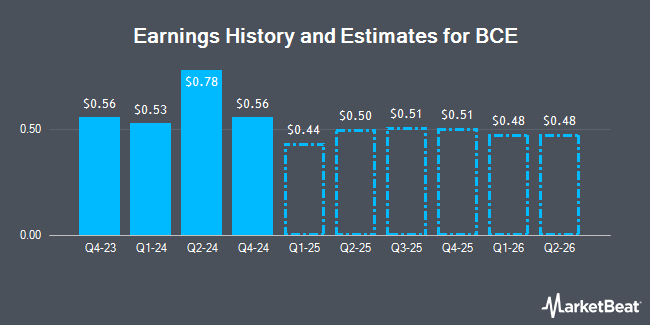

BCE Inc. (NYSE:BCE - Free Report) TSE: BCE - Analysts at Cormark increased their FY2025 earnings per share estimates for BCE in a research report issued to clients and investors on Tuesday, November 5th. Cormark analyst D. Mcfadgen now expects that the utilities provider will post earnings per share of $2.28 for the year, up from their previous estimate of $2.20. The consensus estimate for BCE's current full-year earnings is $2.20 per share.

Several other equities research analysts also recently weighed in on the stock. BMO Capital Markets increased their target price on shares of BCE from $48.00 to $51.00 and gave the stock a "market perform" rating in a research note on Thursday, September 19th. Barclays decreased their target price on shares of BCE from $35.00 to $34.00 and set an "equal weight" rating for the company in a research note on Wednesday, October 9th. Cibc World Mkts upgraded shares of BCE from a "hold" rating to a "strong-buy" rating in a research note on Friday, August 2nd. Edward Jones downgraded shares of BCE from a "buy" rating to a "hold" rating in a research note on Tuesday. Finally, Canaccord Genuity Group downgraded shares of BCE from a "buy" rating to a "hold" rating in a research note on Tuesday. Nine analysts have rated the stock with a hold rating, one has assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $46.33.

View Our Latest Stock Analysis on BCE

BCE Stock Performance

Shares of BCE traded down $0.10 during mid-day trading on Wednesday, hitting $28.74. 5,657,466 shares of the company's stock were exchanged, compared to its average volume of 2,255,912. BCE has a fifty-two week low of $28.26 and a fifty-two week high of $41.77. The firm has a market capitalization of $26.22 billion, a P/E ratio of 18.08, a P/E/G ratio of 5.36 and a beta of 0.59. The business's 50 day moving average is $33.87 and its two-hundred day moving average is $33.64. The company has a current ratio of 0.65, a quick ratio of 0.62 and a debt-to-equity ratio of 2.00.

Institutional Investors Weigh In On BCE

A number of hedge funds and other institutional investors have recently modified their holdings of the stock. Vanguard Group Inc. lifted its position in shares of BCE by 0.6% during the 1st quarter. Vanguard Group Inc. now owns 14,725,614 shares of the utilities provider's stock valued at $500,376,000 after acquiring an additional 80,879 shares during the period. Toronto Dominion Bank increased its stake in shares of BCE by 12.0% during the 2nd quarter. Toronto Dominion Bank now owns 8,450,810 shares of the utilities provider's stock worth $273,553,000 after purchasing an additional 905,857 shares in the last quarter. CIBC Asset Management Inc increased its stake in shares of BCE by 23.8% during the 2nd quarter. CIBC Asset Management Inc now owns 5,520,090 shares of the utilities provider's stock worth $178,677,000 after purchasing an additional 1,061,488 shares in the last quarter. The Manufacturers Life Insurance Company increased its stake in shares of BCE by 0.4% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 5,068,728 shares of the utilities provider's stock worth $163,932,000 after purchasing an additional 21,487 shares in the last quarter. Finally, Federated Hermes Inc. increased its stake in shares of BCE by 5.5% during the 2nd quarter. Federated Hermes Inc. now owns 3,564,393 shares of the utilities provider's stock worth $115,379,000 after purchasing an additional 186,659 shares in the last quarter. 41.46% of the stock is currently owned by institutional investors and hedge funds.

About BCE

(

Get Free Report)

BCE Inc, a communications company, provides wireless, wireline, Internet, and television (TV) services to residential, business, and wholesale customers in Canada. The company operates through two segments, Bell Communication and Technology Services, and Bell Media. The Bell Communication and Technology Services segment provides wireless products and services including mobile data and voice plans and devices; wireline products and services comprising data, including internet access, internet protocol television, cloud-based services, and business solutions, as well as voice, and other communication services and products; and satellite TV and connectivity services for residential, small and medium-sized business, government, and large enterprise customers.

Recommended Stories

Before you consider BCE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BCE wasn't on the list.

While BCE currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.