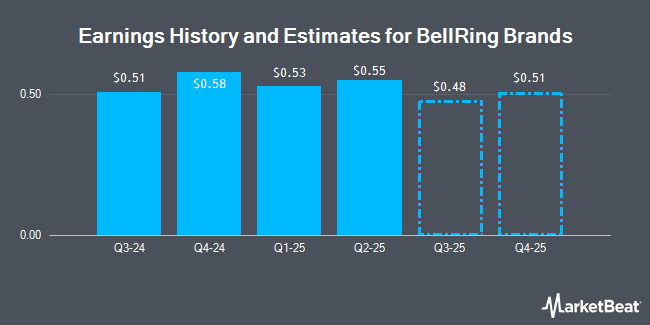

BellRing Brands, Inc. (NYSE:BRBR - Free Report) - Research analysts at William Blair issued their Q1 2025 earnings per share estimates for BellRing Brands in a note issued to investors on Tuesday, November 19th. William Blair analyst J. Andersen forecasts that the company will post earnings of $0.46 per share for the quarter. The consensus estimate for BellRing Brands' current full-year earnings is $1.92 per share. William Blair also issued estimates for BellRing Brands' Q2 2025 earnings at $0.49 EPS, Q3 2025 earnings at $0.60 EPS, Q4 2025 earnings at $0.59 EPS, FY2025 earnings at $2.14 EPS and FY2026 earnings at $2.38 EPS.

Other equities research analysts have also issued research reports about the company. Barclays lifted their price target on BellRing Brands from $68.00 to $74.00 and gave the stock an "overweight" rating in a research note on Wednesday, November 6th. Mizuho lifted their price objective on BellRing Brands from $72.00 to $80.00 and gave the stock an "outperform" rating in a report on Wednesday. JPMorgan Chase & Co. decreased their price objective on BellRing Brands from $65.00 to $64.00 and set an "overweight" rating on the stock in a report on Wednesday, August 7th. Deutsche Bank Aktiengesellschaft boosted their price target on BellRing Brands from $73.00 to $77.00 and gave the company a "buy" rating in a report on Wednesday. Finally, Bank of America upped their target price on BellRing Brands from $75.00 to $82.00 and gave the stock a "buy" rating in a report on Wednesday. Three investment analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $73.93.

Check Out Our Latest Research Report on BellRing Brands

BellRing Brands Stock Performance

NYSE:BRBR opened at $74.38 on Thursday. The firm has a market capitalization of $9.61 billion, a price-to-earnings ratio of 44.54, a P/E/G ratio of 1.61 and a beta of 0.84. BellRing Brands has a 52-week low of $46.03 and a 52-week high of $75.44. The stock has a fifty day moving average of $64.89 and a 200 day moving average of $59.07.

BellRing Brands (NYSE:BRBR - Get Free Report) last announced its quarterly earnings results on Monday, November 18th. The company reported $0.51 earnings per share for the quarter, beating the consensus estimate of $0.50 by $0.01. The company had revenue of $555.80 million during the quarter, compared to analysts' expectations of $545.00 million. BellRing Brands had a negative return on equity of 88.30% and a net margin of 11.55%. The firm's quarterly revenue was up 17.6% compared to the same quarter last year. During the same period in the previous year, the business earned $0.41 earnings per share.

Hedge Funds Weigh In On BellRing Brands

Several hedge funds and other institutional investors have recently modified their holdings of the company. Vanguard Group Inc. lifted its holdings in shares of BellRing Brands by 5.3% during the 1st quarter. Vanguard Group Inc. now owns 13,978,857 shares of the company's stock valued at $825,172,000 after buying an additional 698,121 shares during the period. Wasatch Advisors LP lifted its holdings in shares of BellRing Brands by 8.0% during the 3rd quarter. Wasatch Advisors LP now owns 6,701,299 shares of the company's stock valued at $406,903,000 after buying an additional 494,669 shares during the period. State Street Corp lifted its holdings in shares of BellRing Brands by 1.3% during the 3rd quarter. State Street Corp now owns 3,886,709 shares of the company's stock valued at $236,001,000 after buying an additional 50,339 shares during the period. Wellington Management Group LLP lifted its holdings in shares of BellRing Brands by 11.4% during the 3rd quarter. Wellington Management Group LLP now owns 2,756,722 shares of the company's stock valued at $167,388,000 after buying an additional 281,667 shares during the period. Finally, Point72 Asset Management L.P. lifted its holdings in shares of BellRing Brands by 21.5% during the 3rd quarter. Point72 Asset Management L.P. now owns 2,588,970 shares of the company's stock valued at $157,202,000 after buying an additional 457,796 shares during the period. 94.97% of the stock is owned by institutional investors.

BellRing Brands Company Profile

(

Get Free Report)

BellRing Brands, Inc, together with its subsidiaries, provides various nutrition products in the United States. The company offers ready-to-drink (RTD) protein shakes, other RTD beverages, powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. It distributes its products through club, food, drug, mass, eCommerce, specialty, and convenience channels.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BellRing Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BellRing Brands wasn't on the list.

While BellRing Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.