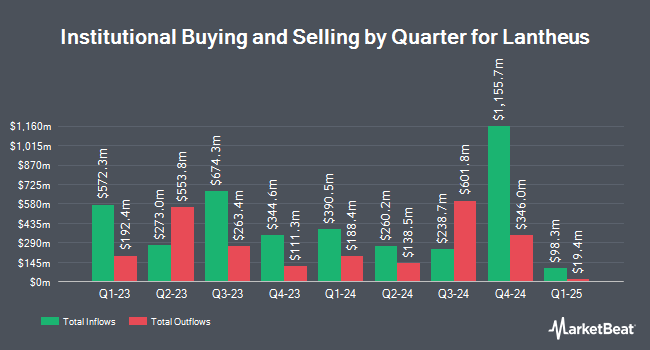

Westfield Capital Management Co. LP lowered its position in Lantheus Holdings, Inc. (NASDAQ:LNTH - Free Report) by 7.5% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,518,465 shares of the medical equipment provider's stock after selling 122,693 shares during the period. Lantheus comprises about 0.8% of Westfield Capital Management Co. LP's portfolio, making the stock its 28th largest position. Westfield Capital Management Co. LP owned about 2.18% of Lantheus worth $166,652,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Centaurus Financial Inc. raised its holdings in shares of Lantheus by 13.0% in the third quarter. Centaurus Financial Inc. now owns 3,103 shares of the medical equipment provider's stock valued at $341,000 after purchasing an additional 357 shares during the last quarter. Swedbank AB raised its holdings in shares of Lantheus by 21.1% in the third quarter. Swedbank AB now owns 722,243 shares of the medical equipment provider's stock valued at $79,266,000 after purchasing an additional 125,843 shares during the last quarter. Penserra Capital Management LLC purchased a new stake in shares of Lantheus in the third quarter valued at about $1,331,000. Cerity Partners LLC increased its holdings in Lantheus by 19.8% during the third quarter. Cerity Partners LLC now owns 11,897 shares of the medical equipment provider's stock worth $1,306,000 after buying an additional 1,966 shares during the last quarter. Finally, Massachusetts Financial Services Co. MA purchased a new stake in Lantheus during the third quarter worth about $25,955,000. Hedge funds and other institutional investors own 99.06% of the company's stock.

Lantheus Stock Up 3.7 %

Shares of NASDAQ:LNTH opened at $90.52 on Friday. The firm has a market capitalization of $6.29 billion, a PE ratio of 15.06 and a beta of 0.51. Lantheus Holdings, Inc. has a twelve month low of $50.20 and a twelve month high of $126.89. The company has a 50-day moving average price of $103.13 and a two-hundred day moving average price of $96.63.

Analyst Ratings Changes

A number of analysts recently issued reports on LNTH shares. Redburn Atlantic started coverage on shares of Lantheus in a report on Tuesday, September 3rd. They set a "buy" rating and a $175.00 price objective for the company. StockNews.com downgraded shares of Lantheus from a "buy" rating to a "hold" rating in a report on Thursday. JMP Securities decreased their price objective on shares of Lantheus from $125.00 to $112.00 and set a "market outperform" rating for the company in a report on Thursday, November 7th. Finally, Truist Financial restated a "buy" rating and set a $120.00 price objective (down previously from $135.00) on shares of Lantheus in a report on Friday, November 8th. Two analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $122.50.

Check Out Our Latest Report on Lantheus

About Lantheus

(

Free Report)

Lantheus Holdings, Inc develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in the diagnosis and treatment of heart, cancer, and other diseases worldwide. It provides DEFINITY, an injectable ultrasound enhancing agent used in echocardiography exams; TechneLite, a technetium generator for nuclear medicine procedures; Xenon-133, a radiopharmaceutical gas to assess pulmonary function; Neurolite, an injectable imaging agent to identify the area within the brain where blood flow has been blocked or reduced due to stroke; Cardiolite, an injectable Tc-99m-labeled imaging agent to assess blood flow to the muscle of the heart; and PYLARIFY, an F 18-labelled PSMA-targeted PET imaging agent used for imaging of PSMA positive-lesions in men with prostate cancer.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lantheus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lantheus wasn't on the list.

While Lantheus currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.