Abeona Therapeutics Inc (NASDAQ:ABEO - Free Report) - Stock analysts at HC Wainwright issued their Q1 2026 earnings per share estimates for Abeona Therapeutics in a research report issued on Monday, March 24th. HC Wainwright analyst R. Selvaraju anticipates that the biopharmaceutical company will post earnings per share of ($0.10) for the quarter. HC Wainwright has a "Buy" rating and a $15.00 price target on the stock. The consensus estimate for Abeona Therapeutics' current full-year earnings is ($1.16) per share. HC Wainwright also issued estimates for Abeona Therapeutics' Q2 2026 earnings at ($0.06) EPS, Q3 2026 earnings at ($0.01) EPS, Q4 2026 earnings at $0.05 EPS and FY2026 earnings at ($0.12) EPS.

Other equities research analysts also recently issued research reports about the stock. Oppenheimer assumed coverage on shares of Abeona Therapeutics in a research note on Wednesday, March 5th. They issued an "outperform" rating and a $16.00 target price on the stock. StockNews.com raised shares of Abeona Therapeutics from a "sell" rating to a "hold" rating in a research report on Monday, March 24th. One equities research analyst has rated the stock with a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $17.50.

Read Our Latest Research Report on Abeona Therapeutics

Abeona Therapeutics Trading Down 1.4 %

ABEO traded down $0.07 during trading on Tuesday, reaching $4.97. The company had a trading volume of 529,297 shares, compared to its average volume of 408,282. The company has a quick ratio of 6.12, a current ratio of 6.12 and a debt-to-equity ratio of 0.31. The business has a 50 day simple moving average of $5.42 and a 200-day simple moving average of $5.81. The stock has a market cap of $241.21 million, a P/E ratio of -1.85 and a beta of 1.79. Abeona Therapeutics has a 52 week low of $3.05 and a 52 week high of $8.45.

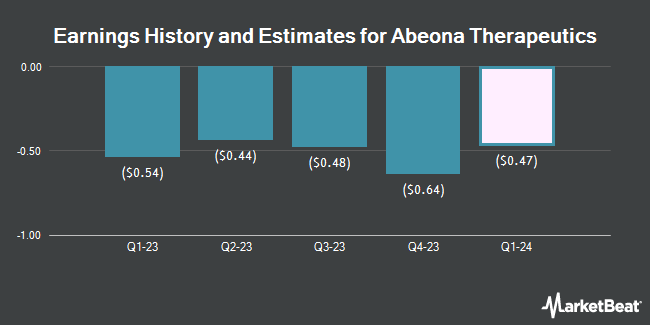

Abeona Therapeutics (NASDAQ:ABEO - Get Free Report) last announced its earnings results on Thursday, March 20th. The biopharmaceutical company reported ($0.24) EPS for the quarter, topping analysts' consensus estimates of ($0.43) by $0.19.

Institutional Trading of Abeona Therapeutics

Several institutional investors and hedge funds have recently made changes to their positions in the business. Twinbeech Capital LP bought a new position in shares of Abeona Therapeutics in the fourth quarter worth about $58,000. Northern Trust Corp boosted its position in Abeona Therapeutics by 6.6% in the 4th quarter. Northern Trust Corp now owns 184,929 shares of the biopharmaceutical company's stock valued at $1,030,000 after buying an additional 11,478 shares during the period. Squarepoint Ops LLC purchased a new stake in Abeona Therapeutics in the 4th quarter valued at about $67,000. Jane Street Group LLC bought a new position in Abeona Therapeutics in the 3rd quarter worth about $84,000. Finally, Oxford Asset Management LLP purchased a new position in shares of Abeona Therapeutics during the fourth quarter worth approximately $118,000. 80.56% of the stock is currently owned by institutional investors.

About Abeona Therapeutics

(

Get Free Report)

Abeona Therapeutics Inc, a clinical-stage biopharmaceutical company, focuses on developing and delivering gene therapy products for severe and life-threatening rare diseases. The company's lead programs are EB-101 (gene-corrected skin grafts) for recessive dystrophic epidermolysis bullosa (RDEB); ABO-102, which are AAV based gene therapies for Sanfilippo syndrome type A; and ABO-101, an adeno-associated virus (AAV) based gene therapies for Sanfilippo syndrome type B.

Further Reading

Before you consider Abeona Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abeona Therapeutics wasn't on the list.

While Abeona Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.