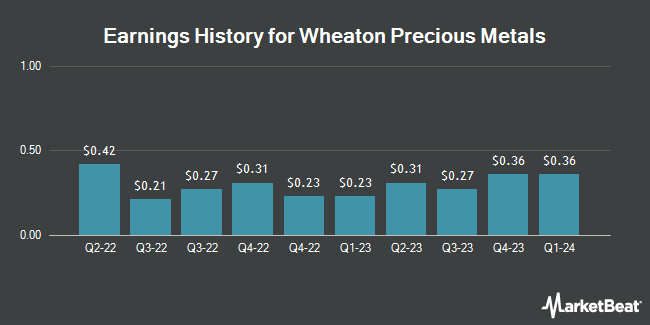

Wheaton Precious Metals (NYSE:WPM - Get Free Report) will likely be announcing its earnings results before the market opens on Thursday, March 13th. Analysts expect the company to announce earnings of $0.45 per share and revenue of $395.74 million for the quarter. Individual that wish to register for the company's earnings conference call can do so using this link.

Wheaton Precious Metals Stock Performance

Shares of NYSE WPM traded down $0.72 during midday trading on Thursday, reaching $70.25. 1,120,096 shares of the company's stock were exchanged, compared to its average volume of 1,506,211. The stock has a market capitalization of $31.87 billion, a PE ratio of 52.42, a price-to-earnings-growth ratio of 1.91 and a beta of 0.76. Wheaton Precious Metals has a 52-week low of $43.18 and a 52-week high of $71.55. The business's fifty day moving average price is $62.70 and its two-hundred day moving average price is $62.21.

Analyst Ratings Changes

A number of research analysts have commented on WPM shares. TD Securities increased their price objective on shares of Wheaton Precious Metals from $74.00 to $75.00 and gave the company a "buy" rating in a research note on Friday, November 8th. Stifel Canada upgraded Wheaton Precious Metals from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, February 4th. Finally, UBS Group started coverage on Wheaton Precious Metals in a research note on Monday, November 18th. They set a "buy" rating and a $78.00 price objective on the stock. Nine investment analysts have rated the stock with a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the company has an average rating of "Buy" and an average price target of $71.67.

Get Our Latest Research Report on Wheaton Precious Metals

Wheaton Precious Metals Company Profile

(

Get Free Report)

Wheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 2017. Wheaton Precious Metals Corp.

Read More

Before you consider Wheaton Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wheaton Precious Metals wasn't on the list.

While Wheaton Precious Metals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.