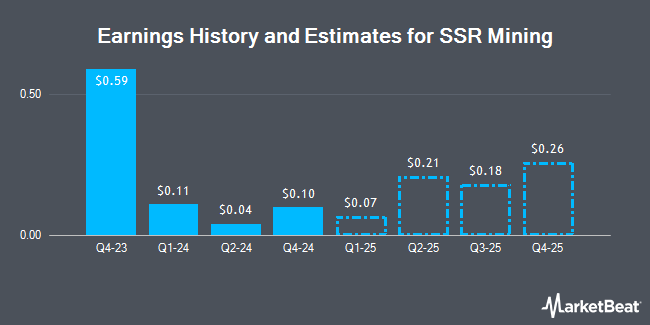

SSR Mining Inc. (NASDAQ:SSRM - Free Report) TSE: SSO - Stock analysts at Cormark reduced their FY2024 earnings per share (EPS) estimates for shares of SSR Mining in a research report issued on Monday, November 11th. Cormark analyst R. Gray now expects that the basic materials company will earn $0.38 per share for the year, down from their prior forecast of $0.58. The consensus estimate for SSR Mining's current full-year earnings is $0.33 per share. Cormark also issued estimates for SSR Mining's FY2025 earnings at $0.71 EPS and FY2026 earnings at $0.68 EPS.

Separately, UBS Group boosted their target price on SSR Mining from $6.30 to $6.80 and gave the stock a "buy" rating in a report on Tuesday, October 15th. Two research analysts have rated the stock with a sell rating, five have given a hold rating and one has given a buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $7.01.

View Our Latest Analysis on SSRM

SSR Mining Trading Up 0.9 %

SSRM stock traded up $0.05 during trading on Wednesday, reaching $5.37. 2,036,493 shares of the stock traded hands, compared to its average volume of 3,486,320. The business's 50 day moving average price is $5.82 and its 200-day moving average price is $5.35. The firm has a market capitalization of $1.09 billion, a PE ratio of -2.25, a P/E/G ratio of 0.90 and a beta of 0.72. The company has a debt-to-equity ratio of 0.08, a current ratio of 3.91 and a quick ratio of 1.97. SSR Mining has a 52-week low of $3.76 and a 52-week high of $12.04.

Institutional Trading of SSR Mining

Several large investors have recently bought and sold shares of the company. Vanguard Group Inc. grew its holdings in SSR Mining by 6.9% during the 1st quarter. Vanguard Group Inc. now owns 8,303,664 shares of the basic materials company's stock valued at $37,034,000 after purchasing an additional 533,880 shares in the last quarter. D. E. Shaw & Co. Inc. boosted its position in SSR Mining by 45.9% in the 2nd quarter. D. E. Shaw & Co. Inc. now owns 8,228,572 shares of the basic materials company's stock valued at $37,124,000 after buying an additional 2,587,212 shares during the last quarter. National Bank of Canada FI grew its stake in shares of SSR Mining by 73.7% during the second quarter. National Bank of Canada FI now owns 2,636,902 shares of the basic materials company's stock valued at $11,815,000 after acquiring an additional 1,118,417 shares in the last quarter. Tidal Investments LLC purchased a new stake in shares of SSR Mining during the first quarter worth about $6,485,000. Finally, Charles Schwab Investment Management Inc. lifted its stake in shares of SSR Mining by 6.0% in the third quarter. Charles Schwab Investment Management Inc. now owns 1,327,251 shares of the basic materials company's stock worth $7,542,000 after acquiring an additional 75,563 shares in the last quarter. Institutional investors and hedge funds own 68.30% of the company's stock.

SSR Mining Company Profile

(

Get Free Report)

SSR Mining Inc, together with its subsidiaries, engages in the operation, acquisition, exploration, and development of precious metal resource properties in the United States, Türkiye, Canada, and Argentina. The company explores for gold doré, copper, silver, lead, and zinc deposits. Its mines include the Çöpler, located in Erzincan province, Turkey; the Marigold, located in Nevada, the United States; the Seabee, located in Saskatchewan, Canada; and the Puna, located in Jujuy province, Argentina.

Read More

Before you consider SSR Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SSR Mining wasn't on the list.

While SSR Mining currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.