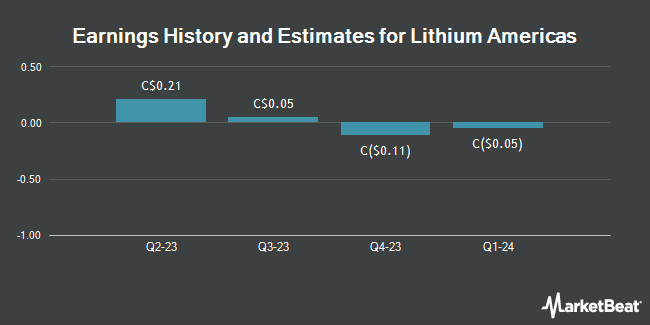

Lithium Americas Corp. (TSE:LAC - Free Report) - Equities researchers at B. Riley decreased their FY2024 earnings per share estimates for shares of Lithium Americas in a research note issued to investors on Tuesday, November 12th. B. Riley analyst M. Key now anticipates that the company will post earnings per share of ($0.18) for the year, down from their previous estimate of ($0.16). The consensus estimate for Lithium Americas' current full-year earnings is $1.38 per share. B. Riley also issued estimates for Lithium Americas' Q4 2024 earnings at ($0.03) EPS and FY2025 earnings at ($0.50) EPS.

Lithium Americas (TSE:LAC - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The company reported C($0.02) earnings per share for the quarter, beating the consensus estimate of C($0.03) by C$0.01.

LAC has been the topic of a number of other research reports. BMO Capital Markets raised shares of Lithium Americas to a "hold" rating in a research note on Wednesday, October 23rd. National Bankshares raised Lithium Americas from a "sector perform" rating to an "outperform" rating and raised their price objective for the company from C$5.75 to C$7.25 in a research report on Thursday, October 17th. National Bank Financial raised Lithium Americas from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, October 16th. Finally, Piper Sandler downgraded Lithium Americas from a "strong-buy" rating to a "hold" rating in a research report on Monday, July 29th. Three equities research analysts have rated the stock with a hold rating, one has assigned a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat, Lithium Americas currently has a consensus rating of "Moderate Buy" and a consensus price target of C$7.38.

View Our Latest Report on LAC

Lithium Americas Trading Down 5.9 %

TSE LAC traded down C$0.35 during mid-day trading on Thursday, hitting C$5.58. The company's stock had a trading volume of 1,190,191 shares, compared to its average volume of 815,065. The company has a debt-to-equity ratio of 0.69, a current ratio of 20.15 and a quick ratio of 52.06. Lithium Americas has a 52-week low of C$2.87 and a 52-week high of C$10.75. The stock's fifty day simple moving average is C$4.17 and its two-hundred day simple moving average is C$4.29. The firm has a market capitalization of C$1.22 billion, a P/E ratio of -37.06 and a beta of 1.58.

Insider Transactions at Lithium Americas

In other news, Senior Officer Oleksandr Shulga sold 24,862 shares of the company's stock in a transaction dated Friday, September 13th. The stock was sold at an average price of C$3.40, for a total value of C$84,530.80. Company insiders own 7.40% of the company's stock.

Lithium Americas Company Profile

(

Get Free Report)

Lithium Americas Corp. engages in the exploration and development of lithium properties in the United States and Canada. It holds a 100% interest in the Thacker Pass project located in northern Nevada, as well as investments in exploration properties in the United States and Canada. Lithium Americas Corp.

See Also

Before you consider Lithium Americas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithium Americas wasn't on the list.

While Lithium Americas currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.