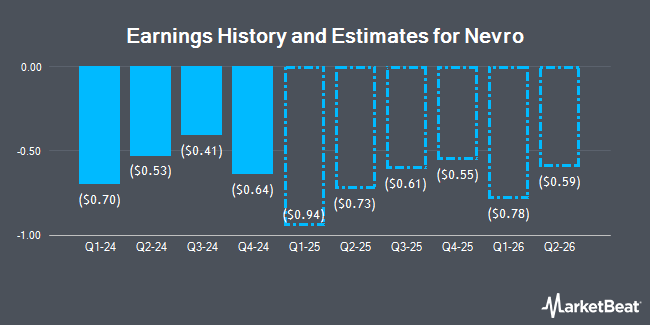

Nevro Corp. (NYSE:NVRO - Free Report) - Equities research analysts at William Blair issued their FY2026 earnings estimates for Nevro in a research report issued on Tuesday, November 12th. William Blair analyst B. Vazquez anticipates that the medical equipment provider will post earnings per share of ($2.46) for the year. The consensus estimate for Nevro's current full-year earnings is ($2.60) per share.

Nevro (NYSE:NVRO - Get Free Report) last posted its quarterly earnings results on Monday, November 11th. The medical equipment provider reported ($0.41) earnings per share for the quarter, beating the consensus estimate of ($0.81) by $0.40. The business had revenue of $96.60 million during the quarter, compared to analysts' expectations of $93.09 million. Nevro had a negative net margin of 16.54% and a negative return on equity of 23.35%. The business's revenue for the quarter was down 7.0% on a year-over-year basis. During the same quarter in the prior year, the company posted ($0.65) EPS.

A number of other research firms have also recently weighed in on NVRO. Robert W. Baird increased their price target on Nevro from $5.00 to $6.00 and gave the stock a "neutral" rating in a report on Tuesday. Citigroup lowered their target price on shares of Nevro from $6.89 to $6.00 and set a "neutral" rating for the company in a research note on Tuesday, October 1st. Wells Fargo & Company downgraded shares of Nevro from an "equal weight" rating to an "underweight" rating and reduced their price target for the company from $13.00 to $5.50 in a research note on Wednesday, August 7th. JMP Securities reaffirmed a "market perform" rating on shares of Nevro in a research report on Tuesday. Finally, Wolfe Research raised Nevro from an "underperform" rating to a "peer perform" rating in a research report on Thursday, August 8th. Three analysts have rated the stock with a sell rating and twelve have given a hold rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $9.10.

View Our Latest Stock Report on NVRO

Nevro Trading Down 6.1 %

NVRO stock traded down $0.31 during midday trading on Wednesday, hitting $4.75. 419,657 shares of the company's stock were exchanged, compared to its average volume of 559,512. Nevro has a 1-year low of $4.38 and a 1-year high of $22.64. The company has a current ratio of 4.77, a quick ratio of 3.53 and a debt-to-equity ratio of 0.66. The stock has a market capitalization of $177.08 million, a PE ratio of -2.47 and a beta of 0.93. The business has a 50-day simple moving average of $5.24 and a two-hundred day simple moving average of $7.48.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently made changes to their positions in the business. Nisa Investment Advisors LLC grew its position in shares of Nevro by 1,788.8% in the 2nd quarter. Nisa Investment Advisors LLC now owns 6,932 shares of the medical equipment provider's stock valued at $58,000 after buying an additional 6,565 shares during the last quarter. Intech Investment Management LLC purchased a new position in shares of Nevro during the third quarter worth about $69,000. SG Americas Securities LLC acquired a new stake in shares of Nevro during the third quarter worth about $71,000. Quantbot Technologies LP lifted its holdings in shares of Nevro by 1,290.4% in the 3rd quarter. Quantbot Technologies LP now owns 14,418 shares of the medical equipment provider's stock valued at $81,000 after purchasing an additional 13,381 shares during the last quarter. Finally, Canada Pension Plan Investment Board lifted its holdings in shares of Nevro by 345.8% in the 2nd quarter. Canada Pension Plan Investment Board now owns 10,700 shares of the medical equipment provider's stock valued at $90,000 after purchasing an additional 8,300 shares during the last quarter. 95.52% of the stock is owned by institutional investors and hedge funds.

Nevro Company Profile

(

Get Free Report)

Nevro Corp., a medical device company, engages in the provision of products for patients suffering from chronic pain in the United States and internationally. The company provides HFX spinal cord stimulation (SCS) platform, which includes the Senza SCS implantable pulse generator (IPG) system, an evidence-based neuromodulation system for the treatment of chronic back and leg pain through paresthesia-free 10 kHz therapy, as well as offers Senza II and Senza Omnia SCS IPG systems.

Featured Articles

Before you consider Nevro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nevro wasn't on the list.

While Nevro currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.