stock valued at $44,522,000 after purchasing an additional 506,778 shares in the last quarter. 79.15% of the stock is owned by institutional investors.

Western Alliance Bancorporation Stock Down 2.2 %

Western Alliance Bancorporation stock traded down $2.08 during mid-day trading on Monday, hitting $91.66. 596,843 shares of the company's stock were exchanged, compared to its average volume of 1,272,309. The company has a current ratio of 0.85, a quick ratio of 0.82 and a debt-to-equity ratio of 0.61. The stock has a market cap of $10.09 billion, a P/E ratio of 14.15, a P/E/G ratio of 1.47 and a beta of 1.45. Western Alliance Bancorporation has a 1-year low of $53.75 and a 1-year high of $98.10. The stock has a 50 day moving average of $88.54 and a two-hundred day moving average of $77.96.

Western Alliance Bancorporation (NYSE:WAL - Get Free Report) last posted its earnings results on Thursday, October 17th. The financial services provider reported $1.80 EPS for the quarter, missing the consensus estimate of $1.90 by ($0.10). The business had revenue of $833.10 million for the quarter, compared to analyst estimates of $811.40 million. Western Alliance Bancorporation had a return on equity of 13.16% and a net margin of 14.66%. As a group, analysts anticipate that Western Alliance Bancorporation will post 7.14 EPS for the current fiscal year.

Western Alliance Bancorporation Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, November 29th. Shareholders of record on Friday, November 15th were given a dividend of $0.38 per share. This represents a $1.52 annualized dividend and a yield of 1.66%. This is an increase from Western Alliance Bancorporation's previous quarterly dividend of $0.37. The ex-dividend date of this dividend was Friday, November 15th. Western Alliance Bancorporation's dividend payout ratio is presently 23.46%.

Analysts Set New Price Targets

A number of equities research analysts have recently commented on WAL shares. JPMorgan Chase & Co. cut their price objective on Western Alliance Bancorporation from $107.00 to $105.00 and set an "overweight" rating for the company in a research report on Monday, October 21st. Piper Sandler cut their price objective on Western Alliance Bancorporation from $102.00 to $101.00 and set an "overweight" rating for the company in a research report on Monday, October 21st. Royal Bank of Canada set a $99.00 price objective on Western Alliance Bancorporation and gave the company an "outperform" rating in a research report on Friday, October 18th. Deutsche Bank Aktiengesellschaft upgraded Western Alliance Bancorporation from a "hold" rating to a "buy" rating and increased their price objective for the company from $83.00 to $101.00 in a research report on Monday, October 7th. Finally, StockNews.com downgraded Western Alliance Bancorporation from a "hold" rating to a "sell" rating in a research report on Tuesday, August 13th. One investment analyst has rated the stock with a sell rating, one has given a hold rating and fourteen have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $93.40.

Check Out Our Latest Stock Analysis on Western Alliance Bancorporation

Western Alliance Bancorporation Profile

(

Free Report)

Western Alliance Bancorporation operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada. It operates through Commercial and Consumer Related segments. The company offers deposit products, including checking, savings, and money market accounts, as well as fixed-rate and fixed maturity certificates of deposit accounts; demand deposits; and treasury management and residential mortgage products and services.

Recommended Stories

Before you consider Western Alliance Bancorporation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Alliance Bancorporation wasn't on the list.

While Western Alliance Bancorporation currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.