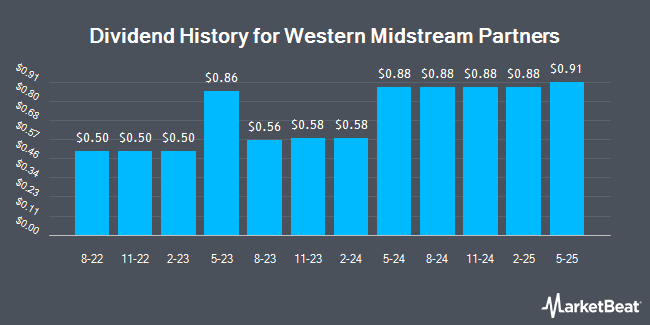

Western Midstream Partners, LP (NYSE:WES - Get Free Report) declared a quarterly dividend on Tuesday, April 22nd, Wall Street Journal reports. Shareholders of record on Friday, May 2nd will be paid a dividend of 0.91 per share by the pipeline company on Thursday, May 15th. This represents a $3.64 dividend on an annualized basis and a yield of 9.59%. The ex-dividend date is Friday, May 2nd. This is a 4.0% increase from Western Midstream Partners's previous quarterly dividend of $0.88.

Western Midstream Partners has raised its dividend by an average of 36.2% per year over the last three years. Western Midstream Partners has a payout ratio of 93.8% meaning its dividend is currently covered by earnings, but may not be in the future if the company's earnings fall. Analysts expect Western Midstream Partners to earn $3.47 per share next year, which means the company may not be able to cover its $3.50 annual dividend with an expected future payout ratio of 100.9%.

Western Midstream Partners Price Performance

Shares of NYSE WES traded up $1.06 during trading on Tuesday, hitting $37.96. The company had a trading volume of 1,064,260 shares, compared to its average volume of 1,247,960. The company has a quick ratio of 1.11, a current ratio of 1.11 and a debt-to-equity ratio of 2.05. Western Midstream Partners has a fifty-two week low of $33.60 and a fifty-two week high of $43.33. The firm has a market capitalization of $14.47 billion, a price-to-earnings ratio of 9.68, a price-to-earnings-growth ratio of 1.40 and a beta of 2.40. The stock has a fifty day simple moving average of $39.53 and a two-hundred day simple moving average of $39.41.

Wall Street Analysts Forecast Growth

Separately, StockNews.com upgraded Western Midstream Partners from a "hold" rating to a "buy" rating in a report on Saturday, March 8th. Two analysts have rated the stock with a sell rating, four have given a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $38.43.

View Our Latest Stock Report on WES

About Western Midstream Partners

(

Get Free Report)

Western Midstream Partners, LP, together with its subsidiaries, operates as a midstream energy company primarily in the United States. It is involved in gathering, compressing, treating, processing, and transporting natural gas; gathering, stabilizing, and transporting condensate, natural gas liquids (NGLs), and crude oil; and gathering and disposing produced water.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Western Midstream Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Midstream Partners wasn't on the list.

While Western Midstream Partners currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.