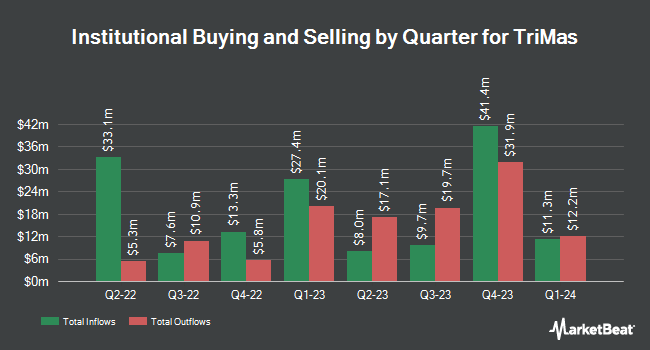

Western Standard LLC grew its stake in shares of TriMas Co. (NASDAQ:TRS - Free Report) by 86.6% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 169,069 shares of the industrial products company's stock after buying an additional 78,450 shares during the quarter. TriMas comprises 4.0% of Western Standard LLC's holdings, making the stock its 11th biggest position. Western Standard LLC owned about 0.42% of TriMas worth $4,316,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors also recently made changes to their positions in the stock. State Street Corp boosted its holdings in shares of TriMas by 4.1% in the third quarter. State Street Corp now owns 994,114 shares of the industrial products company's stock worth $25,380,000 after buying an additional 39,497 shares during the period. Invenomic Capital Management LP acquired a new stake in TriMas in the third quarter valued at approximately $3,655,000. Atom Investors LP increased its position in TriMas by 62.0% during the third quarter. Atom Investors LP now owns 179,328 shares of the industrial products company's stock worth $4,578,000 after buying an additional 68,608 shares during the last quarter. Barington Capital Group L.P. raised its position in shares of TriMas by 4.3% in the third quarter. Barington Capital Group L.P. now owns 608,000 shares of the industrial products company's stock valued at $15,522,000 after purchasing an additional 25,000 shares during the period. Finally, Paloma Partners Management Co bought a new stake in TriMas during the third quarter valued at about $293,000. 99.42% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of analysts have commented on the company. StockNews.com upgraded TriMas from a "sell" rating to a "hold" rating in a research report on Wednesday, November 13th. BWS Financial reaffirmed a "buy" rating and set a $40.00 price objective on shares of TriMas in a research note on Tuesday, November 5th.

Check Out Our Latest Report on TRS

TriMas Trading Down 1.7 %

Shares of TRS stock traded down $0.46 on Friday, hitting $25.87. The stock had a trading volume of 139,867 shares, compared to its average volume of 265,773. TriMas Co. has a twelve month low of $22.45 and a twelve month high of $28.51. The company has a current ratio of 2.83, a quick ratio of 1.44 and a debt-to-equity ratio of 0.60. The firm has a market cap of $1.05 billion, a P/E ratio of 41.14 and a beta of 0.66. The company has a fifty day moving average price of $26.53 and a two-hundred day moving average price of $25.83.

TriMas (NASDAQ:TRS - Get Free Report) last released its earnings results on Monday, November 4th. The industrial products company reported $0.43 EPS for the quarter, missing the consensus estimate of $0.57 by ($0.14). The firm had revenue of $229.36 million during the quarter, compared to the consensus estimate of $239.33 million. TriMas had a net margin of 2.93% and a return on equity of 9.21%. The company's revenue was down 2.5% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.57 EPS. As a group, analysts forecast that TriMas Co. will post 1.69 earnings per share for the current fiscal year.

TriMas Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Tuesday, November 12th. Shareholders of record on Tuesday, November 5th were given a dividend of $0.04 per share. The ex-dividend date was Tuesday, November 5th. This represents a $0.16 dividend on an annualized basis and a dividend yield of 0.62%. TriMas's payout ratio is presently 25.00%.

TriMas Profile

(

Free Report)

TriMas Corporation engages in the design, development, manufacture, and sale of products for consumer products, aerospace, and industrial markets worldwide. The company operates through Packaging, Aerospace, and Specialty Products segments. The Packaging segment offers dispensing products, such as foaming and sanitizer pumps, lotion and hand soap pumps, beverage dispensers, perfume sprayers, and nasal and trigger sprayers; polymeric and steel caps and closures comprising food lids, flip-top and beverage closures, child resistance caps, drum and pail closures, and flexible spouts; polymeric jar products; integrated dispensers; bag-in-box products; and consumable vascular delivery and diagnostic test components under the Rieke, Taplast, Affaba & Ferrari, Intertech, Omega, and Rapak brands.

Further Reading

Before you consider TriMas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TriMas wasn't on the list.

While TriMas currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.