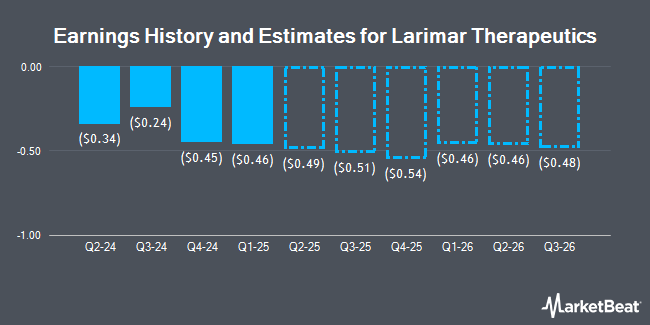

Larimar Therapeutics, Inc. (NASDAQ:LRMR - Free Report) - Investment analysts at William Blair dropped their Q1 2025 earnings estimates for shares of Larimar Therapeutics in a report released on Monday, December 16th. William Blair analyst M. Minter now expects that the company will post earnings of ($0.35) per share for the quarter, down from their previous forecast of ($0.32). William Blair has a "Outperform" rating on the stock. The consensus estimate for Larimar Therapeutics' current full-year earnings is ($1.16) per share. William Blair also issued estimates for Larimar Therapeutics' Q2 2025 earnings at ($0.40) EPS, Q3 2025 earnings at ($0.44) EPS, Q4 2025 earnings at ($0.44) EPS, FY2025 earnings at ($1.64) EPS, FY2026 earnings at ($1.81) EPS, FY2027 earnings at ($1.83) EPS and FY2028 earnings at ($0.19) EPS.

Larimar Therapeutics (NASDAQ:LRMR - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The company reported ($0.24) earnings per share for the quarter, beating analysts' consensus estimates of ($0.37) by $0.13. During the same quarter last year, the company earned ($0.21) earnings per share.

A number of other research analysts have also recently commented on the company. Wedbush initiated coverage on Larimar Therapeutics in a research report on Thursday, October 3rd. They issued an "outperform" rating and a $22.00 price target on the stock. Baird R W raised shares of Larimar Therapeutics to a "strong-buy" rating in a report on Wednesday, September 4th. Oppenheimer initiated coverage on shares of Larimar Therapeutics in a report on Wednesday, October 16th. They set an "outperform" rating and a $26.00 price target for the company. Robert W. Baird assumed coverage on shares of Larimar Therapeutics in a research report on Wednesday, September 4th. They set an "outperform" rating and a $16.00 price target on the stock. Finally, HC Wainwright restated a "buy" rating and set a $15.00 price objective on shares of Larimar Therapeutics in a research report on Monday. Ten research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus price target of $20.43.

Check Out Our Latest Report on Larimar Therapeutics

Larimar Therapeutics Trading Down 4.3 %

NASDAQ LRMR traded down $0.18 during midday trading on Thursday, hitting $3.98. The company had a trading volume of 1,552,424 shares, compared to its average volume of 626,714. The firm has a 50-day moving average price of $6.97 and a 200-day moving average price of $7.65. The company has a market capitalization of $253.95 million, a PE ratio of -3.46 and a beta of 0.86. Larimar Therapeutics has a twelve month low of $3.01 and a twelve month high of $13.68.

Institutional Trading of Larimar Therapeutics

Hedge funds have recently added to or reduced their stakes in the stock. Quarry LP lifted its stake in shares of Larimar Therapeutics by 966.7% in the 2nd quarter. Quarry LP now owns 8,000 shares of the company's stock valued at $58,000 after acquiring an additional 7,250 shares during the last quarter. Quest Partners LLC increased its holdings in Larimar Therapeutics by 171.1% in the 3rd quarter. Quest Partners LLC now owns 9,183 shares of the company's stock worth $60,000 after purchasing an additional 5,796 shares in the last quarter. Virtu Financial LLC acquired a new position in Larimar Therapeutics in the 3rd quarter worth about $71,000. Intech Investment Management LLC bought a new position in Larimar Therapeutics in the third quarter valued at about $85,000. Finally, SG Americas Securities LLC acquired a new stake in shares of Larimar Therapeutics during the third quarter valued at about $94,000. Institutional investors and hedge funds own 91.92% of the company's stock.

Larimar Therapeutics Company Profile

(

Get Free Report)

Larimar Therapeutics, Inc, a clinical-stage biotechnology company, focuses on developing treatments for rare diseases using its novel cell penetrating peptide technology platform. Its lead product candidate is CTI-1601, which is in Phase 2 OLE clinical trial for the treatment of Friedreich's ataxia, a rare, progressive and fatal genetic disease.

Read More

Before you consider Larimar Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Larimar Therapeutics wasn't on the list.

While Larimar Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.