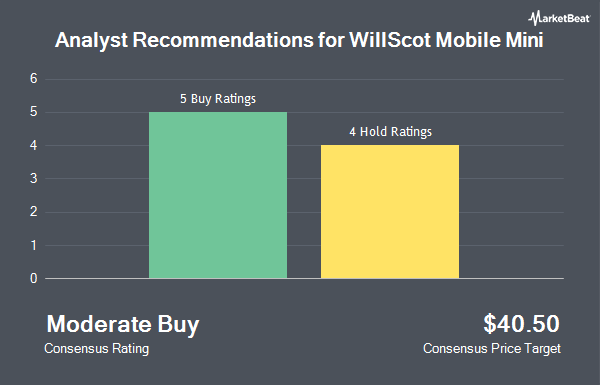

WillScot Mobile Mini Holdings Corp. (NASDAQ:WSC - Get Free Report) has been assigned a consensus recommendation of "Hold" from the eleven ratings firms that are currently covering the company, Marketbeat.com reports. Six analysts have rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average 12 month target price among analysts that have issued ratings on the stock in the last year is $45.00.

A number of analysts have recently weighed in on WSC shares. Baird R W lowered WillScot Mobile Mini from a "strong-buy" rating to a "hold" rating in a research note on Thursday, October 24th. Deutsche Bank Aktiengesellschaft cut shares of WillScot Mobile Mini from a "buy" rating to a "hold" rating and decreased their price target for the company from $46.00 to $35.00 in a research note on Thursday, October 31st. Barclays decreased their price objective on WillScot Mobile Mini from $44.00 to $40.00 and set an "equal weight" rating on the stock in a research report on Friday, November 1st. Finally, Robert W. Baird decreased their price target on WillScot Mobile Mini from $42.00 to $38.00 and set a "neutral" rating on the stock in a report on Thursday, October 31st.

Get Our Latest Research Report on WillScot Mobile Mini

WillScot Mobile Mini Price Performance

NASDAQ:WSC traded up $1.63 during trading hours on Wednesday, reaching $39.33. The company had a trading volume of 2,150,423 shares, compared to its average volume of 2,281,903. The stock has a 50-day moving average of $37.40 and a two-hundred day moving average of $38.03. The company has a quick ratio of 0.82, a current ratio of 0.90 and a debt-to-equity ratio of 3.42. WillScot Mobile Mini has a one year low of $32.71 and a one year high of $52.16. The firm has a market capitalization of $7.27 billion, a PE ratio of 356.64, a PEG ratio of 2.31 and a beta of 1.38.

WillScot Mobile Mini (NASDAQ:WSC - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The company reported $0.38 earnings per share for the quarter, missing the consensus estimate of $0.48 by ($0.10). The firm had revenue of $601.43 million for the quarter, compared to analyst estimates of $617.83 million. WillScot Mobile Mini had a return on equity of 23.97% and a net margin of 1.05%. The business's quarterly revenue was down .6% on a year-over-year basis. During the same period in the previous year, the business posted $0.46 EPS. Analysts forecast that WillScot Mobile Mini will post 1.53 earnings per share for the current year.

Insiders Place Their Bets

In related news, EVP Hezron T. Lopez sold 20,000 shares of the stock in a transaction on Friday, November 8th. The shares were sold at an average price of $39.38, for a total transaction of $787,600.00. Following the completion of the transaction, the executive vice president now owns 57,918 shares in the company, valued at approximately $2,280,810.84. This represents a 25.67 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CAO Sally J. Shanks sold 14,059 shares of the stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $34.69, for a total value of $487,706.71. Following the transaction, the chief accounting officer now directly owns 26,113 shares of the company's stock, valued at $905,859.97. This trade represents a 35.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have acquired 20,000 shares of company stock worth $728,750. Corporate insiders own 3.30% of the company's stock.

Institutional Trading of WillScot Mobile Mini

A number of hedge funds have recently made changes to their positions in the business. First Horizon Advisors Inc. lifted its holdings in WillScot Mobile Mini by 16.4% during the 3rd quarter. First Horizon Advisors Inc. now owns 2,138 shares of the company's stock worth $80,000 after purchasing an additional 302 shares during the last quarter. Salvus Wealth Management LLC lifted its holdings in shares of WillScot Mobile Mini by 1.0% during the third quarter. Salvus Wealth Management LLC now owns 47,830 shares of the company's stock worth $1,798,000 after buying an additional 485 shares in the last quarter. Arizona State Retirement System raised its stake in WillScot Mobile Mini by 1.0% in the 2nd quarter. Arizona State Retirement System now owns 53,184 shares of the company's stock worth $2,002,000 after purchasing an additional 520 shares in the last quarter. Hexagon Capital Partners LLC raised its stake in WillScot Mobile Mini by 200.0% in the 3rd quarter. Hexagon Capital Partners LLC now owns 900 shares of the company's stock worth $34,000 after purchasing an additional 600 shares in the last quarter. Finally, Vanguard Personalized Indexing Management LLC raised its position in shares of WillScot Mobile Mini by 11.1% in the second quarter. Vanguard Personalized Indexing Management LLC now owns 6,242 shares of the company's stock valued at $228,000 after buying an additional 624 shares in the last quarter. 95.81% of the stock is owned by institutional investors and hedge funds.

WillScot Mobile Mini Company Profile

(

Get Free ReportWillScot Holdings Corporation provides workspace and portable storage solutions in the United States, Canada, and Mexico. It operates in two segments, Modular Solutions and Storage Solutions. Its modular solutions include panelized and stackable offices, single-wide modular space units, section modulars and redi-plex, classrooms, ground level offices, blast-resistant modules, clearspan structures, and other modular space; and portable storage solutions, such as portable and cold storage containers, as well as trailers.

Featured Stories

Before you consider WillScot Mobile Mini, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WillScot Mobile Mini wasn't on the list.

While WillScot Mobile Mini currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.