Whalen Wealth Management Inc. bought a new stake in CRH plc (NYSE:CRH - Free Report) during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund bought 5,349 shares of the construction company's stock, valued at approximately $496,000.

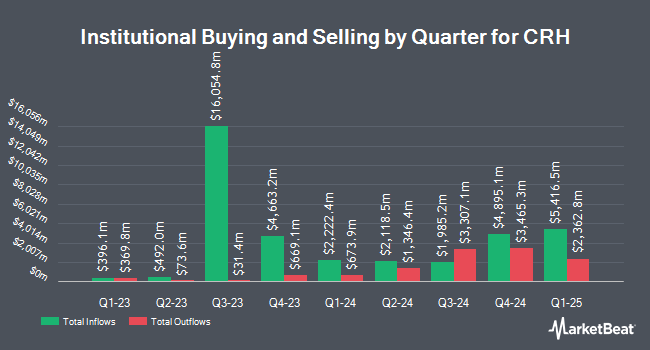

A number of other institutional investors have also modified their holdings of the business. Greenhaven Associates Inc. increased its holdings in shares of CRH by 0.3% in the 3rd quarter. Greenhaven Associates Inc. now owns 11,155,273 shares of the construction company's stock valued at $1,034,540,000 after acquiring an additional 35,209 shares during the period. Bank of New York Mellon Corp boosted its position in shares of CRH by 5.3% during the 2nd quarter. Bank of New York Mellon Corp now owns 8,618,144 shares of the construction company's stock worth $646,188,000 after purchasing an additional 431,172 shares in the last quarter. Lazard Asset Management LLC boosted its position in shares of CRH by 35,497.5% during the 1st quarter. Lazard Asset Management LLC now owns 5,082,961 shares of the construction company's stock worth $438,455,000 after purchasing an additional 5,068,682 shares in the last quarter. Legal & General Group Plc boosted its position in shares of CRH by 36,503.4% during the 2nd quarter. Legal & General Group Plc now owns 4,838,972 shares of the construction company's stock worth $361,278,000 after purchasing an additional 4,825,752 shares in the last quarter. Finally, American Century Companies Inc. boosted its position in shares of CRH by 103.9% during the 2nd quarter. American Century Companies Inc. now owns 4,642,729 shares of the construction company's stock worth $348,112,000 after purchasing an additional 2,365,589 shares in the last quarter. 62.50% of the stock is owned by institutional investors and hedge funds.

CRH Stock Performance

CRH stock traded up $0.14 during trading on Tuesday, hitting $99.79. The stock had a trading volume of 4,447,517 shares, compared to its average volume of 4,875,525. The company's 50 day moving average price is $93.36 and its two-hundred day moving average price is $85.25. CRH plc has a 1-year low of $58.57 and a 1-year high of $102.51. The stock has a market cap of $67.78 billion, a price-to-earnings ratio of 19.96, a price-to-earnings-growth ratio of 1.44 and a beta of 1.29.

CRH Cuts Dividend

The company also recently announced a Variable dividend, which will be paid on Wednesday, December 18th. Investors of record on Friday, November 22nd will be paid a $0.262 dividend. This represents a yield of 1.4%. The ex-dividend date is Friday, November 22nd. CRH's payout ratio is 32.00%.

Wall Street Analysts Forecast Growth

Several equities research analysts have commented on the stock. HSBC assumed coverage on shares of CRH in a research report on Monday, November 11th. They set a "buy" rating and a $116.00 target price on the stock. Barclays assumed coverage on shares of CRH in a research report on Tuesday, October 29th. They set an "overweight" rating and a $110.00 target price on the stock. Truist Financial boosted their target price on shares of CRH from $110.00 to $120.00 and gave the stock a "buy" rating in a research report on Friday, November 8th. Hsbc Global Res upgraded shares of CRH to a "strong-buy" rating in a research report on Monday, November 11th. Finally, StockNews.com upgraded shares of CRH from a "hold" rating to a "buy" rating in a research report on Monday, November 11th. One investment analyst has rated the stock with a hold rating, eleven have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, CRH has a consensus rating of "Buy" and a consensus target price of $105.55.

Get Our Latest Stock Report on CRH

About CRH

(

Free Report)

CRH plc, together with its subsidiaries, provides building materials solutions in Ireland and internationally. It operates through four segments: Americas Materials Solutions, Americas Building Solutions, Europe Materials Solutions, and Europe Building Solutions. The company provides solutions for the construction and maintenance of public infrastructure and commercial and residential buildings; and produces and sells aggregates, cement, readymixed concrete, and asphalt, as well as provides paving and construction services.

Featured Stories

Before you consider CRH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CRH wasn't on the list.

While CRH currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.