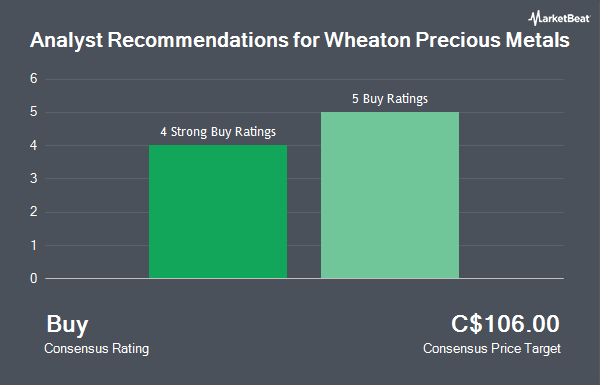

Wheaton Precious Metals Corp. (TSE:WPM - Get Free Report) has earned an average recommendation of "Buy" from the nine research firms that are covering the company, MarketBeat Ratings reports. Six equities research analysts have rated the stock with a buy rating and three have issued a strong buy rating on the company. The average 12 month price target among brokerages that have updated their coverage on the stock in the last year is C$98.38.

WPM has been the topic of several research analyst reports. National Bankshares increased their price target on Wheaton Precious Metals from C$115.00 to C$120.00 and gave the company an "outperform" rating in a report on Monday, March 17th. TD Securities upped their target price on Wheaton Precious Metals from C$78.00 to C$83.00 and gave the company a "buy" rating in a research note on Friday, March 14th. CIBC boosted their price target on Wheaton Precious Metals from C$85.00 to C$88.00 and gave the stock an "outperform" rating in a research report on Friday, March 14th. Peel Hunt upped their target price on Wheaton Precious Metals from C$95.00 to C$110.00 and gave the company a "buy" rating in a research report on Tuesday, March 11th. Finally, Stifel Canada raised shares of Wheaton Precious Metals from a "hold" rating to a "strong-buy" rating in a report on Tuesday, February 4th.

Get Our Latest Research Report on Wheaton Precious Metals

Wheaton Precious Metals Stock Performance

Shares of WPM stock traded up C$1.19 during mid-day trading on Friday, hitting C$108.49. The company's stock had a trading volume of 836,215 shares, compared to its average volume of 691,267. Wheaton Precious Metals has a 52-week low of C$60.61 and a 52-week high of C$110.46. The stock has a market cap of C$34.41 billion, a price-to-earnings ratio of 56.45 and a beta of 0.70. The business has a 50-day moving average price of C$96.05 and a 200 day moving average price of C$89.04.

Wheaton Precious Metals Company Profile

(

Get Free ReportWheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 2017. Wheaton Precious Metals Corp.

Featured Stories

Before you consider Wheaton Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wheaton Precious Metals wasn't on the list.

While Wheaton Precious Metals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.