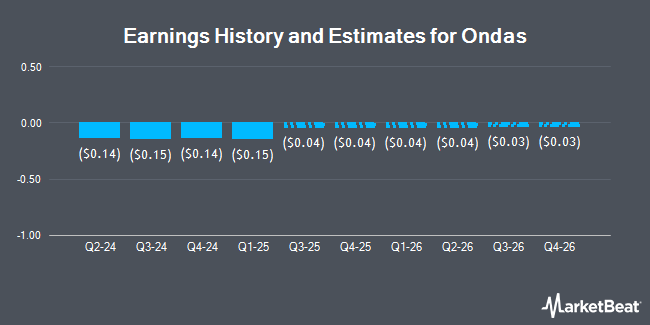

Ondas Holdings Inc. (NASDAQ:ONDS - Free Report) - Equities researchers at Northland Capmk issued their Q1 2026 earnings estimates for Ondas in a note issued to investors on Friday, March 14th. Northland Capmk analyst M. Latimore anticipates that the company will earn ($0.07) per share for the quarter. The consensus estimate for Ondas' current full-year earnings is ($0.53) per share. Northland Capmk also issued estimates for Ondas' Q2 2026 earnings at ($0.07) EPS, Q3 2026 earnings at ($0.06) EPS and Q4 2026 earnings at ($0.06) EPS.

Separately, Northland Securities raised their price target on shares of Ondas from $1.50 to $4.00 and gave the stock an "outperform" rating in a research note on Monday, December 30th.

Get Our Latest Stock Report on Ondas

Ondas Trading Down 8.3 %

ONDS stock traded down $0.06 during trading on Monday, hitting $0.70. The company had a trading volume of 2,226,823 shares, compared to its average volume of 7,306,091. The firm has a market capitalization of $73.48 million, a P/E ratio of -0.97 and a beta of 2.00. Ondas has a 52-week low of $0.54 and a 52-week high of $3.40. The company has a 50 day simple moving average of $1.52 and a 200-day simple moving average of $1.24. The company has a quick ratio of 0.21, a current ratio of 0.43 and a debt-to-equity ratio of 0.02.

Ondas (NASDAQ:ONDS - Get Free Report) last posted its quarterly earnings results on Wednesday, March 12th. The company reported ($0.14) EPS for the quarter, missing the consensus estimate of ($0.09) by ($0.05). The company had revenue of $4.13 million during the quarter, compared to analysts' expectations of $5.75 million. Ondas had a negative return on equity of 183.49% and a negative net margin of 544.24%.

Institutional Inflows and Outflows

A number of institutional investors have recently added to or reduced their stakes in ONDS. Penbrook Management LLC purchased a new position in Ondas during the 4th quarter valued at about $28,000. Wells Fargo & Company MN increased its position in Ondas by 119.2% during the 4th quarter. Wells Fargo & Company MN now owns 11,400 shares of the company's stock valued at $29,000 after purchasing an additional 6,200 shares during the period. Two Sigma Investments LP bought a new stake in shares of Ondas in the 4th quarter valued at about $31,000. Staley Capital Advisers Inc. bought a new stake in shares of Ondas in the 4th quarter valued at about $32,000. Finally, B. Riley Wealth Advisors Inc. bought a new stake in shares of Ondas in the 4th quarter valued at about $46,000. Hedge funds and other institutional investors own 37.73% of the company's stock.

Ondas Company Profile

(

Get Free Report)

Ondas Holdings Inc, through its subsidiaries, provides private wireless, drone, and automated data solutions. It operates in two segments, Ondas Networks and Ondas Autonomous Systems. The company designs, develops, manufactures, sells, and supports FullMAX, a software defined radio (SDR) platform for wide-area broadband networks.

Featured Stories

Before you consider Ondas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ondas wasn't on the list.

While Ondas currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.