Westfield Capital Management Co. LP increased its position in shares of Ichor Holdings, Ltd. (NASDAQ:ICHR - Free Report) by 4.5% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 580,818 shares of the technology company's stock after acquiring an additional 24,889 shares during the period. Westfield Capital Management Co. LP owned about 1.72% of Ichor worth $18,476,000 at the end of the most recent reporting period.

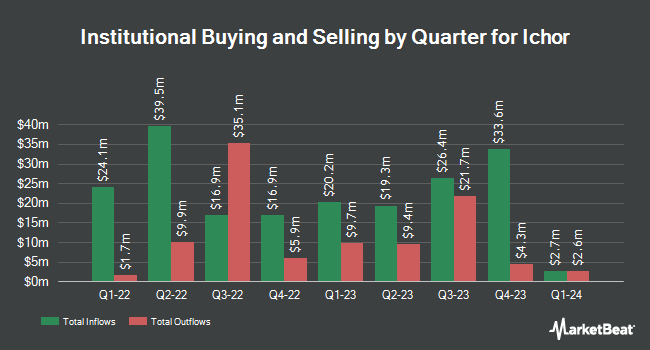

A number of other institutional investors and hedge funds have also bought and sold shares of ICHR. Quarry LP grew its holdings in shares of Ichor by 99.5% during the second quarter. Quarry LP now owns 868 shares of the technology company's stock worth $33,000 after purchasing an additional 433 shares during the last quarter. GAMMA Investing LLC grew its holdings in Ichor by 136.2% during the 3rd quarter. GAMMA Investing LLC now owns 1,084 shares of the technology company's stock worth $34,000 after acquiring an additional 625 shares during the last quarter. Signaturefd LLC increased its position in Ichor by 214.6% in the 3rd quarter. Signaturefd LLC now owns 1,252 shares of the technology company's stock valued at $40,000 after acquiring an additional 854 shares during the period. CWM LLC increased its position in Ichor by 50.5% in the 2nd quarter. CWM LLC now owns 1,540 shares of the technology company's stock valued at $59,000 after acquiring an additional 517 shares during the period. Finally, Intech Investment Management LLC bought a new position in shares of Ichor during the third quarter valued at $209,000. Institutional investors and hedge funds own 94.81% of the company's stock.

Ichor Trading Up 3.1 %

Shares of ICHR stock traded up $1.02 during trading hours on Monday, hitting $34.37. 438,616 shares of the company were exchanged, compared to its average volume of 302,495. The company has a 50 day simple moving average of $29.70 and a two-hundred day simple moving average of $33.19. The firm has a market cap of $1.16 billion, a P/E ratio of -36.96 and a beta of 1.91. The company has a debt-to-equity ratio of 0.18, a quick ratio of 1.69 and a current ratio of 3.64. Ichor Holdings, Ltd. has a fifty-two week low of $25.32 and a fifty-two week high of $46.43.

Ichor (NASDAQ:ICHR - Get Free Report) last posted its quarterly earnings results on Monday, November 4th. The technology company reported $0.12 EPS for the quarter, topping analysts' consensus estimates of $0.11 by $0.01. Ichor had a negative net margin of 3.51% and a negative return on equity of 2.14%. The business had revenue of $211.14 million during the quarter, compared to analysts' expectations of $203.24 million. During the same period last year, the company posted ($0.09) earnings per share. The business's quarterly revenue was up 7.3% on a year-over-year basis. Equities analysts anticipate that Ichor Holdings, Ltd. will post -0.1 EPS for the current year.

Analyst Ratings Changes

A number of analysts recently weighed in on the company. DA Davidson initiated coverage on Ichor in a report on Thursday, September 26th. They issued a "buy" rating and a $50.00 price objective for the company. Needham & Company LLC lowered their price objective on Ichor from $44.00 to $40.00 and set a "buy" rating for the company in a research report on Wednesday, August 7th. StockNews.com upgraded Ichor from a "sell" rating to a "hold" rating in a report on Wednesday, August 14th. B. Riley reissued a "buy" rating and set a $38.00 target price (up previously from $36.00) on shares of Ichor in a research report on Tuesday, November 5th. Finally, TD Cowen upped their price objective on shares of Ichor from $35.00 to $40.00 and gave the company a "buy" rating in a research note on Tuesday, November 5th. Two analysts have rated the stock with a hold rating, five have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $42.57.

Read Our Latest Analysis on ICHR

Ichor Profile

(

Free Report)

Ichor Holdings, Ltd. engages in the design, engineering, and manufacture of fluid delivery subsystems and components for semiconductor capital equipment in the United States and internationally. It primarily offers gas and chemical delivery systems and subsystems that are used in the manufacturing of semiconductor devices.

Further Reading

Before you consider Ichor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ichor wasn't on the list.

While Ichor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.