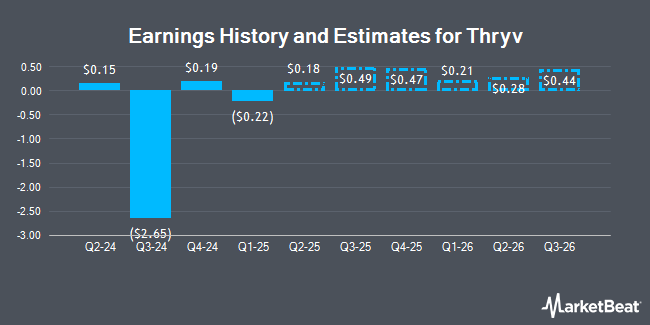

Thryv Holdings, Inc. (NASDAQ:THRY - Free Report) - Research analysts at William Blair dropped their FY2024 earnings per share (EPS) estimates for Thryv in a research report issued on Wednesday, December 4th. William Blair analyst A. Bhatia now expects that the company will post earnings per share of ($2.19) for the year, down from their prior forecast of ($2.05). The consensus estimate for Thryv's current full-year earnings is ($2.24) per share. William Blair also issued estimates for Thryv's Q4 2024 earnings at ($0.05) EPS, Q1 2025 earnings at ($0.05) EPS, Q2 2025 earnings at $0.36 EPS, Q3 2025 earnings at $0.54 EPS, Q4 2025 earnings at $0.51 EPS and FY2025 earnings at $1.37 EPS.

Thryv (NASDAQ:THRY - Get Free Report) last announced its quarterly earnings data on Thursday, November 7th. The company reported ($2.65) earnings per share for the quarter, missing analysts' consensus estimates of ($2.53) by ($0.12). The company had revenue of $179.85 million for the quarter, compared to the consensus estimate of $179.24 million. Thryv had a negative net margin of 38.87% and a negative return on equity of 42.95%. The company's quarterly revenue was down 2.2% compared to the same quarter last year. During the same quarter in the previous year, the business earned ($0.78) EPS.

A number of other brokerages have also weighed in on THRY. Craig Hallum assumed coverage on Thryv in a research report on Wednesday, October 2nd. They set a "buy" rating and a $25.00 target price for the company. Needham & Company LLC restated a "buy" rating and issued a $28.00 price objective on shares of Thryv in a report on Wednesday. Finally, Robert W. Baird dropped their target price on shares of Thryv from $25.00 to $20.00 and set an "outperform" rating on the stock in a report on Friday, November 8th.

Read Our Latest Stock Analysis on Thryv

Thryv Trading Up 2.2 %

Shares of NASDAQ THRY traded up $0.34 during trading hours on Friday, reaching $15.98. The stock had a trading volume of 337,162 shares, compared to its average volume of 454,675. Thryv has a 52-week low of $13.06 and a 52-week high of $26.42. The firm has a market cap of $671.80 million, a price-to-earnings ratio of -1.65 and a beta of 0.86. The business's fifty day moving average price is $16.00 and its two-hundred day moving average price is $17.62. The company has a current ratio of 1.04, a quick ratio of 1.04 and a debt-to-equity ratio of 2.70.

Institutional Investors Weigh In On Thryv

Hedge funds have recently made changes to their positions in the stock. Harspring Capital Management LLC boosted its stake in Thryv by 51.2% in the third quarter. Harspring Capital Management LLC now owns 635,000 shares of the company's stock valued at $10,941,000 after acquiring an additional 215,000 shares in the last quarter. Blair William & Co. IL boosted its position in shares of Thryv by 95.8% in the 2nd quarter. Blair William & Co. IL now owns 355,790 shares of the company's stock worth $6,340,000 after purchasing an additional 174,090 shares in the last quarter. Renaissance Technologies LLC purchased a new position in Thryv during the 2nd quarter worth $2,816,000. Assenagon Asset Management S.A. increased its position in Thryv by 182.8% during the 3rd quarter. Assenagon Asset Management S.A. now owns 220,346 shares of the company's stock valued at $3,797,000 after buying an additional 142,434 shares in the last quarter. Finally, Millennium Management LLC raised its stake in Thryv by 78.8% in the second quarter. Millennium Management LLC now owns 178,807 shares of the company's stock valued at $3,186,000 after buying an additional 78,793 shares during the last quarter. 96.38% of the stock is currently owned by hedge funds and other institutional investors.

About Thryv

(

Get Free Report)

Thryv Holdings, Inc provides digital marketing solutions and cloud-based tools to the small-to-medium sized businesses in the United States. It operates through four segments: Thryv U.S. Marketing Services, Thryv U.S. SaaS, Thryv International Marketing Services, and Thryv International SaaS. The company provides print yellow pages, internet yellow pages, and search engine marketing; and other digital media solutions, such as online display and social advertising, online presence and video, and search engine optimization tools.

Recommended Stories

Before you consider Thryv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thryv wasn't on the list.

While Thryv currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.