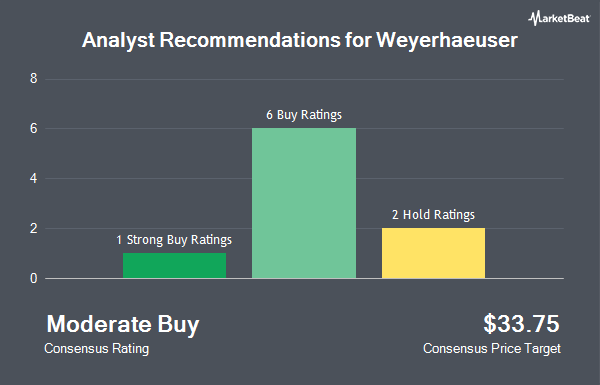

Weyerhaeuser (NYSE:WY - Get Free Report) has earned a consensus recommendation of "Moderate Buy" from the seven brokerages that are currently covering the company, MarketBeat.com reports. Three analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average 12 month price target among brokerages that have issued ratings on the stock in the last year is $36.33.

A number of research analysts have recently weighed in on WY shares. StockNews.com cut Weyerhaeuser from a "hold" rating to a "sell" rating in a research report on Monday, October 28th. BMO Capital Markets upgraded shares of Weyerhaeuser from a "market perform" rating to an "outperform" rating and set a $38.00 target price for the company in a research report on Friday, December 6th. Finally, Truist Financial increased their price target on shares of Weyerhaeuser from $31.00 to $34.00 and gave the company a "hold" rating in a research report on Tuesday, October 15th.

View Our Latest Research Report on WY

Weyerhaeuser Price Performance

WY stock traded down $0.34 during trading on Friday, reaching $30.06. 3,176,023 shares of the company were exchanged, compared to its average volume of 2,994,645. The company has a debt-to-equity ratio of 0.49, a quick ratio of 1.41 and a current ratio of 2.01. The stock's 50 day moving average price is $31.72 and its 200 day moving average price is $30.87. Weyerhaeuser has a 52-week low of $26.73 and a 52-week high of $36.27. The company has a market cap of $21.84 billion, a P/E ratio of 40.62 and a beta of 1.40.

Weyerhaeuser (NYSE:WY - Get Free Report) last announced its quarterly earnings results on Thursday, October 24th. The real estate investment trust reported $0.05 EPS for the quarter, topping the consensus estimate of $0.02 by $0.03. The business had revenue of $1.68 billion for the quarter, compared to analyst estimates of $1.70 billion. Weyerhaeuser had a return on equity of 4.21% and a net margin of 7.43%. The company's quarterly revenue was down 13.3% on a year-over-year basis. During the same quarter in the previous year, the company earned $0.33 EPS. As a group, analysts predict that Weyerhaeuser will post 0.46 earnings per share for the current fiscal year.

Weyerhaeuser Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, December 13th. Stockholders of record on Friday, November 29th were given a $0.20 dividend. This represents a $0.80 dividend on an annualized basis and a dividend yield of 2.66%. The ex-dividend date was Friday, November 29th. Weyerhaeuser's dividend payout ratio is presently 108.11%.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in the business. Oakworth Capital Inc. acquired a new stake in shares of Weyerhaeuser in the third quarter worth approximately $25,000. Ridgewood Investments LLC purchased a new position in Weyerhaeuser during the second quarter worth approximately $26,000. Itau Unibanco Holding S.A. acquired a new position in shares of Weyerhaeuser in the 2nd quarter valued at $27,000. Thurston Springer Miller Herd & Titak Inc. boosted its holdings in shares of Weyerhaeuser by 4,884.2% in the 3rd quarter. Thurston Springer Miller Herd & Titak Inc. now owns 947 shares of the real estate investment trust's stock valued at $32,000 after purchasing an additional 928 shares during the last quarter. Finally, Bangor Savings Bank grew its stake in shares of Weyerhaeuser by 140.3% during the 3rd quarter. Bangor Savings Bank now owns 1,115 shares of the real estate investment trust's stock valued at $38,000 after buying an additional 651 shares during the period. Hedge funds and other institutional investors own 82.99% of the company's stock.

About Weyerhaeuser

(

Get Free ReportWeyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900. We own or control approximately 11 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards.

Further Reading

Before you consider Weyerhaeuser, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weyerhaeuser wasn't on the list.

While Weyerhaeuser currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.