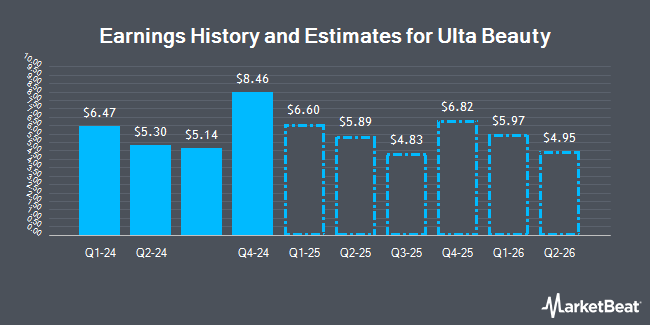

Ulta Beauty, Inc. (NASDAQ:ULTA - Free Report) - Investment analysts at B. Riley increased their FY2025 EPS estimates for shares of Ulta Beauty in a research report issued to clients and investors on Friday, December 6th. B. Riley analyst A. Glaessgen now anticipates that the specialty retailer will post earnings per share of $23.45 for the year, up from their previous estimate of $23.00. B. Riley currently has a "Sell" rating and a $330.00 price target on the stock. The consensus estimate for Ulta Beauty's current full-year earnings is $23.48 per share. B. Riley also issued estimates for Ulta Beauty's Q4 2025 earnings at $6.54 EPS, Q1 2026 earnings at $6.11 EPS, Q2 2026 earnings at $5.13 EPS, Q3 2026 earnings at $5.17 EPS, Q4 2026 earnings at $6.44 EPS and FY2026 earnings at $22.85 EPS.

Ulta Beauty (NASDAQ:ULTA - Get Free Report) last announced its earnings results on Thursday, December 5th. The specialty retailer reported $5.14 earnings per share for the quarter, beating analysts' consensus estimates of $4.45 by $0.69. Ulta Beauty had a net margin of 10.58% and a return on equity of 51.95%. The business had revenue of $2.53 billion during the quarter, compared to the consensus estimate of $2.50 billion. During the same quarter last year, the firm earned $5.07 earnings per share. The business's revenue for the quarter was up 1.7% on a year-over-year basis.

Several other research firms also recently weighed in on ULTA. Stifel Nicolaus lifted their target price on Ulta Beauty from $395.00 to $455.00 and gave the company a "hold" rating in a research report on Friday. JPMorgan Chase & Co. upped their price objective on Ulta Beauty from $472.00 to $480.00 and gave the stock an "overweight" rating in a research note on Friday. Bank of America dropped their price target on Ulta Beauty from $425.00 to $380.00 and set a "neutral" rating for the company in a research note on Friday, August 30th. Piper Sandler boosted their target price on shares of Ulta Beauty from $357.00 to $360.00 and gave the stock a "neutral" rating in a report on Tuesday, December 3rd. Finally, DA Davidson lifted their price target on shares of Ulta Beauty from $435.00 to $510.00 and gave the company a "buy" rating in a report on Friday. Two equities research analysts have rated the stock with a sell rating, twelve have assigned a hold rating and eleven have issued a buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and an average price target of $439.30.

View Our Latest Research Report on Ulta Beauty

Ulta Beauty Price Performance

Shares of ULTA traded down $5.57 on Monday, reaching $422.60. The company's stock had a trading volume of 666,285 shares, compared to its average volume of 982,073. The stock's 50 day simple moving average is $374.15 and its two-hundred day simple moving average is $376.63. The stock has a market capitalization of $19.60 billion, a P/E ratio of 17.13, a PEG ratio of 2.42 and a beta of 1.33. Ulta Beauty has a 12-month low of $318.17 and a 12-month high of $574.76.

Hedge Funds Weigh In On Ulta Beauty

Large investors have recently made changes to their positions in the company. International Assets Investment Management LLC grew its position in shares of Ulta Beauty by 180,713.0% in the third quarter. International Assets Investment Management LLC now owns 1,238,569 shares of the specialty retailer's stock valued at $481,952,000 after purchasing an additional 1,237,884 shares during the period. Ontario Teachers Pension Plan Board purchased a new position in shares of Ulta Beauty in the third quarter worth about $359,480,000. Holocene Advisors LP lifted its stake in shares of Ulta Beauty by 3,246.2% in the third quarter. Holocene Advisors LP now owns 346,262 shares of the specialty retailer's stock worth $134,737,000 after buying an additional 335,914 shares in the last quarter. Atreides Management LP purchased a new position in shares of Ulta Beauty in the third quarter worth about $73,069,000. Finally, Hsbc Holdings PLC lifted its stake in shares of Ulta Beauty by 87.3% in the second quarter. Hsbc Holdings PLC now owns 337,882 shares of the specialty retailer's stock worth $130,380,000 after buying an additional 157,497 shares in the last quarter. 90.39% of the stock is currently owned by institutional investors and hedge funds.

Ulta Beauty Company Profile

(

Get Free Report)

Ulta Beauty, Inc operates as a specialty beauty retailer in the United States. The company offers branded and private label beauty products, including cosmetics, fragrance, haircare, skincare, bath and body products, professional hair products, and salon styling tools through its Ulta Beauty stores, shop-in-shops, Ulta.com website, and its mobile applications.

Featured Stories

Before you consider Ulta Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ulta Beauty wasn't on the list.

While Ulta Beauty currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.