Wexford Capital LP boosted its stake in Alight, Inc. (NYSE:ALIT - Free Report) by 320.2% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 110,000 shares of the company's stock after acquiring an additional 83,822 shares during the period. Wexford Capital LP's holdings in Alight were worth $814,000 at the end of the most recent reporting period.

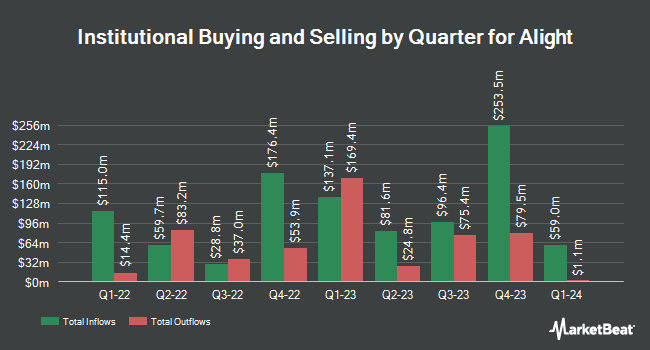

Several other institutional investors and hedge funds have also bought and sold shares of ALIT. Nisa Investment Advisors LLC raised its holdings in Alight by 65.3% in the second quarter. Nisa Investment Advisors LLC now owns 7,498 shares of the company's stock worth $55,000 after buying an additional 2,961 shares during the last quarter. Oppenheimer & Co. Inc. bought a new stake in Alight in the 3rd quarter worth about $74,000. KBC Group NV increased its holdings in Alight by 24.0% in the 3rd quarter. KBC Group NV now owns 12,049 shares of the company's stock worth $89,000 after buying an additional 2,331 shares in the last quarter. Soros Fund Management LLC bought a new stake in shares of Alight in the third quarter worth approximately $89,000. Finally, FMR LLC raised its holdings in shares of Alight by 44.4% during the third quarter. FMR LLC now owns 11,995 shares of the company's stock valued at $89,000 after purchasing an additional 3,689 shares during the last quarter. 96.74% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity

In related news, Director William P. Foley II sold 5,000,000 shares of the business's stock in a transaction that occurred on Wednesday, November 13th. The stock was sold at an average price of $8.25, for a total value of $41,250,000.00. Following the completion of the sale, the director now owns 883,323 shares in the company, valued at approximately $7,287,414.75. The trade was a 84.99 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, President Gregory R. Goff sold 250,000 shares of the firm's stock in a transaction on Wednesday, November 27th. The stock was sold at an average price of $8.00, for a total value of $2,000,000.00. Following the transaction, the president now owns 852,694 shares in the company, valued at $6,821,552. The trade was a 22.67 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 5,334,929 shares of company stock valued at $43,895,460. 5.33% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

A number of equities analysts have recently issued reports on ALIT shares. JPMorgan Chase & Co. downgraded Alight from an "overweight" rating to a "neutral" rating and set a $8.00 price target on the stock. in a research note on Tuesday, August 20th. Canaccord Genuity Group boosted their price objective on Alight from $11.00 to $12.00 and gave the company a "buy" rating in a research note on Wednesday, November 13th. KeyCorp raised their target price on shares of Alight from $10.00 to $11.00 and gave the stock an "overweight" rating in a research note on Wednesday, November 13th. Citigroup dropped their price target on shares of Alight from $12.00 to $11.00 and set a "buy" rating for the company in a research report on Thursday, August 29th. Finally, Needham & Company LLC raised their price objective on shares of Alight from $9.00 to $11.00 and gave the company a "buy" rating in a research report on Wednesday, November 13th. One research analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company. According to data from MarketBeat, Alight presently has an average rating of "Moderate Buy" and a consensus target price of $10.83.

View Our Latest Stock Analysis on ALIT

Alight Price Performance

Shares of NYSE:ALIT traded down $0.02 during mid-day trading on Friday, reaching $7.48. The stock had a trading volume of 4,422,040 shares, compared to its average volume of 7,240,189. The company has a current ratio of 1.30, a quick ratio of 1.30 and a debt-to-equity ratio of 0.46. The company has a market cap of $4.06 billion, a P/E ratio of -15.58 and a beta of 0.92. Alight, Inc. has a 1 year low of $6.15 and a 1 year high of $10.38. The business's 50 day moving average price is $7.46 and its 200 day moving average price is $7.36.

Alight (NYSE:ALIT - Get Free Report) last released its quarterly earnings results on Tuesday, November 12th. The company reported $0.09 EPS for the quarter, hitting the consensus estimate of $0.09. Alight had a positive return on equity of 5.61% and a negative net margin of 7.95%. The company had revenue of $555.00 million during the quarter, compared to analyst estimates of $538.39 million. During the same quarter last year, the business posted $0.07 earnings per share. The firm's revenue was down .4% on a year-over-year basis. Research analysts expect that Alight, Inc. will post 0.47 EPS for the current fiscal year.

Alight Dividend Announcement

The company also recently declared a -- dividend, which will be paid on Monday, December 16th. Investors of record on Monday, December 2nd will be paid a dividend of $0.04 per share. The ex-dividend date is Monday, December 2nd.

About Alight

(

Free Report)

Alight, Inc provides cloud-based integrated digital human capital and business solutions worldwide. The company operates through two segments, Employer Solutions and Professional Services. The Employer Solutions segment offers employee wellbeing, integrated benefits administration, healthcare navigation, financial wellbeing, leave of absence management, retiree healthcare and payroll; and operates AI-led capabilities software.

Featured Articles

Before you consider Alight, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alight wasn't on the list.

While Alight currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.