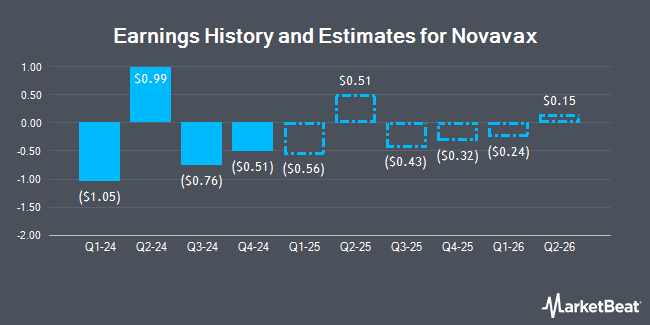

Novavax, Inc. (NASDAQ:NVAX - Free Report) - Equities research analysts at B. Riley reduced their FY2024 EPS estimates for shares of Novavax in a research note issued to investors on Monday, November 18th. B. Riley analyst M. Mamtani now expects that the biopharmaceutical company will post earnings of ($1.41) per share for the year, down from their previous estimate of ($0.12). B. Riley currently has a "Buy" rating and a $26.00 target price on the stock. The consensus estimate for Novavax's current full-year earnings is ($1.21) per share. B. Riley also issued estimates for Novavax's Q4 2024 earnings at ($0.71) EPS, Q1 2025 earnings at ($0.49) EPS, Q2 2025 earnings at $0.65 EPS, Q3 2025 earnings at ($0.40) EPS, Q4 2025 earnings at ($0.57) EPS, FY2025 earnings at ($0.57) EPS, FY2026 earnings at $2.17 EPS, FY2027 earnings at $1.69 EPS and FY2028 earnings at $1.10 EPS.

Other equities analysts have also issued research reports about the company. HC Wainwright reiterated a "buy" rating and issued a $19.00 price target on shares of Novavax in a research note on Tuesday, November 12th. Jefferies Financial Group decreased their price objective on shares of Novavax from $31.00 to $25.00 and set a "buy" rating for the company in a report on Wednesday, October 16th. Finally, JPMorgan Chase & Co. lifted their price objective on Novavax from $8.00 to $9.00 and gave the company an "underweight" rating in a research note on Monday, August 12th. One analyst has rated the stock with a sell rating, three have issued a hold rating and three have given a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $17.83.

Read Our Latest Stock Analysis on NVAX

Novavax Stock Performance

NVAX traded up $0.03 during trading hours on Wednesday, reaching $8.03. The company's stock had a trading volume of 1,342,173 shares, compared to its average volume of 9,720,944. Novavax has a 52 week low of $3.53 and a 52 week high of $23.86. The firm has a market cap of $1.29 billion, a PE ratio of -3.54 and a beta of 2.10. The company's 50-day moving average is $11.07 and its 200-day moving average is $12.55.

Novavax (NASDAQ:NVAX - Get Free Report) last announced its quarterly earnings data on Tuesday, November 12th. The biopharmaceutical company reported ($0.76) EPS for the quarter, topping analysts' consensus estimates of ($0.83) by $0.07. The company had revenue of $84.51 million for the quarter, compared to analyst estimates of $65.80 million. The firm's revenue for the quarter was down 54.8% on a year-over-year basis. During the same period last year, the firm earned ($1.26) earnings per share.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Shah Capital Management boosted its position in Novavax by 19.0% during the 2nd quarter. Shah Capital Management now owns 9,662,090 shares of the biopharmaceutical company's stock valued at $122,322,000 after acquiring an additional 1,544,263 shares in the last quarter. Vontobel Holding Ltd. grew its stake in shares of Novavax by 110.3% in the 3rd quarter. Vontobel Holding Ltd. now owns 498,532 shares of the biopharmaceutical company's stock valued at $6,296,000 after buying an additional 261,464 shares during the period. Squarepoint Ops LLC purchased a new stake in shares of Novavax in the 2nd quarter valued at approximately $1,251,000. Edgestream Partners L.P. boosted its stake in shares of Novavax by 23.7% in the first quarter. Edgestream Partners L.P. now owns 12,753 shares of the biopharmaceutical company's stock valued at $61,000 after purchasing an additional 2,447 shares during the period. Finally, ProShare Advisors LLC increased its stake in shares of Novavax by 29.9% during the first quarter. ProShare Advisors LLC now owns 37,203 shares of the biopharmaceutical company's stock worth $178,000 after buying an additional 8,570 shares during the period. Hedge funds and other institutional investors own 53.04% of the company's stock.

About Novavax

(

Get Free Report)

Novavax, Inc, a biotechnology company, that promotes improved health by discovering, developing, and commercializing vaccines to protect against serious infectious diseases. It offers vaccine platform that combines a recombinant protein approach, nanoparticle technology, and its patented Matrix-M adjuvant to enhance the immune response.

Read More

Before you consider Novavax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novavax wasn't on the list.

While Novavax currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.