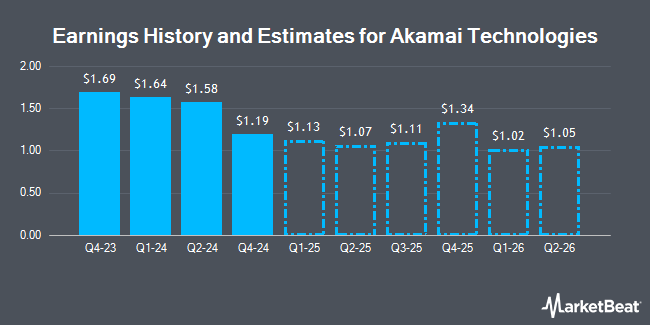

Akamai Technologies, Inc. (NASDAQ:AKAM - Free Report) - Research analysts at Zacks Research reduced their FY2025 earnings per share estimates for shares of Akamai Technologies in a report issued on Thursday, December 12th. Zacks Research analyst A. Chatterjee now forecasts that the technology infrastructure company will earn $4.52 per share for the year, down from their prior forecast of $4.53. The consensus estimate for Akamai Technologies' current full-year earnings is $4.29 per share. Zacks Research also issued estimates for Akamai Technologies' FY2026 earnings at $4.67 EPS.

A number of other equities research analysts have also issued reports on AKAM. Hsbc Global Res raised Akamai Technologies from a "hold" rating to a "strong-buy" rating in a research report on Monday, November 11th. Royal Bank of Canada reissued a "sector perform" rating and issued a $100.00 price objective on shares of Akamai Technologies in a research report on Thursday, August 15th. Tigress Financial reaffirmed a "strong-buy" rating and issued a $140.00 target price on shares of Akamai Technologies in a research report on Thursday, August 29th. Robert W. Baird cut their price target on shares of Akamai Technologies from $120.00 to $115.00 and set an "outperform" rating on the stock in a research report on Monday, November 11th. Finally, Scotiabank decreased their price objective on Akamai Technologies from $115.00 to $112.00 and set a "sector outperform" rating for the company in a report on Friday, November 8th. One analyst has rated the stock with a sell rating, five have given a hold rating, thirteen have given a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat, Akamai Technologies presently has a consensus rating of "Moderate Buy" and an average price target of $117.61.

View Our Latest Stock Report on AKAM

Akamai Technologies Stock Down 0.7 %

Shares of NASDAQ:AKAM traded down $0.70 during trading on Friday, hitting $99.30. 695,489 shares of the company's stock traded hands, compared to its average volume of 1,672,416. The company has a 50-day moving average price of $98.24 and a 200-day moving average price of $96.46. Akamai Technologies has a 52 week low of $84.70 and a 52 week high of $129.17. The company has a current ratio of 1.33, a quick ratio of 1.33 and a debt-to-equity ratio of 0.50. The company has a market cap of $14.92 billion, a price-to-earnings ratio of 29.59, a price-to-earnings-growth ratio of 3.83 and a beta of 0.65.

Institutional Inflows and Outflows

Several hedge funds have recently modified their holdings of AKAM. Retirement Systems of Alabama boosted its holdings in Akamai Technologies by 20.0% during the third quarter. Retirement Systems of Alabama now owns 837,155 shares of the technology infrastructure company's stock worth $84,511,000 after purchasing an additional 139,760 shares during the last quarter. Tidal Investments LLC increased its position in shares of Akamai Technologies by 15.6% during the third quarter. Tidal Investments LLC now owns 22,131 shares of the technology infrastructure company's stock valued at $2,234,000 after acquiring an additional 2,993 shares during the last quarter. Cim Investment Management Inc. lifted its holdings in Akamai Technologies by 124.9% during the third quarter. Cim Investment Management Inc. now owns 21,502 shares of the technology infrastructure company's stock worth $2,171,000 after acquiring an additional 11,943 shares during the period. Wilmington Savings Fund Society FSB purchased a new position in Akamai Technologies in the third quarter worth $483,000. Finally, Pine Valley Investments Ltd Liability Co grew its stake in Akamai Technologies by 13.2% in the 3rd quarter. Pine Valley Investments Ltd Liability Co now owns 14,577 shares of the technology infrastructure company's stock valued at $1,472,000 after purchasing an additional 1,700 shares during the period. Hedge funds and other institutional investors own 94.28% of the company's stock.

Insider Activity at Akamai Technologies

In other news, Director William Raymond Wagner sold 1,000 shares of the company's stock in a transaction dated Wednesday, November 27th. The shares were sold at an average price of $93.38, for a total transaction of $93,380.00. Following the transaction, the director now owns 15,719 shares in the company, valued at approximately $1,467,840.22. This represents a 5.98 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CTO Robert Blumofe sold 2,500 shares of the stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $88.61, for a total value of $221,525.00. Following the completion of the transaction, the chief technology officer now owns 19,510 shares in the company, valued at approximately $1,728,781.10. The trade was a 11.36 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 7,500 shares of company stock worth $669,425 over the last quarter. Company insiders own 1.80% of the company's stock.

About Akamai Technologies

(

Get Free Report)

Akamai Technologies, Inc provides cloud computing, security, and content delivery services in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance.

Featured Stories

Before you consider Akamai Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akamai Technologies wasn't on the list.

While Akamai Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.