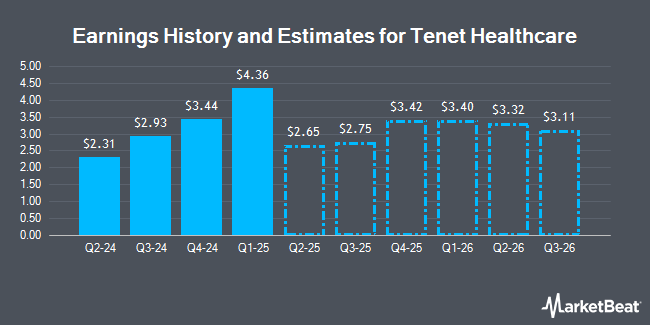

Tenet Healthcare Co. (NYSE:THC - Free Report) - Investment analysts at Zacks Research issued their FY2024 earnings estimates for Tenet Healthcare in a research report issued on Tuesday, November 12th. Zacks Research analyst R. Department expects that the company will earn $11.34 per share for the year. The consensus estimate for Tenet Healthcare's current full-year earnings is $11.38 per share. Zacks Research also issued estimates for Tenet Healthcare's Q4 2024 earnings at $2.88 EPS, Q1 2025 earnings at $2.94 EPS, Q2 2025 earnings at $2.67 EPS, Q3 2025 earnings at $2.71 EPS, Q4 2025 earnings at $3.21 EPS, FY2025 earnings at $11.53 EPS, Q1 2026 earnings at $3.46 EPS, Q2 2026 earnings at $3.21 EPS, Q3 2026 earnings at $3.02 EPS and FY2026 earnings at $13.45 EPS.

Several other equities analysts have also recently weighed in on THC. UBS Group increased their price target on Tenet Healthcare from $197.00 to $217.00 and gave the company a "buy" rating in a report on Wednesday, October 30th. Truist Financial restated a "buy" rating and set a $190.00 price target (up from $180.00) on shares of Tenet Healthcare in a research note on Wednesday, October 30th. Royal Bank of Canada increased their price objective on shares of Tenet Healthcare from $174.00 to $183.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 30th. Wells Fargo & Company increased their price target on shares of Tenet Healthcare from $195.00 to $205.00 and gave the stock an "overweight" rating in a research report on Wednesday, November 6th. Finally, The Goldman Sachs Group raised their target price on Tenet Healthcare from $173.00 to $196.00 and gave the stock a "buy" rating in a report on Wednesday, October 30th. One analyst has rated the stock with a hold rating, thirteen have assigned a buy rating and four have given a strong buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Buy" and an average price target of $170.38.

View Our Latest Stock Analysis on THC

Tenet Healthcare Stock Performance

Shares of THC traded down $7.31 during mid-day trading on Friday, hitting $155.34. 1,573,677 shares of the company traded hands, compared to its average volume of 1,218,194. Tenet Healthcare has a 1 year low of $57.65 and a 1 year high of $171.20. The company has a debt-to-equity ratio of 2.35, a quick ratio of 1.52 and a current ratio of 1.58. The stock has a 50-day moving average price of $159.54 and a two-hundred day moving average price of $146.36. The stock has a market cap of $14.77 billion, a price-to-earnings ratio of 5.21, a P/E/G ratio of 0.73 and a beta of 2.15.

Tenet Healthcare (NYSE:THC - Get Free Report) last posted its earnings results on Tuesday, October 29th. The company reported $2.93 EPS for the quarter, topping analysts' consensus estimates of $2.33 by $0.60. Tenet Healthcare had a return on equity of 24.05% and a net margin of 14.91%. The business had revenue of $5.12 billion during the quarter, compared to analyst estimates of $5.05 billion. During the same quarter last year, the company earned $1.44 EPS. The company's quarterly revenue was up 1.1% compared to the same quarter last year.

Institutional Investors Weigh In On Tenet Healthcare

A number of institutional investors and hedge funds have recently modified their holdings of the business. Legacy Capital Group California Inc. bought a new position in Tenet Healthcare in the third quarter worth approximately $1,055,000. Diversified Trust Co bought a new stake in Tenet Healthcare during the 2nd quarter valued at $558,000. O Shaughnessy Asset Management LLC increased its holdings in shares of Tenet Healthcare by 31.1% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 28,171 shares of the company's stock valued at $2,961,000 after acquiring an additional 6,687 shares during the period. Janney Montgomery Scott LLC purchased a new stake in shares of Tenet Healthcare during the 1st quarter worth $537,000. Finally, Envestnet Portfolio Solutions Inc. boosted its holdings in shares of Tenet Healthcare by 124.0% in the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 12,787 shares of the company's stock valued at $1,701,000 after buying an additional 7,078 shares in the last quarter. 95.44% of the stock is owned by institutional investors.

Insider Activity at Tenet Healthcare

In other Tenet Healthcare news, Director Richard W. Fisher sold 2,000 shares of the business's stock in a transaction that occurred on Tuesday, August 27th. The stock was sold at an average price of $163.67, for a total transaction of $327,340.00. Following the sale, the director now directly owns 14,227 shares of the company's stock, valued at $2,328,533.09. The trade was a 12.33 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, insider R. Scott Ramsey sold 11,599 shares of Tenet Healthcare stock in a transaction on Thursday, September 5th. The stock was sold at an average price of $162.06, for a total transaction of $1,879,733.94. Following the transaction, the insider now directly owns 6,324 shares of the company's stock, valued at $1,024,867.44. The trade was a 64.72 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 17,599 shares of company stock valued at $2,830,834. Insiders own 0.93% of the company's stock.

Tenet Healthcare announced that its board has authorized a stock repurchase program on Wednesday, July 24th that authorizes the company to buyback $1.50 billion in outstanding shares. This buyback authorization authorizes the company to buy up to 10.3% of its shares through open market purchases. Shares buyback programs are often an indication that the company's management believes its shares are undervalued.

About Tenet Healthcare

(

Get Free Report)

Tenet Healthcare Corporation operates as a diversified healthcare services company in the United States. The company operates through two segments: Hospital Operations and Services, and Ambulatory Care. Its general hospitals offer acute care services, operating and recovery rooms, radiology and respiratory therapy services, clinical laboratories, and pharmacies.

Read More

Before you consider Tenet Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tenet Healthcare wasn't on the list.

While Tenet Healthcare currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.