Loomis Sayles & Co. L P grew its stake in shares of WEX Inc. (NYSE:WEX - Free Report) by 5.7% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 308,065 shares of the business services provider's stock after purchasing an additional 16,739 shares during the period. Loomis Sayles & Co. L P owned approximately 0.77% of WEX worth $64,611,000 as of its most recent SEC filing.

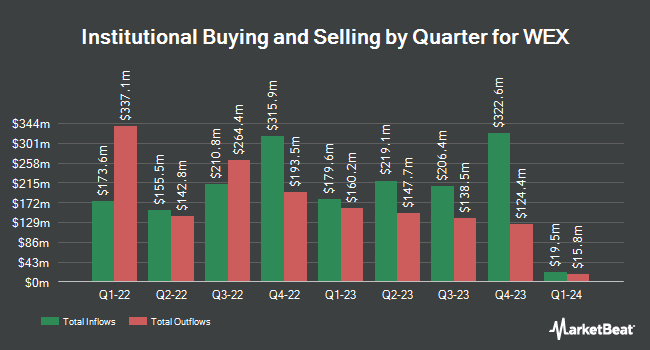

Several other hedge funds and other institutional investors also recently modified their holdings of the stock. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA increased its stake in shares of WEX by 5.6% in the 2nd quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA now owns 914,250 shares of the business services provider's stock worth $173,561,000 after acquiring an additional 48,182 shares in the last quarter. River Road Asset Management LLC increased its stake in shares of WEX by 5.0% during the third quarter. River Road Asset Management LLC now owns 720,465 shares of the business services provider's stock valued at $151,103,000 after purchasing an additional 34,264 shares in the last quarter. Dimensional Fund Advisors LP lifted its holdings in shares of WEX by 34.3% during the second quarter. Dimensional Fund Advisors LP now owns 495,527 shares of the business services provider's stock valued at $87,772,000 after purchasing an additional 126,663 shares during the last quarter. Federated Hermes Inc. boosted its position in shares of WEX by 3.0% in the 2nd quarter. Federated Hermes Inc. now owns 402,365 shares of the business services provider's stock worth $71,275,000 after purchasing an additional 11,821 shares in the last quarter. Finally, Bank of New York Mellon Corp grew its stake in shares of WEX by 5.0% in the 2nd quarter. Bank of New York Mellon Corp now owns 378,969 shares of the business services provider's stock worth $67,131,000 after buying an additional 17,989 shares during the last quarter. Hedge funds and other institutional investors own 97.47% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts have issued reports on WEX shares. JPMorgan Chase & Co. lowered their price objective on WEX from $210.00 to $200.00 and set a "neutral" rating for the company in a research note on Tuesday, August 20th. Wolfe Research cut shares of WEX from an "outperform" rating to a "peer perform" rating in a research note on Monday, October 28th. Robert W. Baird reduced their price objective on shares of WEX from $285.00 to $230.00 and set an "outperform" rating for the company in a research note on Friday, October 25th. Wells Fargo & Company cut their price target on shares of WEX from $200.00 to $180.00 and set an "equal weight" rating on the stock in a report on Friday, October 25th. Finally, Bank of America boosted their price objective on shares of WEX from $238.00 to $255.00 and gave the stock a "buy" rating in a report on Tuesday, October 15th. Six investment analysts have rated the stock with a hold rating, seven have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $235.91.

Check Out Our Latest Stock Report on WEX

WEX Stock Performance

Shares of NYSE:WEX traded up $2.77 during trading on Monday, hitting $188.15. The company's stock had a trading volume of 445,596 shares, compared to its average volume of 360,986. The company has a debt-to-equity ratio of 1.87, a current ratio of 1.04 and a quick ratio of 1.04. The firm has a market cap of $7.48 billion, a price-to-earnings ratio of 23.88, a P/E/G ratio of 1.47 and a beta of 1.57. The company has a 50-day moving average of $196.01 and a 200-day moving average of $187.80. WEX Inc. has a 12 month low of $165.51 and a 12 month high of $244.04.

WEX (NYSE:WEX - Get Free Report) last issued its quarterly earnings results on Thursday, October 24th. The business services provider reported $4.35 earnings per share for the quarter, topping the consensus estimate of $3.82 by $0.53. The business had revenue of $665.50 million for the quarter, compared to analysts' expectations of $688.03 million. WEX had a net margin of 12.45% and a return on equity of 31.35%. The company's revenue was up 2.2% compared to the same quarter last year. During the same quarter last year, the company posted $3.44 EPS. On average, sell-side analysts expect that WEX Inc. will post 13.1 earnings per share for the current year.

Insider Buying and Selling at WEX

In other WEX news, CFO Jagtar Narula sold 508 shares of the company's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $200.00, for a total value of $101,600.00. Following the completion of the transaction, the chief financial officer now directly owns 7,120 shares in the company, valued at $1,424,000. This represents a 6.66 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 1.10% of the stock is currently owned by corporate insiders.

WEX Profile

(

Free Report)

WEX Inc operates a commerce platform in the United States and internationally. The Mobility segment offers fleet vehicle payment solutions, transaction processing, and information management services; and provides account activation and account retention services; authorization and billing inquiries, and account maintenance services; account management; credit and collections services; merchant services; analytics solutions; and ancillary services and offerings.

Featured Articles

Before you consider WEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WEX wasn't on the list.

While WEX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.