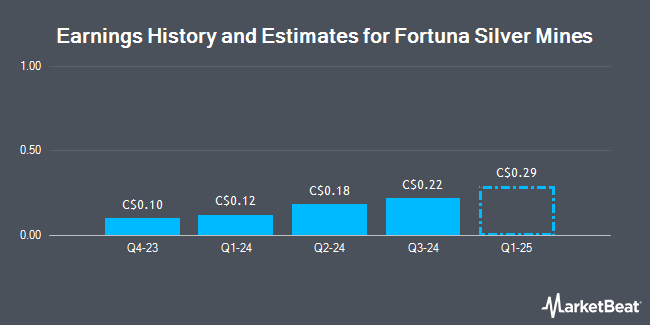

Fortuna Silver Mines Inc. (TSE:FVI - Free Report) NYSE: FSM - Analysts at Scotiabank boosted their FY2025 earnings per share (EPS) estimates for Fortuna Silver Mines in a note issued to investors on Wednesday, March 19th. Scotiabank analyst E. Winmill now expects that the company will post earnings per share of $0.87 for the year, up from their prior forecast of $0.86. The consensus estimate for Fortuna Silver Mines' current full-year earnings is $0.79 per share.

FVI has been the topic of a number of other research reports. CIBC cut shares of Fortuna Silver Mines from a "neutral" rating to an "underperform" rating and cut their price objective for the company from C$8.00 to C$7.00 in a research report on Tuesday, February 18th. Cibc World Mkts downgraded shares of Fortuna Silver Mines from a "hold" rating to a "strong sell" rating in a research note on Tuesday, February 18th.

Check Out Our Latest Analysis on Fortuna Silver Mines

Fortuna Silver Mines Price Performance

TSE:FVI traded up C$0.12 during trading hours on Friday, reaching C$8.51. The stock had a trading volume of 366,865 shares, compared to its average volume of 875,475. The stock has a market capitalization of C$1.88 billion, a PE ratio of 75.53 and a beta of 1.63. The company has a debt-to-equity ratio of 13.30, a quick ratio of 1.15 and a current ratio of 1.94. The company has a 50 day moving average price of C$7.01 and a two-hundred day moving average price of C$6.71. Fortuna Silver Mines has a 52 week low of C$4.62 and a 52 week high of C$8.77.

Fortuna Silver Mines Company Profile

(

Get Free Report)

Fortuna Silver Mines Inc is engaged in precious and base metal mining and related activities in Argentina, Burkina Faso, Mexico, Peru, and Cote d'Ivoire. The company operates the open pit Lindero gold mine in northern Argentina, the underground Yaramoko mine in southwestern Burkina Faso, the underground San Jose silver and gold mine in southern Mexico, the underground Caylloma silver, lead, and zinc mine in southern Peru, and is developing the open pit Seguela gold mine in southwestern Cote d'Ivoire.

Read More

Before you consider Fortuna Silver Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortuna Silver Mines wasn't on the list.

While Fortuna Silver Mines currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.