Willis Investment Counsel increased its stake in Keysight Technologies, Inc. (NYSE:KEYS - Free Report) by 2.9% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm owned 75,611 shares of the scientific and technical instruments company's stock after purchasing an additional 2,125 shares during the period. Willis Investment Counsel's holdings in Keysight Technologies were worth $12,145,000 as of its most recent filing with the SEC.

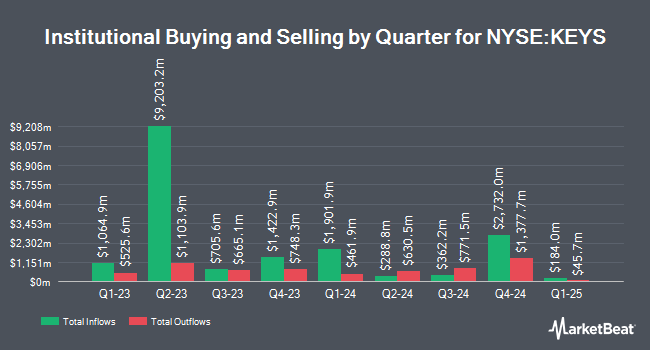

A number of other hedge funds and other institutional investors have also bought and sold shares of KEYS. Truvestments Capital LLC bought a new position in shares of Keysight Technologies in the 3rd quarter valued at $28,000. Erste Asset Management GmbH acquired a new stake in Keysight Technologies in the third quarter valued at about $29,000. Goodman Advisory Group LLC bought a new position in Keysight Technologies in the third quarter valued at about $35,000. Groupama Asset Managment raised its stake in Keysight Technologies by 76.6% during the third quarter. Groupama Asset Managment now owns 21,753 shares of the scientific and technical instruments company's stock worth $35,000 after acquiring an additional 9,437 shares in the last quarter. Finally, Prospera Private Wealth LLC bought a new position in shares of Keysight Technologies in the third quarter worth about $57,000. Institutional investors and hedge funds own 84.58% of the company's stock.

Insider Transactions at Keysight Technologies

In other news, VP Lisa M. Poole sold 350 shares of the firm's stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $171.79, for a total transaction of $60,126.50. Following the completion of the sale, the vice president now owns 4,820 shares of the company's stock, valued at $828,027.80. This trade represents a 6.77 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this link. Also, CEO Satish Dhanasekaran sold 17,822 shares of the stock in a transaction on Monday, December 2nd. The stock was sold at an average price of $169.66, for a total transaction of $3,023,680.52. Following the transaction, the chief executive officer now directly owns 116,582 shares in the company, valued at approximately $19,779,302.12. This represents a 13.26 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 33,063 shares of company stock worth $5,573,941. Company insiders own 0.61% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts recently issued reports on KEYS shares. Deutsche Bank Aktiengesellschaft lifted their price target on shares of Keysight Technologies from $175.00 to $180.00 and gave the company a "buy" rating in a report on Wednesday, November 20th. Morgan Stanley upped their price target on shares of Keysight Technologies from $165.00 to $180.00 and gave the stock an "overweight" rating in a report on Wednesday, November 20th. Susquehanna reissued a "positive" rating and set a $185.00 price objective on shares of Keysight Technologies in a report on Wednesday, November 20th. Robert W. Baird upped their target price on Keysight Technologies from $163.00 to $180.00 and gave the stock an "outperform" rating in a report on Wednesday, November 20th. Finally, JPMorgan Chase & Co. upgraded Keysight Technologies from a "neutral" rating to an "overweight" rating and increased their target price for the company from $170.00 to $200.00 in a research report on Monday, December 16th. One investment analyst has rated the stock with a sell rating and ten have given a buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $180.80.

Read Our Latest Stock Report on Keysight Technologies

Keysight Technologies Trading Up 0.1 %

KEYS stock traded up $0.14 during trading on Thursday, hitting $177.66. The company had a trading volume of 770,375 shares, compared to its average volume of 873,711. The stock has a market cap of $30.72 billion, a PE ratio of 50.76, a PEG ratio of 2.26 and a beta of 1.02. The business has a 50-day moving average of $167.55 and a 200-day moving average of $156.25. The company has a current ratio of 2.98, a quick ratio of 2.27 and a debt-to-equity ratio of 0.35. Keysight Technologies, Inc. has a one year low of $119.72 and a one year high of $180.26.

About Keysight Technologies

(

Free Report)

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

Featured Stories

Before you consider Keysight Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keysight Technologies wasn't on the list.

While Keysight Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.