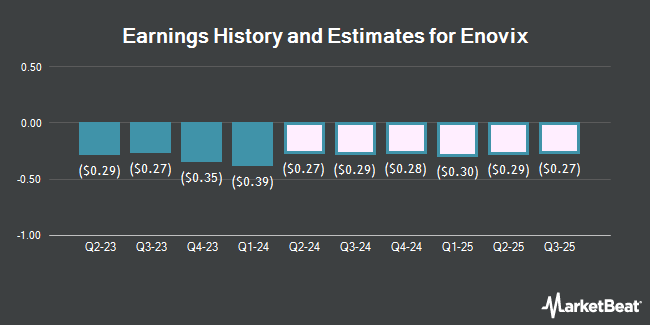

Enovix Co. (NASDAQ:ENVX - Free Report) - Investment analysts at William Blair issued their Q1 2026 EPS estimates for Enovix in a report issued on Thursday, February 20th. William Blair analyst J. Dorsheimer anticipates that the company will earn ($0.29) per share for the quarter. The consensus estimate for Enovix's current full-year earnings is ($1.01) per share. William Blair also issued estimates for Enovix's Q2 2026 earnings at ($0.29) EPS, Q3 2026 earnings at ($0.29) EPS and Q4 2026 earnings at ($0.28) EPS.

Enovix (NASDAQ:ENVX - Get Free Report) last announced its quarterly earnings data on Wednesday, February 19th. The company reported ($0.17) EPS for the quarter, beating the consensus estimate of ($0.18) by $0.01. The firm had revenue of $9.72 million for the quarter, compared to analyst estimates of $8.77 million. Enovix had a negative return on equity of 96.99% and a negative net margin of 963.17%.

A number of other brokerages have also recently commented on ENVX. Craig Hallum decreased their price target on Enovix from $20.00 to $18.00 and set a "buy" rating on the stock in a research note on Thursday, February 20th. Cantor Fitzgerald reiterated an "overweight" rating and issued a $30.00 price objective on shares of Enovix in a report on Thursday, February 20th. Finally, Janney Montgomery Scott downgraded shares of Enovix from a "buy" rating to a "neutral" rating and set a $10.00 price objective on the stock. in a research report on Thursday, October 31st. Two research analysts have rated the stock with a hold rating, eight have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $20.30.

Check Out Our Latest Report on ENVX

Enovix Trading Down 1.3 %

NASDAQ:ENVX traded down $0.12 during trading hours on Monday, reaching $8.92. The company's stock had a trading volume of 7,578,811 shares, compared to its average volume of 7,067,936. The company has a debt-to-equity ratio of 0.99, a quick ratio of 3.61 and a current ratio of 3.77. The firm has a market capitalization of $1.59 billion, a price-to-earnings ratio of -6.15 and a beta of 1.87. The firm has a 50-day simple moving average of $11.24 and a 200-day simple moving average of $10.26. Enovix has a 1 year low of $5.70 and a 1 year high of $18.68.

Insider Activity at Enovix

In other news, Director Betsy S. Atkins sold 75,000 shares of the business's stock in a transaction on Tuesday, December 3rd. The shares were sold at an average price of $9.73, for a total transaction of $729,750.00. Following the completion of the sale, the director now owns 99,497 shares of the company's stock, valued at $968,105.81. The trade was a 42.98 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. 15.70% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Enovix

Several institutional investors and hedge funds have recently bought and sold shares of ENVX. Vanguard Group Inc. raised its stake in shares of Enovix by 15.1% in the fourth quarter. Vanguard Group Inc. now owns 15,773,464 shares of the company's stock worth $171,458,000 after buying an additional 2,063,631 shares during the period. Fred Alger Management LLC increased its holdings in Enovix by 212.4% in the 4th quarter. Fred Alger Management LLC now owns 1,838,914 shares of the company's stock worth $19,989,000 after acquiring an additional 1,250,300 shares in the last quarter. Raymond James Financial Inc. purchased a new stake in Enovix in the 4th quarter worth approximately $3,484,000. Frontier Capital Management Co. LLC bought a new stake in Enovix during the 4th quarter worth approximately $3,397,000. Finally, Geode Capital Management LLC boosted its position in shares of Enovix by 6.6% in the fourth quarter. Geode Capital Management LLC now owns 3,818,827 shares of the company's stock worth $41,520,000 after purchasing an additional 235,142 shares during the period. 50.92% of the stock is currently owned by hedge funds and other institutional investors.

About Enovix

(

Get Free Report)

Enovix Corporation designs, develops, and manufactures lithium-ion batteries. It serves wearables and IoT, smartphone, laptops and tablets, industrial and medical, and electric vehicles industries. The company was founded in 2007 and is headquartered in Fremont, California.

Read More

Before you consider Enovix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enovix wasn't on the list.

While Enovix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.