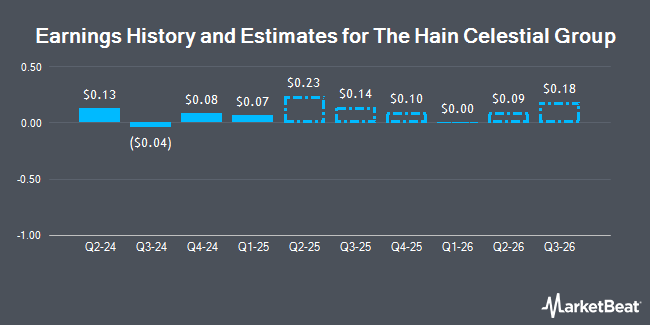

The Hain Celestial Group, Inc. (NASDAQ:HAIN - Free Report) - Equities researchers at William Blair upped their FY2025 EPS estimates for shares of The Hain Celestial Group in a note issued to investors on Tuesday, November 12th. William Blair analyst J. Andersen now expects that the company will post earnings per share of $0.42 for the year, up from their prior forecast of $0.40. The consensus estimate for The Hain Celestial Group's current full-year earnings is $0.46 per share. William Blair also issued estimates for The Hain Celestial Group's FY2026 earnings at $0.54 EPS.

HAIN has been the subject of several other reports. DA Davidson reduced their target price on The Hain Celestial Group from $9.00 to $8.00 and set a "neutral" rating for the company in a research note on Tuesday. Piper Sandler restated a "neutral" rating and set a $8.00 price objective on shares of The Hain Celestial Group in a research report on Thursday, September 19th. Stifel Nicolaus lifted their target price on shares of The Hain Celestial Group from $8.00 to $9.00 and gave the company a "hold" rating in a research report on Wednesday, August 28th. Finally, Barclays cut their target price on shares of The Hain Celestial Group from $9.00 to $8.00 and set an "equal weight" rating for the company in a research note on Monday. Six equities research analysts have rated the stock with a hold rating and one has issued a buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $9.43.

View Our Latest Research Report on HAIN

The Hain Celestial Group Price Performance

NASDAQ HAIN traded up $0.40 during trading hours on Friday, reaching $7.26. The company's stock had a trading volume of 1,942,574 shares, compared to its average volume of 1,199,273. The company's 50-day moving average is $8.29 and its two-hundred day moving average is $7.58. The company has a debt-to-equity ratio of 0.76, a quick ratio of 1.05 and a current ratio of 2.01. The Hain Celestial Group has a 1-year low of $5.68 and a 1-year high of $11.68.

The Hain Celestial Group (NASDAQ:HAIN - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The company reported ($0.04) earnings per share for the quarter, missing analysts' consensus estimates of ($0.02) by ($0.02). The Hain Celestial Group had a positive return on equity of 3.13% and a negative net margin of 4.94%. The firm had revenue of $394.60 million during the quarter, compared to analyst estimates of $394.24 million. During the same quarter last year, the company posted ($0.04) EPS. The company's revenue was down 7.2% on a year-over-year basis.

Institutional Trading of The Hain Celestial Group

Institutional investors have recently made changes to their positions in the company. Vanguard Group Inc. lifted its position in The Hain Celestial Group by 0.8% in the first quarter. Vanguard Group Inc. now owns 10,942,729 shares of the company's stock valued at $86,010,000 after buying an additional 84,689 shares during the last quarter. Barrow Hanley Mewhinney & Strauss LLC lifted its holdings in shares of The Hain Celestial Group by 1.1% in the 2nd quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 5,698,984 shares of the company's stock worth $39,380,000 after acquiring an additional 62,865 shares during the last quarter. PGGM Investments boosted its position in shares of The Hain Celestial Group by 1.3% during the 2nd quarter. PGGM Investments now owns 4,183,854 shares of the company's stock worth $28,910,000 after purchasing an additional 51,912 shares during the period. State Street Corp increased its holdings in The Hain Celestial Group by 0.4% in the 3rd quarter. State Street Corp now owns 3,464,855 shares of the company's stock valued at $29,902,000 after purchasing an additional 15,494 shares during the last quarter. Finally, Millennium Management LLC raised its position in The Hain Celestial Group by 171.3% in the second quarter. Millennium Management LLC now owns 2,634,718 shares of the company's stock valued at $18,206,000 after purchasing an additional 1,663,542 shares during the period. Hedge funds and other institutional investors own 97.01% of the company's stock.

Insider Activity at The Hain Celestial Group

In other news, insider Chad D. Marquardt bought 5,300 shares of the firm's stock in a transaction on Wednesday, September 4th. The shares were bought at an average cost of $8.32 per share, for a total transaction of $44,096.00. Following the acquisition, the insider now directly owns 15,300 shares of the company's stock, valued at $127,296. This trade represents a 53.00 % increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available at the SEC website. Insiders own 0.83% of the company's stock.

The Hain Celestial Group Company Profile

(

Get Free Report)

The Hain Celestial Group, Inc manufactures, markets, and sells organic and natural products in United States, United Kingdom, Europe, and internationally. It operates through two segments: North America and International. The company offers infant formula; infant, toddler, and kids' food; plant-based beverages and frozen desserts, such as soy, rice, oat, and spelt; and condiments.

Recommended Stories

Before you consider The Hain Celestial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hain Celestial Group wasn't on the list.

While The Hain Celestial Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.