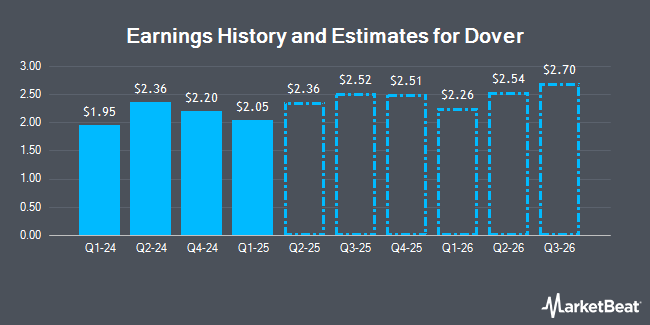

Dover Co. (NYSE:DOV - Free Report) - Analysts at Zacks Research raised their FY2025 earnings estimates for Dover in a report released on Thursday, December 12th. Zacks Research analyst R. Department now anticipates that the industrial products company will earn $9.17 per share for the year, up from their prior forecast of $9.16. The consensus estimate for Dover's current full-year earnings is $8.17 per share. Zacks Research also issued estimates for Dover's Q1 2026 earnings at $2.22 EPS.

Several other analysts have also issued reports on DOV. Wolfe Research upgraded shares of Dover from a "peer perform" rating to an "outperform" rating and set a $227.00 target price on the stock in a research report on Monday, October 28th. JPMorgan Chase & Co. lifted their price objective on Dover from $210.00 to $212.00 and gave the stock an "overweight" rating in a report on Friday, October 25th. Mizuho increased their target price on Dover from $200.00 to $220.00 and gave the company an "outperform" rating in a report on Thursday, October 17th. Wells Fargo & Company boosted their price target on Dover from $190.00 to $197.00 and gave the stock an "equal weight" rating in a research report on Monday, September 30th. Finally, Citigroup raised their price objective on Dover from $226.00 to $236.00 and gave the company a "buy" rating in a report on Monday, December 9th. Five investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the company. Based on data from MarketBeat, Dover presently has an average rating of "Moderate Buy" and a consensus price target of $213.91.

Check Out Our Latest Stock Report on Dover

Dover Stock Performance

DOV traded down $1.36 on Monday, reaching $199.65. The stock had a trading volume of 594,747 shares, compared to its average volume of 936,521. The business's 50-day moving average price is $197.57 and its two-hundred day moving average price is $187.60. The company has a market cap of $27.39 billion, a P/E ratio of 17.86, a price-to-earnings-growth ratio of 2.70 and a beta of 1.22. Dover has a 12-month low of $143.96 and a 12-month high of $208.26. The company has a current ratio of 1.57, a quick ratio of 1.06 and a debt-to-equity ratio of 0.53.

Dover Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Friday, November 29th will be issued a $0.515 dividend. The ex-dividend date is Friday, November 29th. This represents a $2.06 annualized dividend and a yield of 1.03%. Dover's payout ratio is 18.43%.

Institutional Investors Weigh In On Dover

Several hedge funds and other institutional investors have recently added to or reduced their stakes in DOV. American Century Companies Inc. grew its holdings in shares of Dover by 162.2% during the 2nd quarter. American Century Companies Inc. now owns 688,249 shares of the industrial products company's stock worth $124,195,000 after purchasing an additional 425,768 shares during the period. Interval Partners LP boosted its stake in Dover by 110.0% during the second quarter. Interval Partners LP now owns 583,075 shares of the industrial products company's stock worth $105,216,000 after buying an additional 305,436 shares during the period. FMR LLC raised its stake in shares of Dover by 5.1% in the 3rd quarter. FMR LLC now owns 3,085,826 shares of the industrial products company's stock valued at $591,676,000 after acquiring an additional 149,378 shares during the period. National Bank of Canada FI lifted its holdings in shares of Dover by 313.7% in the 3rd quarter. National Bank of Canada FI now owns 191,127 shares of the industrial products company's stock worth $36,647,000 after acquiring an additional 144,930 shares during the last quarter. Finally, Kimelman & Baird LLC acquired a new stake in Dover in the 2nd quarter valued at approximately $17,323,000. Institutional investors and hedge funds own 84.46% of the company's stock.

Dover Company Profile

(

Get Free Report)

Dover Corporation provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide. The company's Engineered Products segment provides various equipment, component, software, solution, and services that are used in vehicle aftermarket, waste handling, industrial automation, aerospace and defense, industrial winch and hoist, and fluid dispensing end-market.

See Also

Before you consider Dover, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dover wasn't on the list.

While Dover currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.