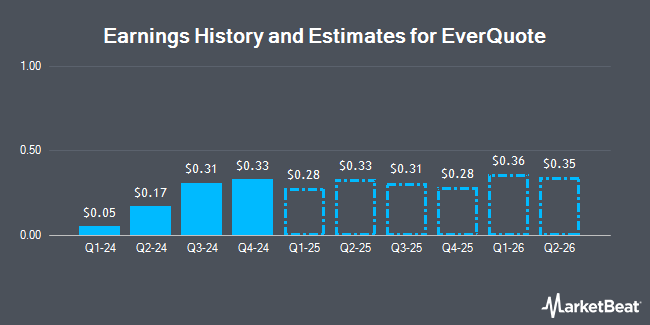

EverQuote, Inc. (NASDAQ:EVER - Free Report) - Investment analysts at William Blair lifted their FY2024 earnings per share estimates for shares of EverQuote in a research report issued on Tuesday, November 5th. William Blair analyst R. Schackart now expects that the company will earn $0.79 per share for the year, up from their previous estimate of $0.70. The consensus estimate for EverQuote's current full-year earnings is $0.57 per share. William Blair also issued estimates for EverQuote's Q1 2025 earnings at $0.17 EPS and FY2026 earnings at $1.06 EPS.

EVER has been the topic of a number of other research reports. JPMorgan Chase & Co. cut their price objective on EverQuote from $34.00 to $28.00 and set an "overweight" rating on the stock in a research report on Tuesday. Needham & Company LLC increased their price target on EverQuote from $30.00 to $38.00 and gave the company a "buy" rating in a research report on Tuesday, August 6th. Craig Hallum boosted their price objective on EverQuote from $30.00 to $33.00 and gave the stock a "buy" rating in a research report on Tuesday, August 6th. Finally, B. Riley reduced their target price on shares of EverQuote from $36.50 to $29.00 and set a "buy" rating on the stock in a report on Tuesday. Six research analysts have rated the stock with a buy rating, According to data from MarketBeat, EverQuote presently has a consensus rating of "Buy" and a consensus price target of $28.50.

Get Our Latest Report on EVER

EverQuote Stock Up 5.9 %

EverQuote stock traded up $1.07 during mid-day trading on Wednesday, reaching $19.08. 721,629 shares of the company's stock were exchanged, compared to its average volume of 471,102. EverQuote has a twelve month low of $7.95 and a twelve month high of $28.09. The company has a market cap of $669.33 million, a P/E ratio of -22.71 and a beta of 1.06. The company has a fifty day moving average of $20.55 and a 200-day moving average of $21.79.

EverQuote (NASDAQ:EVER - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The company reported $0.31 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.22 by $0.09. The business had revenue of $144.53 million for the quarter, compared to analysts' expectations of $140.30 million. EverQuote had a negative net margin of 8.55% and a negative return on equity of 13.24%. The business's quarterly revenue was up 162.7% on a year-over-year basis. During the same quarter in the prior year, the company earned ($0.40) earnings per share.

Insider Activity

In related news, Director George R. Neble sold 2,500 shares of the business's stock in a transaction that occurred on Thursday, October 10th. The stock was sold at an average price of $19.42, for a total transaction of $48,550.00. Following the completion of the sale, the director now owns 54,970 shares in the company, valued at $1,067,517.40. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In related news, Director George R. Neble sold 2,500 shares of EverQuote stock in a transaction on Thursday, October 10th. The shares were sold at an average price of $19.42, for a total transaction of $48,550.00. Following the sale, the director now directly owns 54,970 shares in the company, valued at $1,067,517.40. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CTO David Brainard sold 1,641 shares of the business's stock in a transaction on Wednesday, October 2nd. The shares were sold at an average price of $20.22, for a total transaction of $33,181.02. Following the completion of the sale, the chief technology officer now directly owns 155,491 shares of the company's stock, valued at approximately $3,144,028.02. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 20,270 shares of company stock worth $431,011. 29.79% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Hedge funds have recently added to or reduced their stakes in the company. BNP Paribas Financial Markets boosted its holdings in shares of EverQuote by 127.6% in the first quarter. BNP Paribas Financial Markets now owns 54,755 shares of the company's stock valued at $1,016,000 after acquiring an additional 30,699 shares during the period. Russell Investments Group Ltd. boosted its stake in EverQuote by 244,503.3% during the 1st quarter. Russell Investments Group Ltd. now owns 293,524 shares of the company's stock worth $5,448,000 after purchasing an additional 293,404 shares during the period. State Board of Administration of Florida Retirement System purchased a new position in EverQuote during the 1st quarter worth $211,000. First Eagle Investment Management LLC increased its stake in EverQuote by 3.6% in the first quarter. First Eagle Investment Management LLC now owns 532,138 shares of the company's stock valued at $9,876,000 after purchasing an additional 18,523 shares during the period. Finally, Vanguard Group Inc. raised its holdings in shares of EverQuote by 2.7% in the first quarter. Vanguard Group Inc. now owns 1,157,714 shares of the company's stock valued at $21,487,000 after buying an additional 30,577 shares during the last quarter. Hedge funds and other institutional investors own 91.54% of the company's stock.

EverQuote Company Profile

(

Get Free Report)

EverQuote, Inc operates an online marketplace for insurance shopping in the United States. The company offers auto, home and renters, and life insurance. The company serves carriers and agents, as well as indirect distributors. The company was formerly known as AdHarmonics, Inc, and changed its name to EverQuote, Inc in November 2014.

See Also

Before you consider EverQuote, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EverQuote wasn't on the list.

While EverQuote currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.