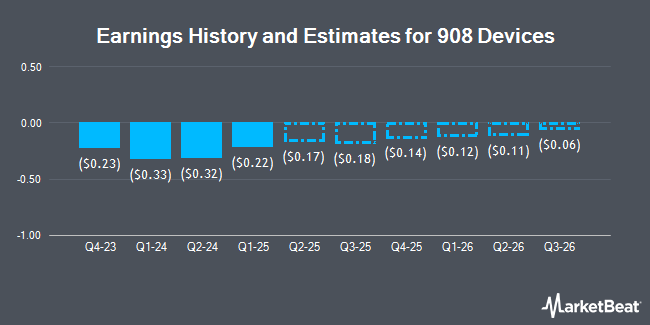

908 Devices Inc. (NASDAQ:MASS - Free Report) - Stock analysts at William Blair raised their FY2024 earnings estimates for shares of 908 Devices in a note issued to investors on Tuesday, November 12th. William Blair analyst M. Larew now anticipates that the company will post earnings per share of ($1.18) for the year, up from their previous forecast of ($1.19). The consensus estimate for 908 Devices' current full-year earnings is ($1.22) per share.

Several other brokerages have also commented on MASS. Stifel Nicolaus cut their price target on shares of 908 Devices from $17.00 to $6.00 and set a "buy" rating on the stock in a research note on Wednesday. Leerink Partnrs lowered shares of 908 Devices from a "strong-buy" rating to a "hold" rating in a research note on Wednesday. Finally, Leerink Partners restated a "market perform" rating and issued a $4.00 price objective (down from $12.00) on shares of 908 Devices in a research note on Wednesday.

Read Our Latest Research Report on MASS

908 Devices Trading Down 1.7 %

NASDAQ:MASS traded down $0.04 during midday trading on Thursday, hitting $2.30. 1,026,803 shares of the company were exchanged, compared to its average volume of 203,210. The company has a fifty day simple moving average of $3.47 and a 200 day simple moving average of $4.70. 908 Devices has a fifty-two week low of $2.19 and a fifty-two week high of $12.51. The company has a market capitalization of $79.72 million, a PE ratio of -1.32 and a beta of 0.98.

Institutional Trading of 908 Devices

Several hedge funds and other institutional investors have recently made changes to their positions in the company. State Board of Administration of Florida Retirement System purchased a new stake in 908 Devices during the first quarter worth about $80,000. Vanguard Group Inc. boosted its holdings in 908 Devices by 0.4% during the first quarter. Vanguard Group Inc. now owns 1,751,102 shares of the company's stock worth $13,221,000 after buying an additional 6,772 shares in the last quarter. AWM Investment Company Inc. boosted its holdings in 908 Devices by 2.3% during the first quarter. AWM Investment Company Inc. now owns 668,526 shares of the company's stock worth $5,047,000 after buying an additional 15,058 shares in the last quarter. GAMMA Investing LLC acquired a new position in 908 Devices during the second quarter worth about $48,000. Finally, Bank of New York Mellon Corp raised its position in 908 Devices by 6.4% during the second quarter. Bank of New York Mellon Corp now owns 69,550 shares of the company's stock worth $358,000 after acquiring an additional 4,212 shares during the last quarter. Hedge funds and other institutional investors own 88.06% of the company's stock.

908 Devices Company Profile

(

Get Free Report)

908 Devices Inc, a commercial-stage technology company, provides various purpose-built handheld and desktop mass spectrometry devices to interrogate unknown and invisible materials in life sciences research, bioprocessing, pharma/biopharma, forensics, and adjacent markets. The company's products include MX908, a handheld, battery-powered, and Mass Spec device that is designed for rapid analysis of solid, liquid, vapor, and aerosol materials of unknown identity; Rebel, a small desktop analyzer that provides real-time information on the extracellular environment in bioprocesses; and Maverick, an optical in-line analyzer that offers real-time monitoring and control of multiple bioprocess parameters, including glucose, lactate, and total biomass in mammalian cell cultures, as well as provides process fingerprint data to support large-scale efforts in predictive bioprocess modeling.

Featured Stories

Before you consider 908 Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 908 Devices wasn't on the list.

While 908 Devices currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.