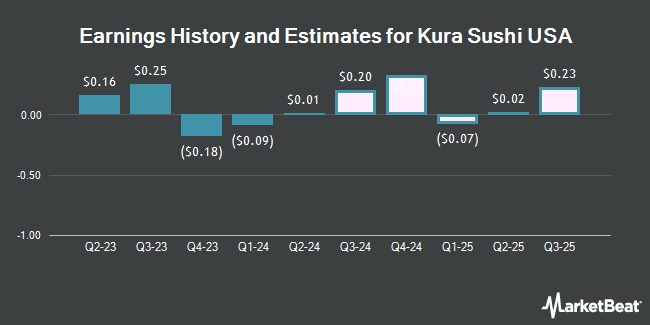

Kura Sushi USA, Inc. (NASDAQ:KRUS - Free Report) - Analysts at William Blair boosted their Q3 2025 earnings per share (EPS) estimates for shares of Kura Sushi USA in a research note issued to investors on Wednesday, April 2nd. William Blair analyst S. Zackfia now forecasts that the company will post earnings per share of $0.12 for the quarter, up from their previous forecast of $0.10. William Blair currently has a "Outperform" rating on the stock. The consensus estimate for Kura Sushi USA's current full-year earnings is $0.22 per share. William Blair also issued estimates for Kura Sushi USA's Q3 2025 earnings at $0.12 EPS, FY2025 earnings at $0.19 EPS, FY2025 earnings at $0.19 EPS, FY2026 earnings at $0.46 EPS and FY2026 earnings at $0.46 EPS.

A number of other research firms have also commented on KRUS. Citigroup decreased their price target on Kura Sushi USA from $116.00 to $71.00 and set a "neutral" rating on the stock in a research report on Wednesday, March 26th. TD Cowen initiated coverage on Kura Sushi USA in a research note on Tuesday, February 25th. They issued a "hold" rating and a $72.00 target price for the company. TD Securities reiterated a "hold" rating and set a $72.00 price target on shares of Kura Sushi USA in a research report on Friday, April 4th. Benchmark decreased their price objective on shares of Kura Sushi USA from $115.00 to $100.00 and set a "buy" rating on the stock in a report on Tuesday, March 25th. Finally, Lake Street Capital reduced their target price on shares of Kura Sushi USA from $103.00 to $62.00 and set a "buy" rating on the stock in a research report on Wednesday. Five analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus target price of $79.60.

Get Our Latest Stock Analysis on KRUS

Kura Sushi USA Stock Performance

Kura Sushi USA stock traded up $10.77 during trading hours on Friday, hitting $52.23. 395,526 shares of the stock were exchanged, compared to its average volume of 195,571. Kura Sushi USA has a 12 month low of $39.40 and a 12 month high of $121.99. The business's 50-day moving average is $62.08 and its two-hundred day moving average is $80.90. The stock has a market capitalization of $630.20 million, a P/E ratio of -76.57 and a beta of 1.72.

Kura Sushi USA (NASDAQ:KRUS - Get Free Report) last issued its quarterly earnings data on Tuesday, April 8th. The company reported ($0.14) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.08) by ($0.06). Kura Sushi USA had a negative net margin of 3.08% and a negative return on equity of 0.50%. The company had revenue of $64.89 million for the quarter, compared to the consensus estimate of $66.30 million. During the same period in the previous year, the business posted ($0.09) earnings per share.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in KRUS. Arcadia Investment Management Corp MI bought a new stake in Kura Sushi USA in the fourth quarter valued at about $31,000. Quantbot Technologies LP acquired a new stake in shares of Kura Sushi USA in the 4th quarter valued at approximately $61,000. BNP Paribas Financial Markets bought a new position in Kura Sushi USA during the 4th quarter worth approximately $77,000. KLP Kapitalforvaltning AS acquired a new position in Kura Sushi USA during the fourth quarter valued at approximately $109,000. Finally, US Bancorp DE raised its holdings in Kura Sushi USA by 43.5% in the fourth quarter. US Bancorp DE now owns 1,805 shares of the company's stock worth $163,000 after purchasing an additional 547 shares during the period. Institutional investors and hedge funds own 65.49% of the company's stock.

Insider Transactions at Kura Sushi USA

In other Kura Sushi USA news, Director Seitaro Ishii sold 6,918 shares of the firm's stock in a transaction that occurred on Thursday, January 16th. The shares were sold at an average price of $83.03, for a total value of $574,401.54. Following the transaction, the director now directly owns 1,313 shares of the company's stock, valued at approximately $109,018.39. This trade represents a 84.05 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 2.30% of the stock is owned by corporate insiders.

About Kura Sushi USA

(

Get Free Report)

Further Reading

Before you consider Kura Sushi USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kura Sushi USA wasn't on the list.

While Kura Sushi USA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.