Wisconsin Capital Management LLC grew its position in WEX Inc. (NYSE:WEX - Free Report) by 15.0% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 33,675 shares of the business services provider's stock after purchasing an additional 4,403 shares during the quarter. WEX comprises approximately 3.7% of Wisconsin Capital Management LLC's investment portfolio, making the stock its 8th biggest holding. Wisconsin Capital Management LLC owned about 0.08% of WEX worth $7,063,000 at the end of the most recent quarter.

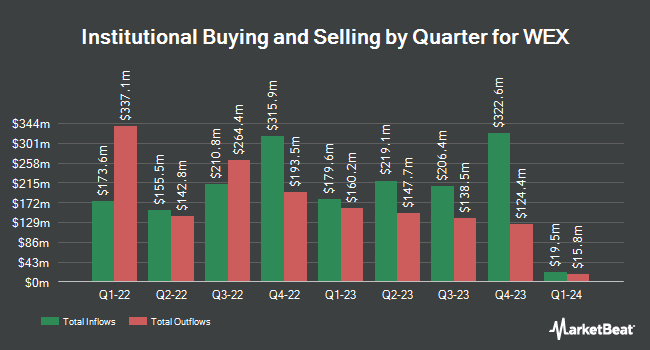

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. Rice Hall James & Associates LLC grew its holdings in WEX by 672.7% in the third quarter. Rice Hall James & Associates LLC now owns 154,033 shares of the business services provider's stock valued at $32,305,000 after purchasing an additional 134,099 shares during the period. Dimensional Fund Advisors LP lifted its holdings in WEX by 34.3% during the second quarter. Dimensional Fund Advisors LP now owns 495,527 shares of the business services provider's stock valued at $87,772,000 after purchasing an additional 126,663 shares in the last quarter. New York State Common Retirement Fund grew its position in shares of WEX by 328.6% in the third quarter. New York State Common Retirement Fund now owns 127,570 shares of the business services provider's stock valued at $26,755,000 after purchasing an additional 97,807 shares during the period. Distillate Capital Partners LLC acquired a new position in shares of WEX during the 2nd quarter worth about $13,950,000. Finally, HM Payson & Co. lifted its stake in WEX by 61.3% in the 3rd quarter. HM Payson & Co. now owns 149,341 shares of the business services provider's stock valued at $31,321,000 after buying an additional 56,775 shares in the last quarter. 97.47% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several research firms have recently weighed in on WEX. JPMorgan Chase & Co. decreased their price target on shares of WEX from $210.00 to $200.00 and set a "neutral" rating on the stock in a research note on Tuesday, August 20th. Wolfe Research cut WEX from an "outperform" rating to a "peer perform" rating in a report on Monday, October 28th. Wells Fargo & Company cut their target price on WEX from $200.00 to $180.00 and set an "equal weight" rating for the company in a research note on Friday, October 25th. Bank of America upped their price target on WEX from $238.00 to $255.00 and gave the company a "buy" rating in a research note on Tuesday, October 15th. Finally, Robert W. Baird reduced their price objective on shares of WEX from $285.00 to $230.00 and set an "outperform" rating on the stock in a report on Friday, October 25th. Six research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $235.91.

Read Our Latest Stock Report on WEX

WEX Stock Up 8.1 %

Shares of NYSE:WEX traded up $13.99 during trading on Wednesday, hitting $187.50. 920,789 shares of the company were exchanged, compared to its average volume of 360,143. The company has a debt-to-equity ratio of 1.87, a current ratio of 1.04 and a quick ratio of 1.04. WEX Inc. has a 12-month low of $165.51 and a 12-month high of $244.04. The stock has a market capitalization of $7.46 billion, a P/E ratio of 23.79, a PEG ratio of 1.35 and a beta of 1.57. The firm's 50 day moving average price is $198.36 and its 200-day moving average price is $191.01.

WEX (NYSE:WEX - Get Free Report) last announced its earnings results on Thursday, October 24th. The business services provider reported $4.35 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.82 by $0.53. WEX had a net margin of 12.45% and a return on equity of 31.35%. The business had revenue of $665.50 million for the quarter, compared to analyst estimates of $688.03 million. During the same period last year, the firm posted $3.44 earnings per share. The company's revenue for the quarter was up 2.2% compared to the same quarter last year. On average, research analysts predict that WEX Inc. will post 13.2 earnings per share for the current fiscal year.

Insider Transactions at WEX

In other news, CFO Jagtar Narula sold 508 shares of the business's stock in a transaction that occurred on Friday, September 13th. The stock was sold at an average price of $200.00, for a total transaction of $101,600.00. Following the sale, the chief financial officer now owns 7,120 shares of the company's stock, valued at $1,424,000. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. In related news, CFO Jagtar Narula sold 508 shares of WEX stock in a transaction dated Friday, September 13th. The stock was sold at an average price of $200.00, for a total transaction of $101,600.00. Following the completion of the sale, the chief financial officer now owns 7,120 shares in the company, valued at approximately $1,424,000. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, COO Robert Joseph Deshaies sold 1,651 shares of the company's stock in a transaction on Wednesday, August 21st. The shares were sold at an average price of $181.67, for a total value of $299,937.17. Following the completion of the transaction, the chief operating officer now owns 7,757 shares of the company's stock, valued at $1,409,214.19. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 1.10% of the company's stock.

WEX Company Profile

(

Free Report)

WEX Inc operates a commerce platform in the United States and internationally. The Mobility segment offers fleet vehicle payment solutions, transaction processing, and information management services; and provides account activation and account retention services; authorization and billing inquiries, and account maintenance services; account management; credit and collections services; merchant services; analytics solutions; and ancillary services and offerings.

Featured Articles

Before you consider WEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WEX wasn't on the list.

While WEX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.