Wilmington Savings Fund Society FSB boosted its stake in CSX Co. (NASDAQ:CSX - Free Report) by 260.8% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 24,970 shares of the transportation company's stock after buying an additional 18,049 shares during the period. Wilmington Savings Fund Society FSB's holdings in CSX were worth $862,000 as of its most recent SEC filing.

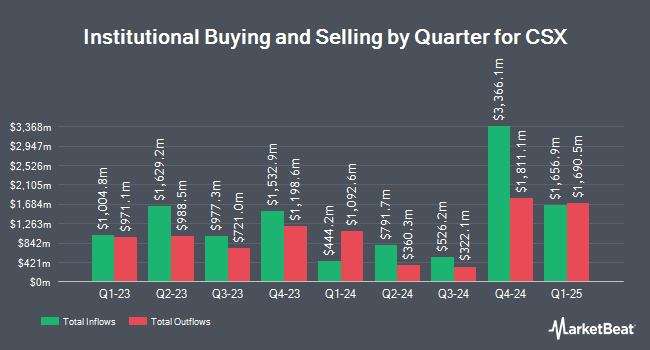

Other large investors have also modified their holdings of the company. State Street Corp lifted its stake in shares of CSX by 0.6% in the 3rd quarter. State Street Corp now owns 82,250,713 shares of the transportation company's stock worth $2,840,117,000 after acquiring an additional 455,258 shares during the period. Geode Capital Management LLC boosted its stake in CSX by 0.5% during the 3rd quarter. Geode Capital Management LLC now owns 40,906,826 shares of the transportation company's stock valued at $1,407,087,000 after purchasing an additional 190,346 shares in the last quarter. Fisher Asset Management LLC boosted its stake in CSX by 3.6% during the 3rd quarter. Fisher Asset Management LLC now owns 24,656,931 shares of the transportation company's stock valued at $851,404,000 after purchasing an additional 857,302 shares in the last quarter. Bank of New York Mellon Corp raised its stake in shares of CSX by 6.6% in the 2nd quarter. Bank of New York Mellon Corp now owns 17,133,857 shares of the transportation company's stock worth $573,128,000 after buying an additional 1,060,204 shares in the last quarter. Finally, FMR LLC lifted its holdings in shares of CSX by 10.2% in the third quarter. FMR LLC now owns 15,612,862 shares of the transportation company's stock valued at $539,112,000 after buying an additional 1,447,651 shares during the period. Institutional investors and hedge funds own 73.57% of the company's stock.

CSX Stock Down 0.9 %

Shares of NASDAQ:CSX traded down $0.30 during mid-day trading on Monday, reaching $32.94. 12,670,723 shares of the stock were exchanged, compared to its average volume of 11,646,790. The company has a market cap of $63.52 billion, a P/E ratio of 17.73, a P/E/G ratio of 2.24 and a beta of 1.20. CSX Co. has a one year low of $31.74 and a one year high of $40.12. The stock's 50 day simple moving average is $34.77 and its 200-day simple moving average is $34.09. The company has a quick ratio of 1.23, a current ratio of 1.39 and a debt-to-equity ratio of 1.43.

CSX (NASDAQ:CSX - Get Free Report) last posted its quarterly earnings results on Wednesday, October 16th. The transportation company reported $0.46 EPS for the quarter, missing analysts' consensus estimates of $0.48 by ($0.02). The business had revenue of $3.62 billion for the quarter, compared to the consensus estimate of $3.68 billion. CSX had a return on equity of 28.92% and a net margin of 24.77%. The company's revenue for the quarter was up 1.3% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.42 EPS. As a group, equities research analysts predict that CSX Co. will post 1.84 EPS for the current year.

CSX Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, December 13th. Shareholders of record on Friday, November 29th were paid a dividend of $0.12 per share. The ex-dividend date of this dividend was Friday, November 29th. This represents a $0.48 dividend on an annualized basis and a yield of 1.46%. CSX's dividend payout ratio (DPR) is presently 25.81%.

Analyst Ratings Changes

Several equities research analysts have commented on the stock. Loop Capital dropped their price target on shares of CSX from $43.00 to $42.00 and set a "buy" rating on the stock in a research report on Thursday, October 17th. Stephens reduced their target price on shares of CSX from $41.00 to $39.00 and set an "overweight" rating for the company in a report on Thursday, October 17th. BMO Capital Markets dropped their price target on CSX from $40.00 to $39.00 and set an "outperform" rating on the stock in a report on Thursday, October 17th. Stifel Nicolaus reduced their price objective on CSX from $39.00 to $37.00 and set a "buy" rating for the company in a research note on Thursday, October 17th. Finally, Citigroup lifted their target price on CSX from $42.00 to $44.00 and gave the stock a "buy" rating in a report on Tuesday, November 12th. Seven investment analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $38.78.

Get Our Latest Stock Analysis on CSX

CSX Company Profile

(

Free Report)

CSX Corporation, together with its subsidiaries, provides rail-based freight transportation services. The company offers rail services; and transportation of intermodal containers and trailers, as well as other transportation services, such as rail-to-truck transfers and bulk commodity operations. It also transports chemicals, agricultural and food products, minerals, automotive, forest products, fertilizers, and metals and equipment; and coal, coke, and iron ore to electricity-generating power plants, steel manufacturers, and industrial plants, as well as exports coal to deep-water port facilities.

Featured Articles

Before you consider CSX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CSX wasn't on the list.

While CSX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.