Wilmington Savings Fund Society FSB lifted its stake in shares of Carrier Global Co. (NYSE:CARR - Free Report) by 280.5% during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 34,717 shares of the company's stock after acquiring an additional 25,594 shares during the period. Wilmington Savings Fund Society FSB's holdings in Carrier Global were worth $2,794,000 as of its most recent filing with the Securities & Exchange Commission.

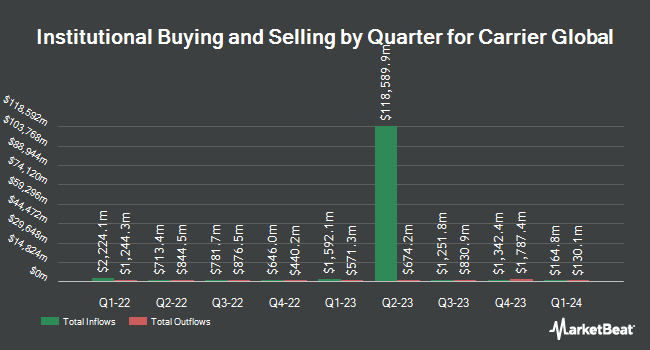

Other institutional investors and hedge funds have also recently modified their holdings of the company. ORG Partners LLC lifted its holdings in Carrier Global by 417.3% in the second quarter. ORG Partners LLC now owns 776 shares of the company's stock valued at $48,000 after acquiring an additional 626 shares during the last quarter. Blue Trust Inc. lifted its position in Carrier Global by 100.9% in the second quarter. Blue Trust Inc. now owns 2,453 shares of the company's stock valued at $143,000 after buying an additional 1,232 shares during the last quarter. World Equity Group Inc. increased its position in shares of Carrier Global by 10.7% during the second quarter. World Equity Group Inc. now owns 5,171 shares of the company's stock valued at $326,000 after acquiring an additional 501 shares during the last quarter. Everpar Advisors LLC purchased a new stake in shares of Carrier Global in the 2nd quarter valued at approximately $209,000. Finally, TCW Group Inc. lifted its holdings in shares of Carrier Global by 1.9% in the 2nd quarter. TCW Group Inc. now owns 11,762 shares of the company's stock worth $742,000 after acquiring an additional 219 shares during the last quarter. Institutional investors and hedge funds own 91.00% of the company's stock.

Carrier Global Stock Down 0.7 %

Shares of NYSE:CARR traded down $0.53 on Friday, hitting $73.01. 2,927,651 shares of the company's stock were exchanged, compared to its average volume of 4,192,215. Carrier Global Co. has a 1-year low of $53.13 and a 1-year high of $83.32. The company has a market capitalization of $65.51 billion, a PE ratio of 18.49, a P/E/G ratio of 2.73 and a beta of 1.33. The company has a debt-to-equity ratio of 0.69, a quick ratio of 0.82 and a current ratio of 1.08. The firm's 50-day moving average is $76.52 and its 200 day moving average is $71.28.

Carrier Global announced that its Board of Directors has authorized a share repurchase plan on Thursday, October 24th that authorizes the company to repurchase $3.00 billion in shares. This repurchase authorization authorizes the company to purchase up to 4.6% of its shares through open market purchases. Shares repurchase plans are typically an indication that the company's board of directors believes its shares are undervalued.

Carrier Global Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, February 7th. Shareholders of record on Friday, December 20th will be paid a $0.225 dividend. This is a positive change from Carrier Global's previous quarterly dividend of $0.19. This represents a $0.90 annualized dividend and a yield of 1.23%. The ex-dividend date is Friday, December 20th. Carrier Global's dividend payout ratio is currently 22.78%.

Analyst Ratings Changes

Several analysts recently weighed in on the stock. Oppenheimer lifted their target price on shares of Carrier Global from $74.00 to $88.00 and gave the company an "outperform" rating in a report on Wednesday, October 2nd. Stephens dropped their price objective on Carrier Global from $85.00 to $80.00 and set an "equal weight" rating for the company in a research note on Monday, October 28th. Wells Fargo & Company decreased their target price on Carrier Global from $82.00 to $76.00 and set an "equal weight" rating on the stock in a research note on Friday, October 25th. UBS Group raised Carrier Global from a "neutral" rating to a "buy" rating and set a $94.00 target price for the company in a research report on Wednesday, November 13th. Finally, Morgan Stanley assumed coverage on shares of Carrier Global in a research report on Friday, September 6th. They set an "equal weight" rating and a $75.00 price target on the stock. Eight analysts have rated the stock with a hold rating, eight have issued a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $83.50.

Get Our Latest Report on CARR

Carrier Global Company Profile

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

Featured Articles

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.