Weyerhaeuser (NYSE:WY - Get Free Report) was upgraded by equities researchers at Raymond James from a "market perform" rating to an "outperform" rating in a research note issued on Monday, Marketbeat reports. The firm currently has a $32.00 price objective on the real estate investment trust's stock. Raymond James' price objective would indicate a potential upside of 13.96% from the stock's previous close.

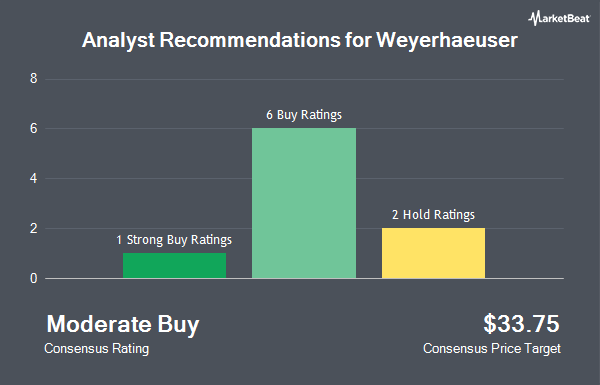

A number of other research firms also recently commented on WY. Truist Financial lifted their target price on shares of Weyerhaeuser from $31.00 to $34.00 and gave the stock a "hold" rating in a research report on Tuesday, October 15th. StockNews.com raised shares of Weyerhaeuser from a "sell" rating to a "hold" rating in a research report on Monday, December 16th. Finally, BMO Capital Markets upgraded shares of Weyerhaeuser from a "market perform" rating to an "outperform" rating and set a $38.00 price objective on the stock in a research note on Friday, December 6th. Four research analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to MarketBeat.com, Weyerhaeuser presently has an average rating of "Moderate Buy" and a consensus price target of $35.71.

View Our Latest Research Report on Weyerhaeuser

Weyerhaeuser Stock Up 2.1 %

Weyerhaeuser stock traded up $0.58 during trading hours on Monday, hitting $28.08. The stock had a trading volume of 3,546,669 shares, compared to its average volume of 3,625,684. The stock's 50-day moving average price is $31.26 and its 200-day moving average price is $30.82. Weyerhaeuser has a 12-month low of $26.73 and a 12-month high of $36.27. The company has a quick ratio of 1.41, a current ratio of 2.01 and a debt-to-equity ratio of 0.49. The stock has a market capitalization of $20.40 billion, a P/E ratio of 37.95 and a beta of 1.40.

Weyerhaeuser (NYSE:WY - Get Free Report) last released its quarterly earnings data on Thursday, October 24th. The real estate investment trust reported $0.05 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.02 by $0.03. The business had revenue of $1.68 billion for the quarter, compared to analysts' expectations of $1.70 billion. Weyerhaeuser had a return on equity of 4.21% and a net margin of 7.43%. The firm's quarterly revenue was down 13.3% on a year-over-year basis. During the same period in the prior year, the firm posted $0.33 EPS. Equities research analysts anticipate that Weyerhaeuser will post 0.46 EPS for the current fiscal year.

Institutional Trading of Weyerhaeuser

A number of hedge funds and other institutional investors have recently modified their holdings of WY. Wellington Management Group LLP lifted its stake in shares of Weyerhaeuser by 12.7% during the 3rd quarter. Wellington Management Group LLP now owns 35,755,865 shares of the real estate investment trust's stock valued at $1,210,694,000 after buying an additional 4,035,048 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its position in shares of Weyerhaeuser by 257.2% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 4,472,451 shares of the real estate investment trust's stock valued at $151,437,000 after acquiring an additional 3,220,235 shares in the last quarter. Daiwa Securities Group Inc. boosted its stake in shares of Weyerhaeuser by 2,664.4% in the third quarter. Daiwa Securities Group Inc. now owns 2,195,958 shares of the real estate investment trust's stock worth $74,355,000 after acquiring an additional 2,116,520 shares during the period. Allspring Global Investments Holdings LLC grew its position in shares of Weyerhaeuser by 30.4% during the third quarter. Allspring Global Investments Holdings LLC now owns 8,603,246 shares of the real estate investment trust's stock worth $291,306,000 after purchasing an additional 2,004,073 shares in the last quarter. Finally, Millennium Management LLC raised its stake in Weyerhaeuser by 512.3% during the 2nd quarter. Millennium Management LLC now owns 1,563,454 shares of the real estate investment trust's stock valued at $44,386,000 after purchasing an additional 1,308,125 shares during the period. 82.99% of the stock is owned by hedge funds and other institutional investors.

About Weyerhaeuser

(

Get Free Report)

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900. We own or control approximately 11 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards.

Further Reading

Before you consider Weyerhaeuser, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weyerhaeuser wasn't on the list.

While Weyerhaeuser currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.