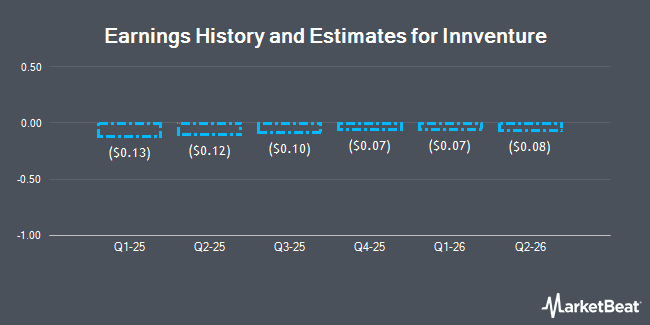

Innventure, Inc. (NASDAQ:INV - Free Report) - Stock analysts at Roth Capital raised their Q1 2025 EPS estimates for shares of Innventure in a research report issued to clients and investors on Monday, April 21st. Roth Capital analyst C. Moore now expects that the company will post earnings per share of ($0.07) for the quarter, up from their previous forecast of ($0.11). Roth Capital has a "Strong-Buy" rating on the stock. Roth Capital also issued estimates for Innventure's Q2 2025 earnings at ($0.07) EPS, Q3 2025 earnings at ($0.04) EPS, Q4 2025 earnings at $0.01 EPS, FY2025 earnings at ($0.16) EPS, Q1 2026 earnings at $0.00 EPS, Q2 2026 earnings at ($0.01) EPS, Q3 2026 earnings at ($0.01) EPS, Q4 2026 earnings at ($0.02) EPS and FY2026 earnings at ($0.04) EPS.

Other equities research analysts have also recently issued research reports about the stock. Roth Mkm started coverage on shares of Innventure in a research report on Thursday, January 23rd. They set a "buy" rating and a $16.00 price target for the company. Northland Capmk upgraded Innventure to a "strong-buy" rating in a report on Wednesday, March 12th. Finally, Northland Securities began coverage on shares of Innventure in a research note on Wednesday, March 12th. They set an "outperform" rating and a $12.00 price objective on the stock.

View Our Latest Stock Report on INV

Innventure Trading Down 4.3 %

Shares of NASDAQ INV traded down $0.20 during trading hours on Thursday, reaching $4.49. 52,286 shares of the stock traded hands, compared to its average volume of 57,482. The business's 50-day moving average is $6.50. Innventure has a 52-week low of $3.00 and a 52-week high of $18.75.

Hedge Funds Weigh In On Innventure

Large investors have recently modified their holdings of the stock. Tower Research Capital LLC TRC bought a new position in shares of Innventure in the fourth quarter worth approximately $52,000. Bank of America Corp DE purchased a new position in Innventure in the 4th quarter worth approximately $126,000. CastleKnight Management LP bought a new position in Innventure in the 4th quarter valued at approximately $387,000. Barclays PLC purchased a new stake in Innventure during the 4th quarter valued at $389,000. Finally, Millennium Management LLC bought a new stake in shares of Innventure in the 4th quarter worth $429,000. Hedge funds and other institutional investors own 55.98% of the company's stock.

Innventure Company Profile

(

Get Free Report)

Innventure Inc founds, funds and operates companies with a focus on transformative, sustainable technology solutions acquired or licensed from multinational corporations. Innventure Inc, formerly known as Learn CW Investment Corporation, is based in ORLANDO, Fla.

See Also

Before you consider Innventure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Innventure wasn't on the list.

While Innventure currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.