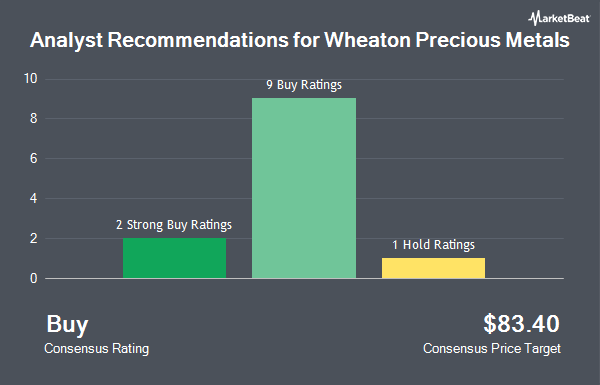

Shares of Wheaton Precious Metals Corp. (NYSE:WPM - Get Free Report) have been given an average rating of "Moderate Buy" by the nine ratings firms that are currently covering the firm, MarketBeat Ratings reports. One investment analyst has rated the stock with a hold rating and eight have issued a buy rating on the company. The average 12-month price objective among brokerages that have covered the stock in the last year is $70.25.

Several research firms recently weighed in on WPM. Jefferies Financial Group boosted their target price on Wheaton Precious Metals from $67.00 to $77.00 and gave the stock a "buy" rating in a report on Friday, October 4th. CIBC increased their target price on Wheaton Precious Metals from $75.00 to $80.00 and gave the stock an "outperformer" rating in a research note on Wednesday, July 10th. Raymond James lifted their target price on Wheaton Precious Metals from $74.00 to $75.00 and gave the stock an "outperform" rating in a report on Friday, October 25th. TD Securities decreased their price objective on Wheaton Precious Metals from $71.00 to $70.00 and set a "buy" rating for the company in a report on Thursday, August 15th. Finally, Stifel Canada cut shares of Wheaton Precious Metals from a "strong-buy" rating to a "hold" rating in a report on Monday, October 21st.

Read Our Latest Research Report on Wheaton Precious Metals

Wheaton Precious Metals Stock Performance

Shares of NYSE WPM traded up $1.66 during mid-day trading on Thursday, reaching $64.41. 2,268,144 shares of the company's stock were exchanged, compared to its average volume of 1,772,054. The firm has a market capitalization of $29.22 billion, a price-to-earnings ratio of 49.80, a PEG ratio of 2.37 and a beta of 0.77. The company's 50-day moving average is $62.67 and its 200-day moving average is $58.44. Wheaton Precious Metals has a 52-week low of $38.57 and a 52-week high of $68.64.

Wheaton Precious Metals (NYSE:WPM - Get Free Report) last posted its quarterly earnings results on Wednesday, August 7th. The company reported $0.33 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.29 by $0.04. The firm had revenue of $299.06 million during the quarter, compared to the consensus estimate of $309.54 million. Wheaton Precious Metals had a return on equity of 8.54% and a net margin of 50.44%. The firm's quarterly revenue was up 12.9% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.31 earnings per share. As a group, equities analysts predict that Wheaton Precious Metals will post 1.44 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Wheaton Precious Metals

Several institutional investors and hedge funds have recently made changes to their positions in WPM. First Eagle Investment Management LLC increased its position in Wheaton Precious Metals by 1.4% during the 1st quarter. First Eagle Investment Management LLC now owns 21,403,409 shares of the company's stock valued at $1,008,743,000 after buying an additional 292,968 shares in the last quarter. Van ECK Associates Corp boosted its holdings in Wheaton Precious Metals by 1.0% in the second quarter. Van ECK Associates Corp now owns 19,984,984 shares of the company's stock valued at $1,047,621,000 after purchasing an additional 197,426 shares during the last quarter. Vanguard Group Inc. lifted its stake in Wheaton Precious Metals by 1.7% in the 1st quarter. Vanguard Group Inc. now owns 16,770,475 shares of the company's stock valued at $790,392,000 after buying an additional 272,918 shares in the last quarter. Price T Rowe Associates Inc. MD increased its holdings in shares of Wheaton Precious Metals by 16.0% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 7,309,175 shares of the company's stock worth $344,483,000 after buying an additional 1,010,307 shares during the last quarter. Finally, TD Asset Management Inc boosted its position in Wheaton Precious Metals by 22.5% in the 2nd quarter. TD Asset Management Inc now owns 5,950,317 shares of the company's stock valued at $311,920,000 after buying an additional 1,092,480 shares during the period. Institutional investors and hedge funds own 70.34% of the company's stock.

About Wheaton Precious Metals

(

Get Free ReportWheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 2017. Wheaton Precious Metals Corp.

Further Reading

Before you consider Wheaton Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wheaton Precious Metals wasn't on the list.

While Wheaton Precious Metals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.